DXY is taking a well-earned breather.

Australian dollar is threatening a bigger bounce.

But the CNY concrete shoes will not come off.

Oil is a worry.

Copper is delusional again.

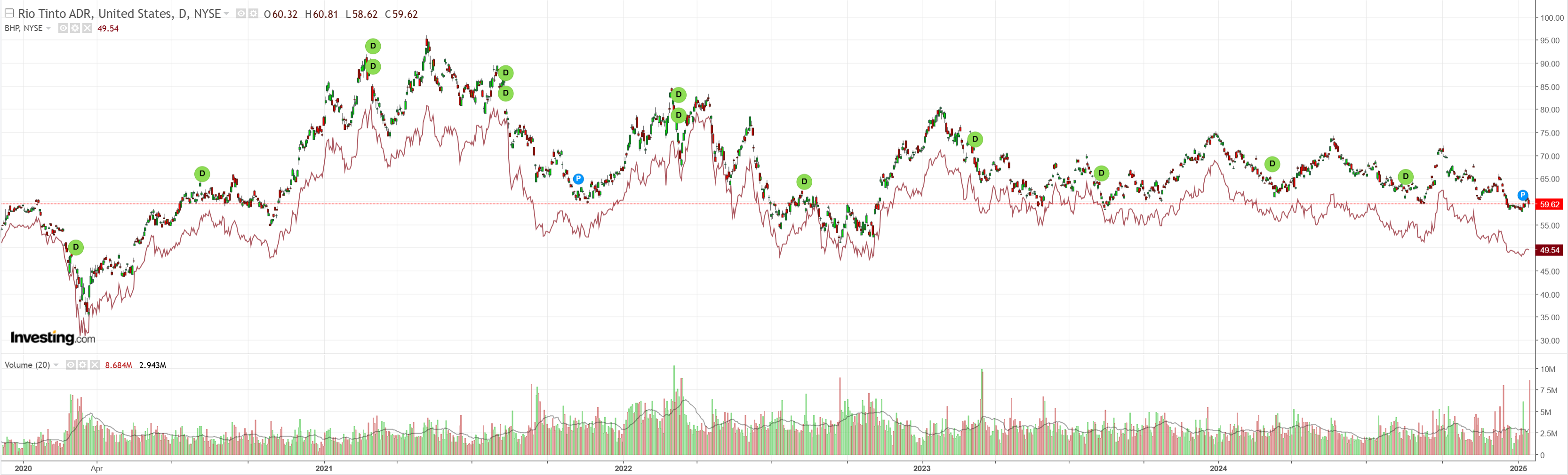

Miners sagged.

EM meh.

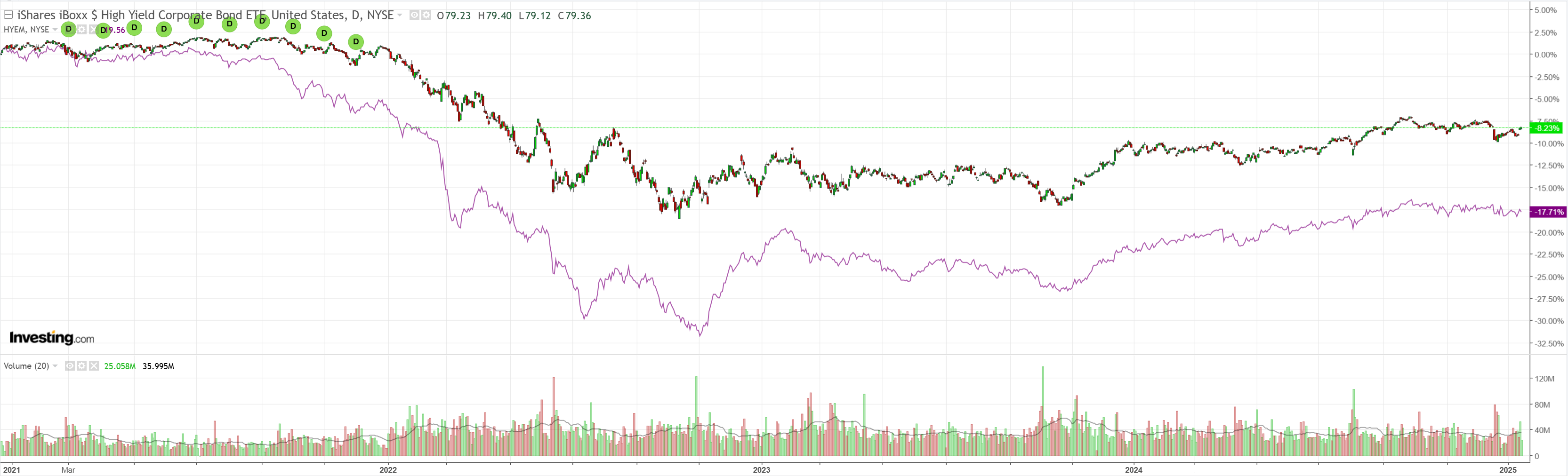

Junk meh.

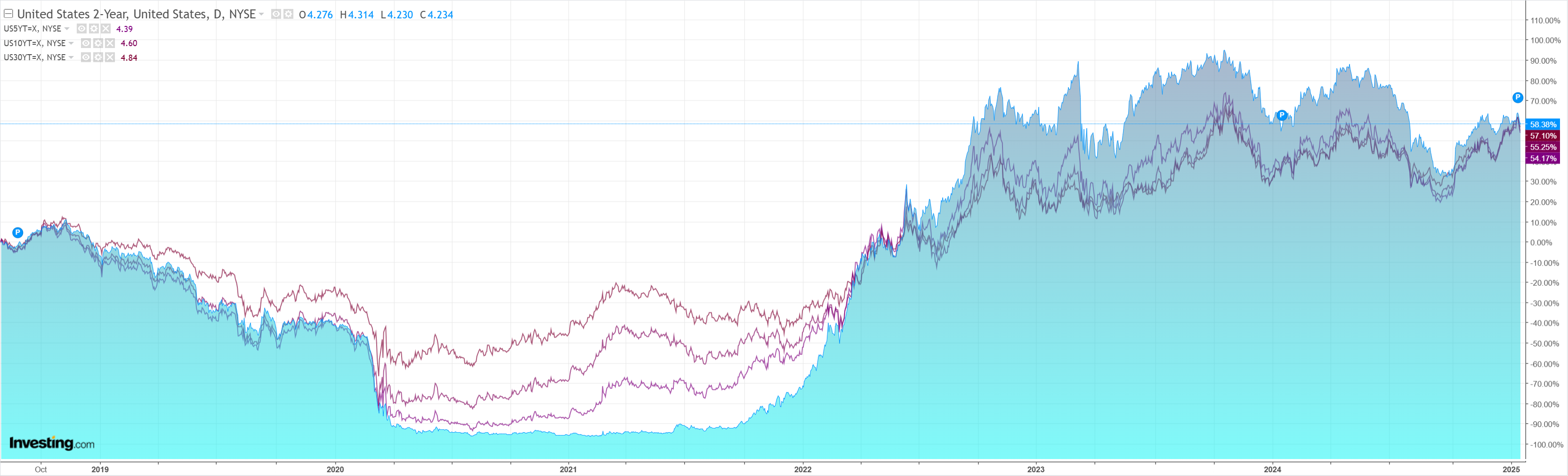

Yields coming off.

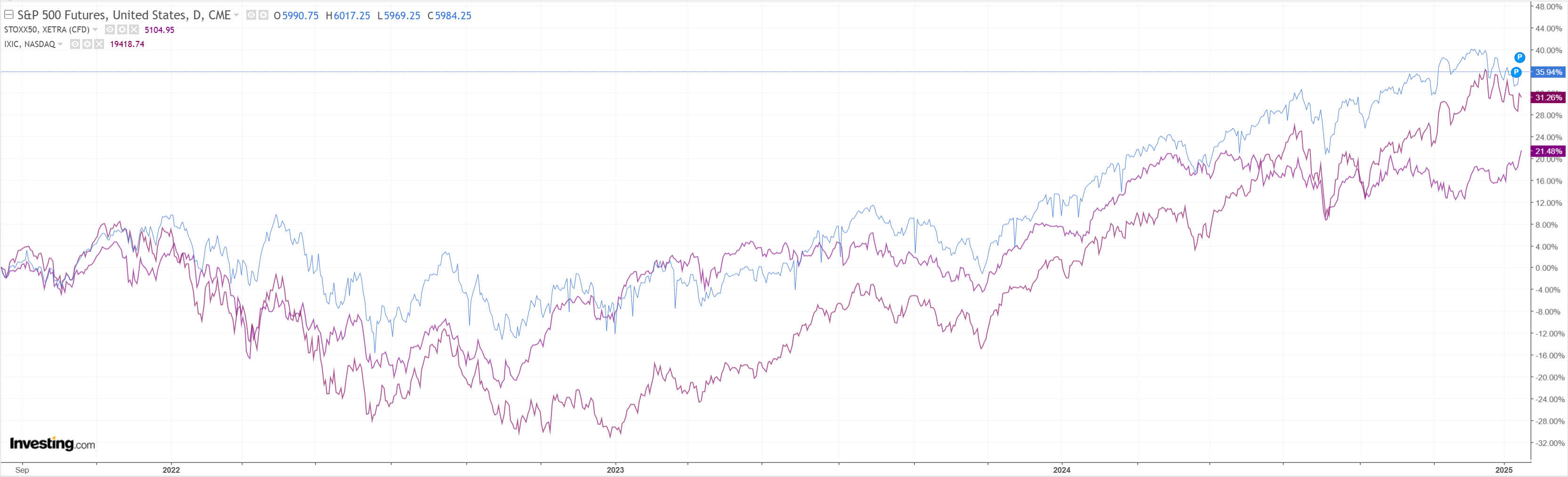

But stocks couldn’t follow through, except in Europe.

Fed hawk Governer WAller was dovish.

The inflation data we got yesterday was very good,” Waller said in an appearance on CNBC (commenting on a 0.1% MoM beat in core CPI which we would not be surprised if it will be revised away next month).

If we continue getting numbers like this, it’s reasonable to think rate cuts could happen in the first half of the year.

It just hinges on the data… If the data doesn’t cooperate, then you’re going to be back to two, maybe even one if we just get a lot of sticky inflation.

Data was weakish, too.

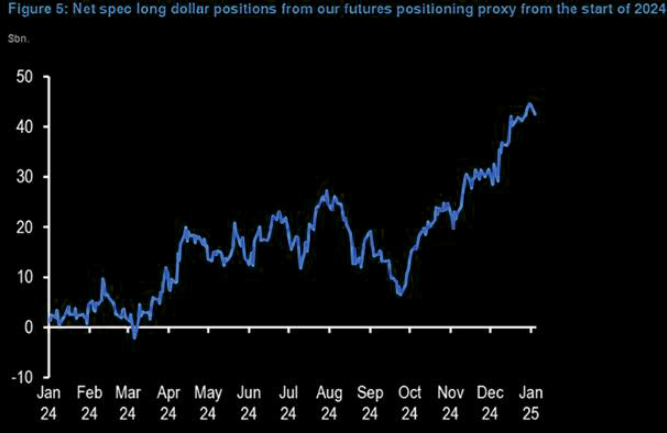

One wonders why DXY did not fall more. It is way overbought.

The market is very nervous about Trump’s incoming policies.

AUD may need more reassurance before it can really dead cat bounce.