DXY is near new highs.

AUD is dangling its feet over critical support.

CNY looks ready to crash.

I see no reason for an oil bounce, but if it comes, it will aid DXY.

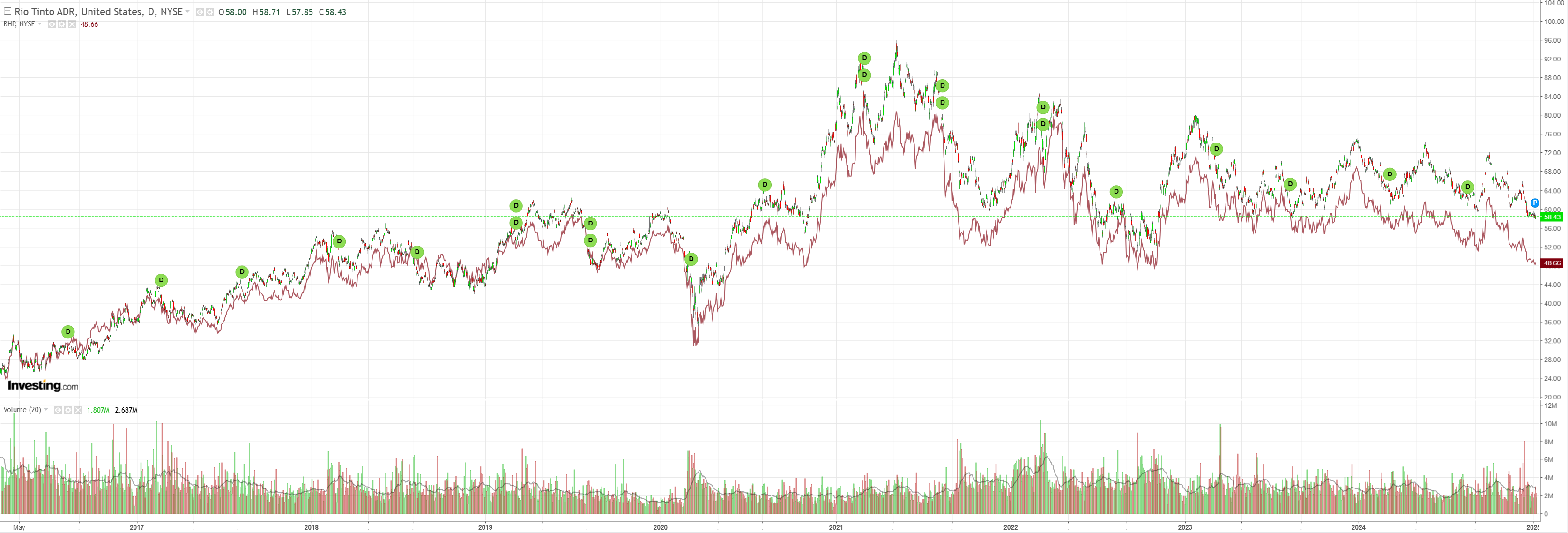

Dirt is caput.

Likewise miners.

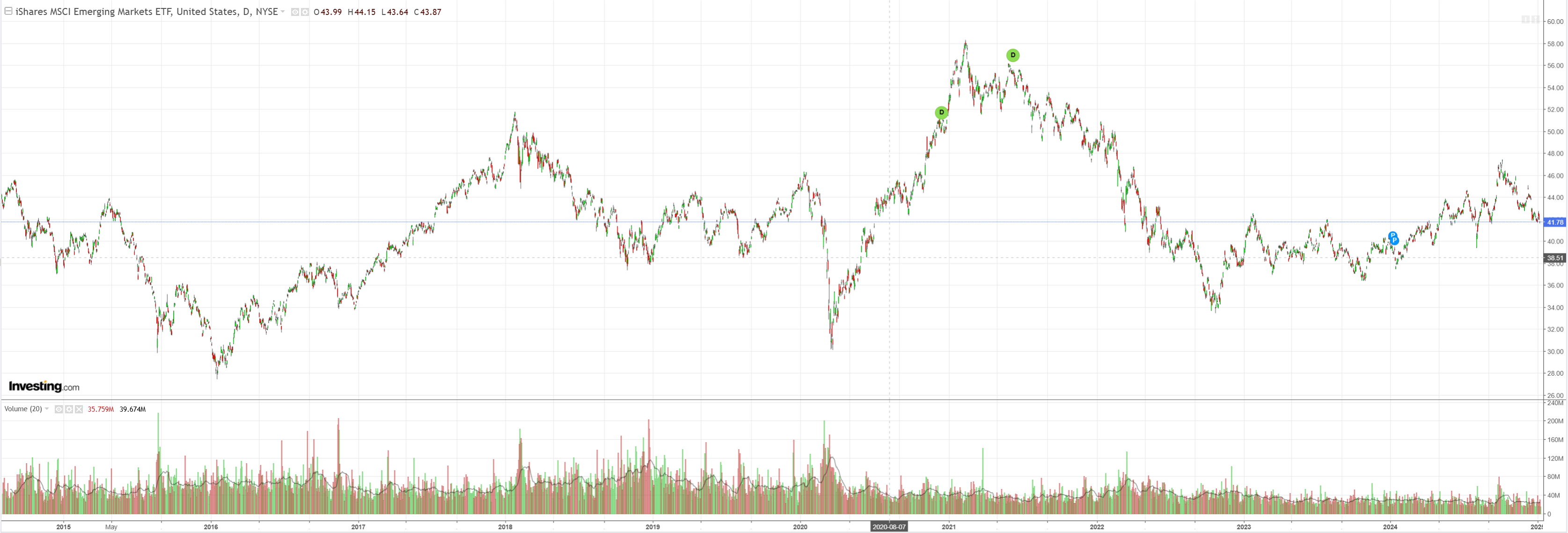

Xi’s big rally is a laugh a minute.

Junk spreads are choking the bulls.

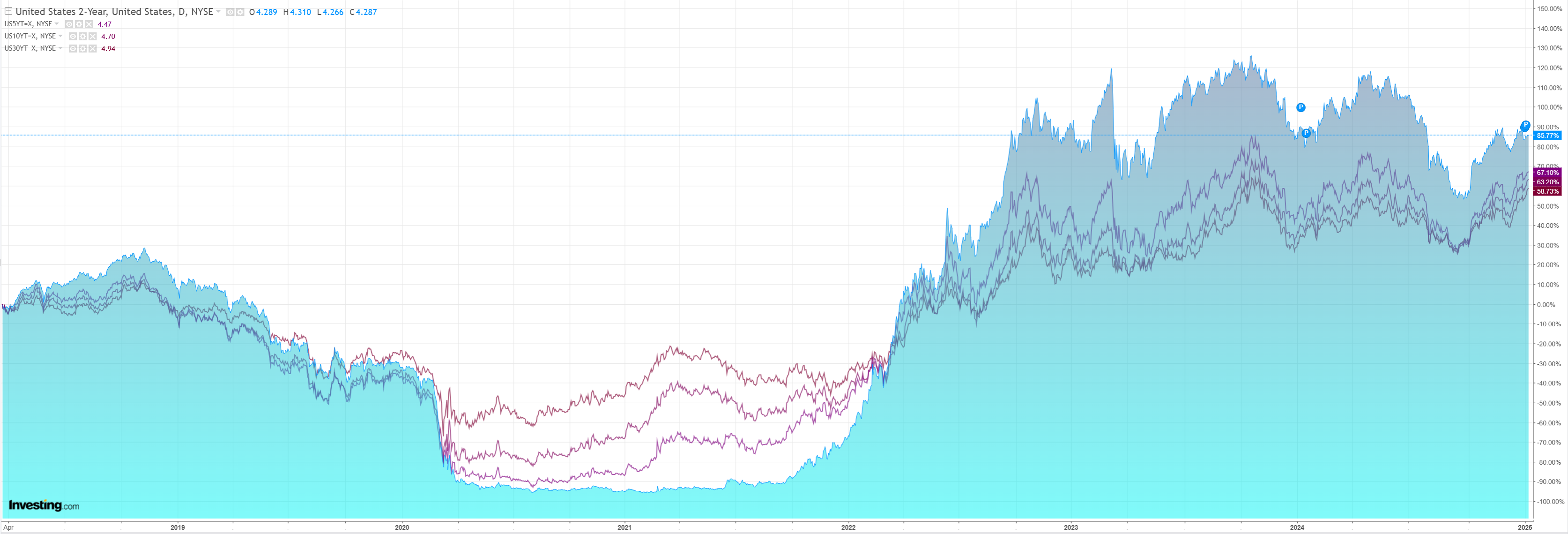

As the Treasury curve flattens.

Stocks are under increasing pressure.

There is little good here for risk, which will weigh on the AUD at the margin.

Trump’s incoming tariff and tax cut agenda is driving yields and curve flattening, not much fun for future profits.

DXY is still the only game in town as well with CNY poised to crash if the tariffs prove to be aggressive.

If so, markets look ready to correct meaningfully, which may weigh against more extreme outcomes.

Or it may mean we need to see it to pull Trump back from being overly punitive.

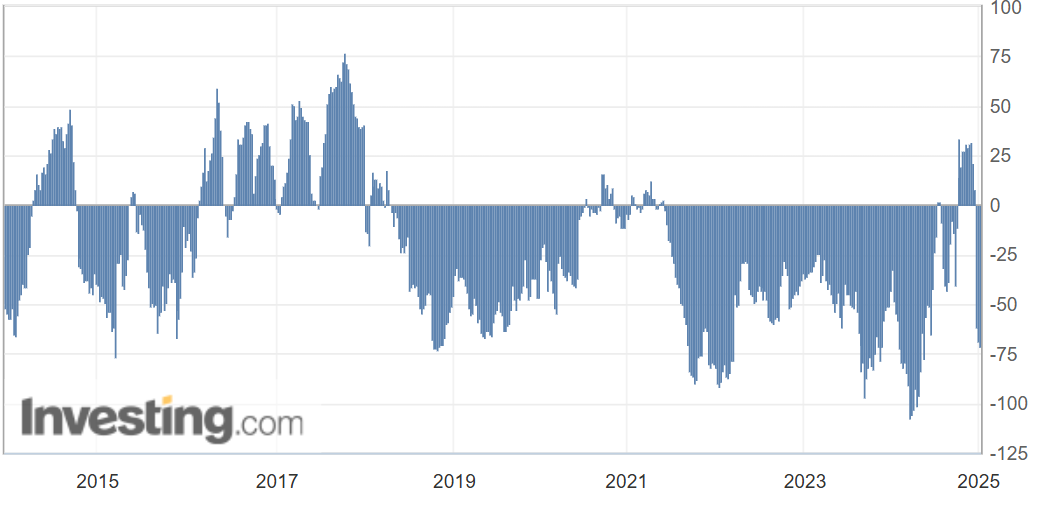

AUD is still in trouble, but of critical importance to the speed of falls is the shift in CFTC positioning from last year’s bizarro long to now being quite short.

This is part of markets being positioned for aggressive Trump tariffs on China, so if they come in more modestly, AUD will fly.

Even in the event of the full 60% tariff, AUD now has parachute to slow its falls.