Metropole’s Dorian Traill claims that Australia is facing a “critical shortage of property investors” that is “further fueling the nation’s escalating rental crisis”.

Traill’s claim is based off new research from the Property Investment Professionals of Australia (PIPA) and the Property Investors Council of Australia (PICA), which shows that a growing number of investors are selling their properties.

The research suggests that Australia has fallen short by 35,000 investors needed to meet tenant demand, “leaving renters grappling with limited options in an already stretched market”.

“Between March 2019 and March 2024, Australia’s population grew by an extraordinary 1.8 million people, requiring an additional 212,000 rental properties to house them”, Traill wrote.

“However, only 110,000 new investors entered the market during this period, far fewer than the 145,000 needed to meet demand”.

PIPA Chair Nicola McDougall noted that “from 2003 to 2017, the number of individual property investors grew steadily, with annual increases ranging from 56,000 to 60,000”.

“However, this upward trend disappeared in recent years due to factors such as increased market interference, restrictive lending policies, and tax hikes, all of which have deterred investors”.

McDougall argued that “instead of penalising investors with increased regulations and taxes, governments should focus on policies that encourage investment in the private rental market”.

Separately, The ABC reported that investors have sold off heavily in Victoria, with rental bond data showing that the state lost 24,726 rentals (3.6% of its stock) in the year to September 2024.

This represented the sharpest decline in rental bonds on record.

The investor sell-off was more severe in Melbourne, which lost 23,108 rentals (4.2% of its stock) in the year to September 2024.

PIPA chair Ben Kingsley claimed that the sell-off in Victoria was driven by four main factors: investors selling due to high interest rates, increased land taxes put in place by the state government to help fund the COVID recovery, tenancy reforms that ended no-fault evictions, and investors who had been in the market for a long time who were now cashing out.

Kingsley argued the fall in rental bonds was “further evidence that the Labor government has made the lives of tenants in Victoria a lot harder” by causing an “exodus of investors providing private rental accommodation in Victoria”.

“I would be very, very worried as a tenant that I’m going to be paying higher rent in Victoria over the near term,” he said.

However, the actual rental and price data shows that the investor sell-off has been positive for Victorian tenants and first home buyers alike.

“Melbourne rents were down 0.4% through the second half of 2024, mostly due to a 1.1% fall in unit rents, while house rents are unchanged over the past six months”, CoreLogic Research Director Tim Lawless said.

“At the same time we are seeing a rise in rental vacancy rates and an easing in rental growth, suggesting less rental supply is being accompanied by less rental demand”.

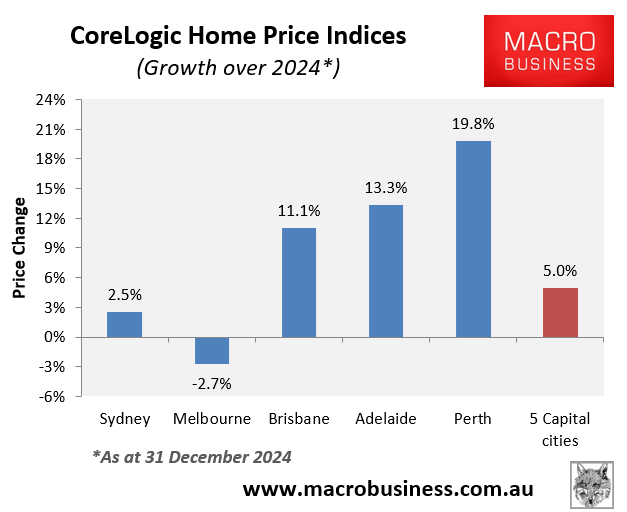

Meanwhile, Melbourne home values declined by 2.7% in 2024, according to CoreLogic, making housing cheaper for first home buyers.

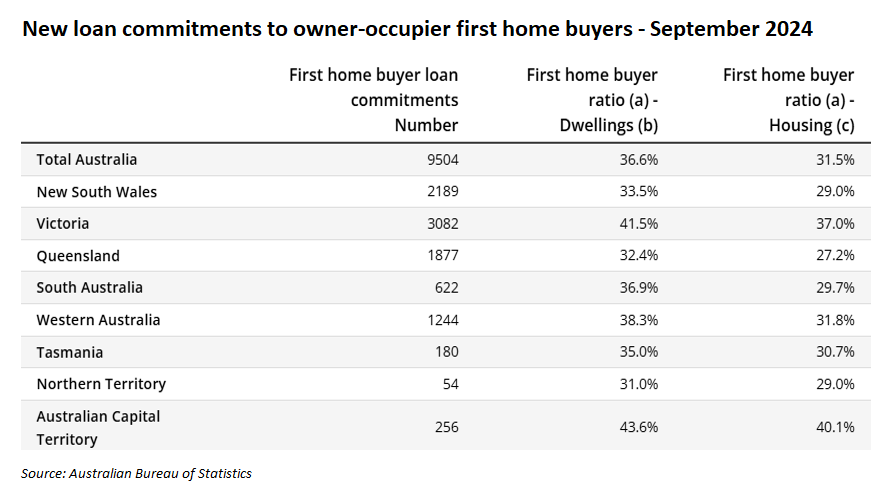

As a result, Victoria has easily the highest share of first-home buyers out of Australia’s states, according to the Australian Bureau of Statistics.

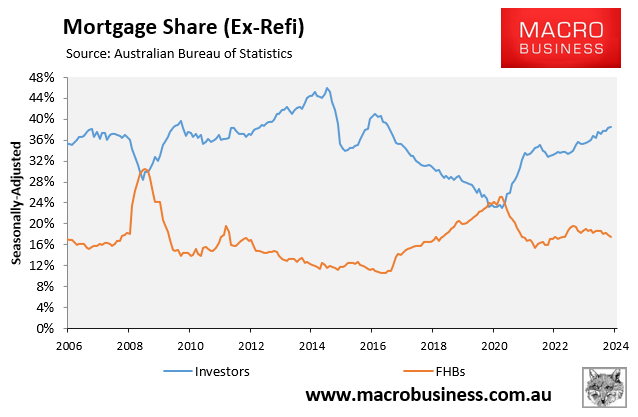

This should come as no surprise, as there has historically been an inverse correlation between investor mortgage demand and first-home buyer mortgage demand.

Thus, when investors sell, these homes inevitably end up in the hands of first-home buyers.

Moreover, when an investor sells to a first-home buyer, it removes a rental property from the market. However, it also removes a renter household from the market.

Therefore, both rental supply and demand are reduced, leaving the rental market in effectively the same position.

If increasing home ownership is the goal, we should want fewer investors in the market. We should want investors to sell to first-home buyers, as is occurring in Victoria.