DXY is going to challenge the 2022 high. EUR is headed to parity.

AUD took out its 2022 low, is taking out its GFC low, and the COVID low is the next target.

Oil took off on tightened Russian sanctions. Even more upside for DXY.

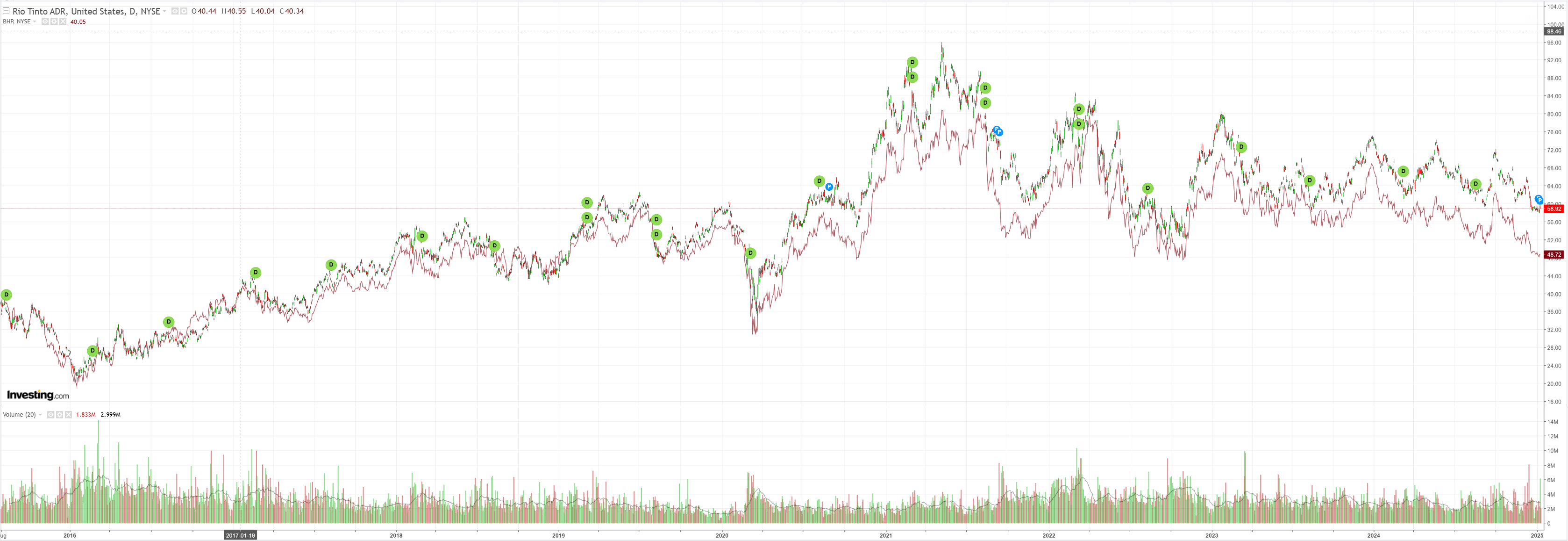

Dirt popped on more Chinese yawnulus.

Miners less so.

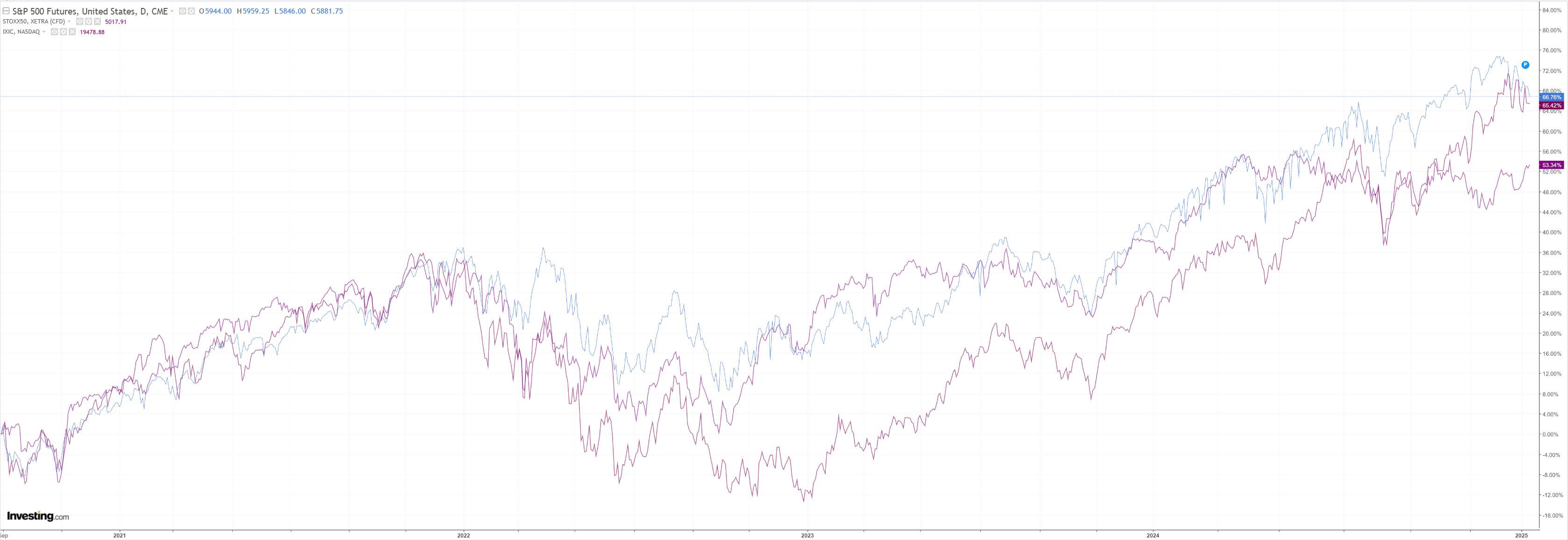

Xi’s bull market is now in full reverse, below where it started.

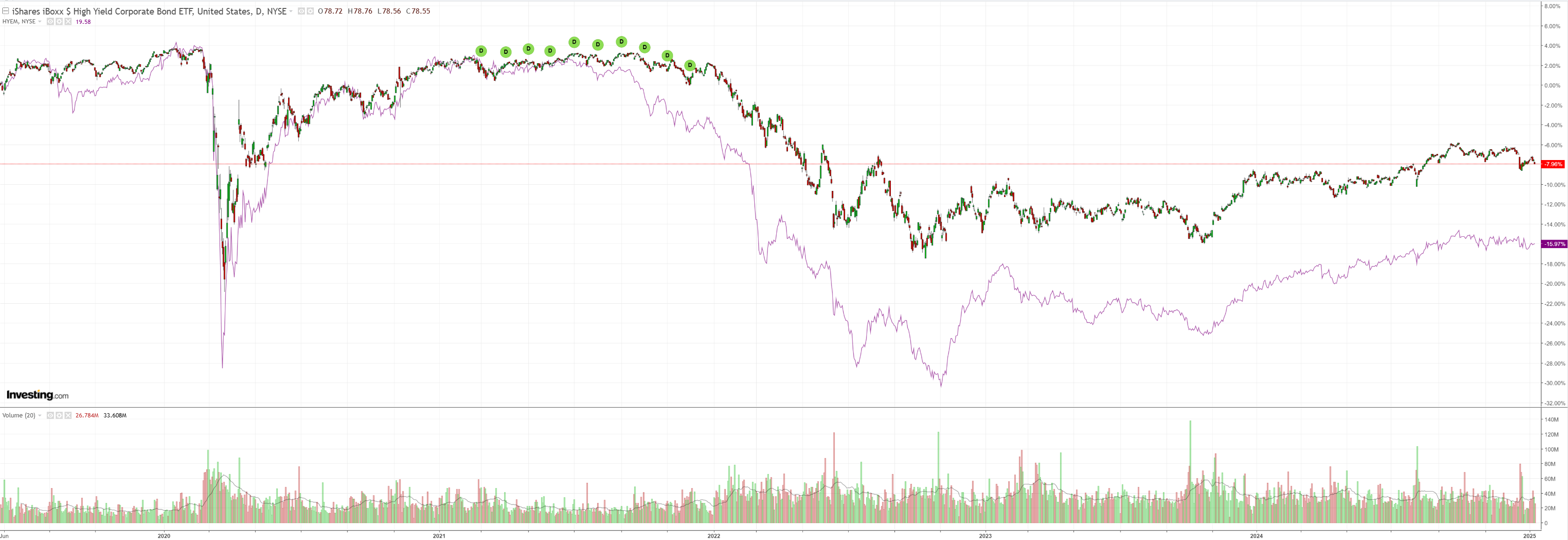

Junk spreads are spoiling the party.

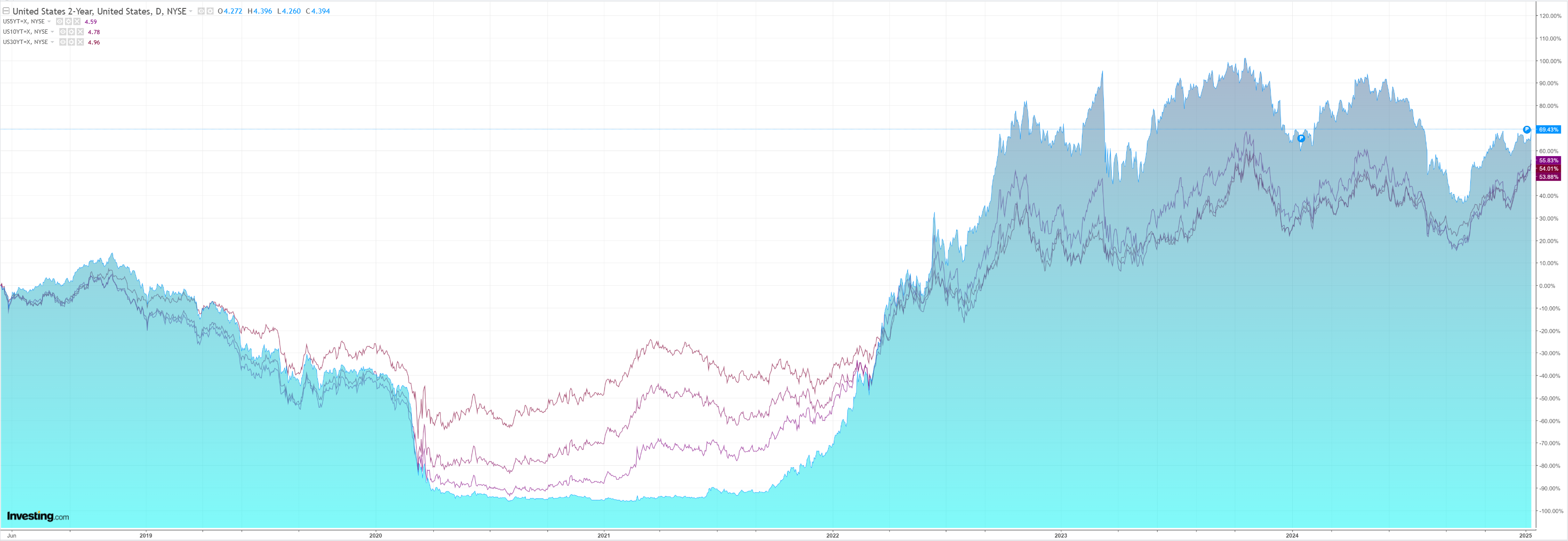

As yields march higher on strong US jobs.

Stocks no likee.

US jobs beat across the board.

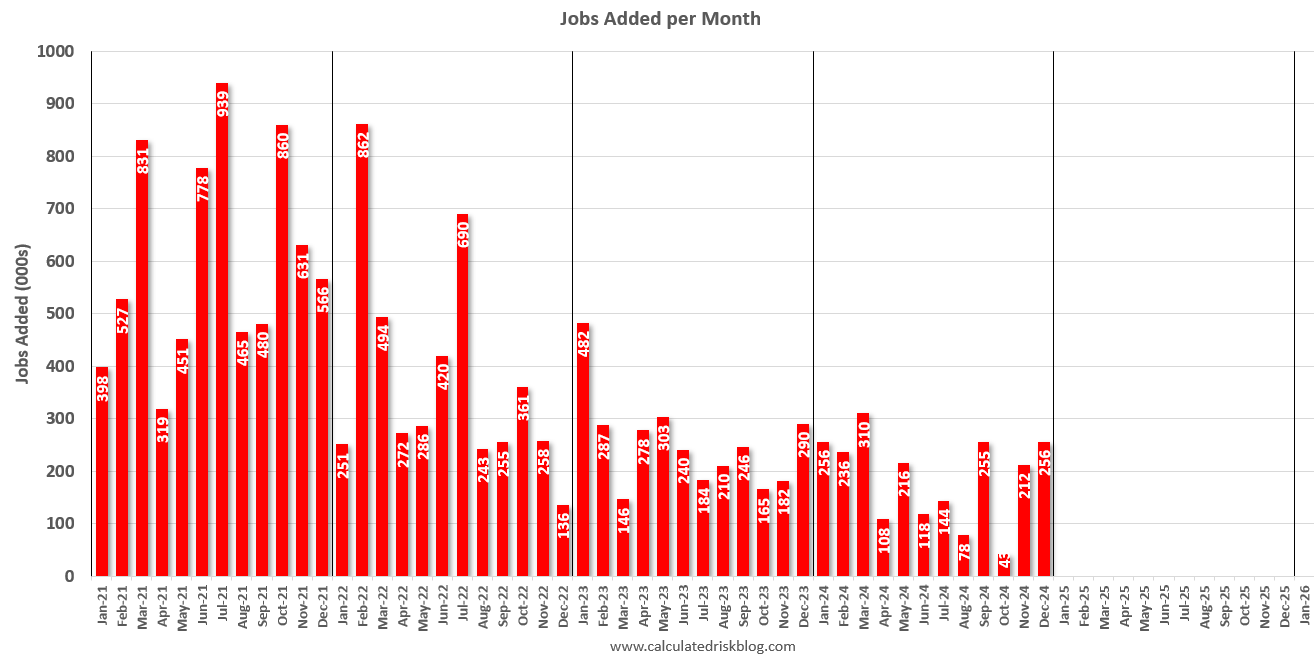

Total nonfarm payroll employment increased by 256,000 in December, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment trended up in health care, government, and social assistance. Retail trade added jobs in December, following a job loss in November.

…The change in total nonfarm payroll employment for October was revised up by 7,000, from +36,000 to +43,000, and the change for November was revised down by 15,000, from +227,000 to +212,000. With these revisions, employment in October and November combined is 8,000 lower than previously reported.

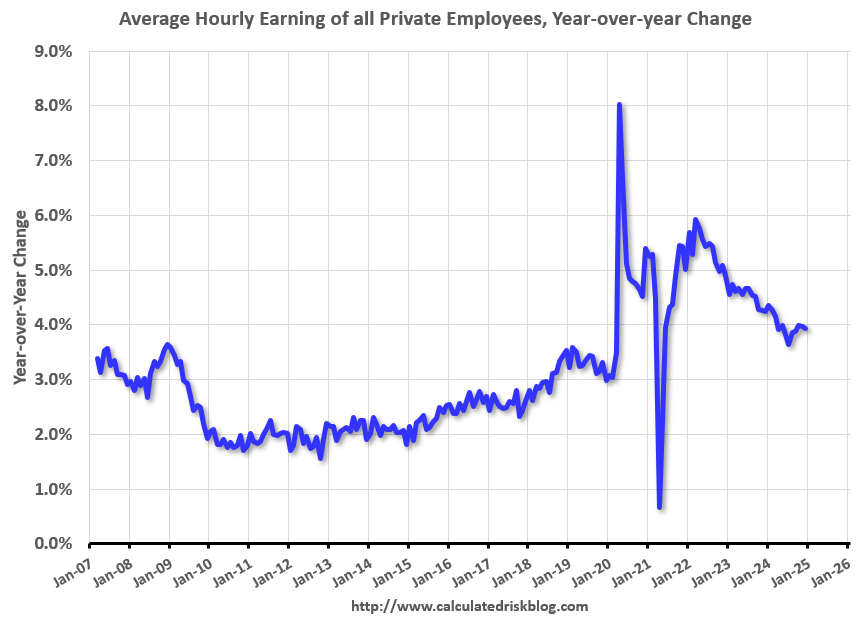

The US economy is in rude health. Strong productivity. Strong real wage gains. Strong consumption. Rebounding investment.

DXY clearly indicates that Trump’s agenda of tariffs, tax cuts, and immigration deportations will overheat it.

Either Trump is going to break or the market is. Perhaps the most likely scenario is both—one followed by the other.

Whichever way you look at it, until this plays out, the AUD is the world’s whipping boy.

50s here we come.