DXY is still poised for higher.

AUD is now trading in the 61s.

CNY was smashed by deflation.

Gold is marking time. Oil has lost its mojo.

Advertisement

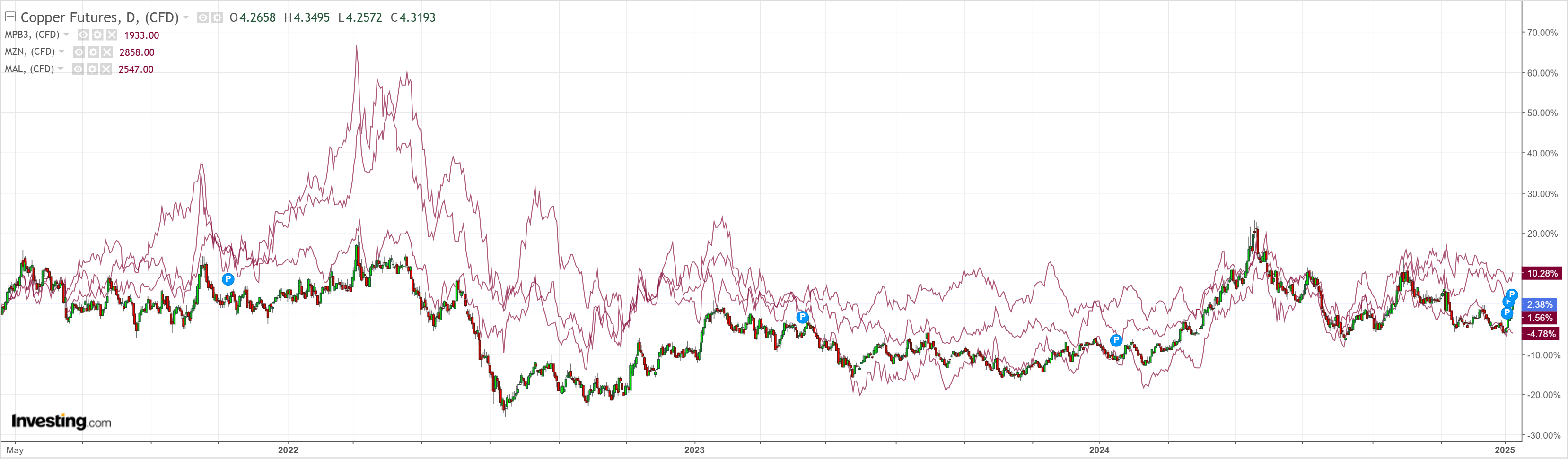

Copper pop!

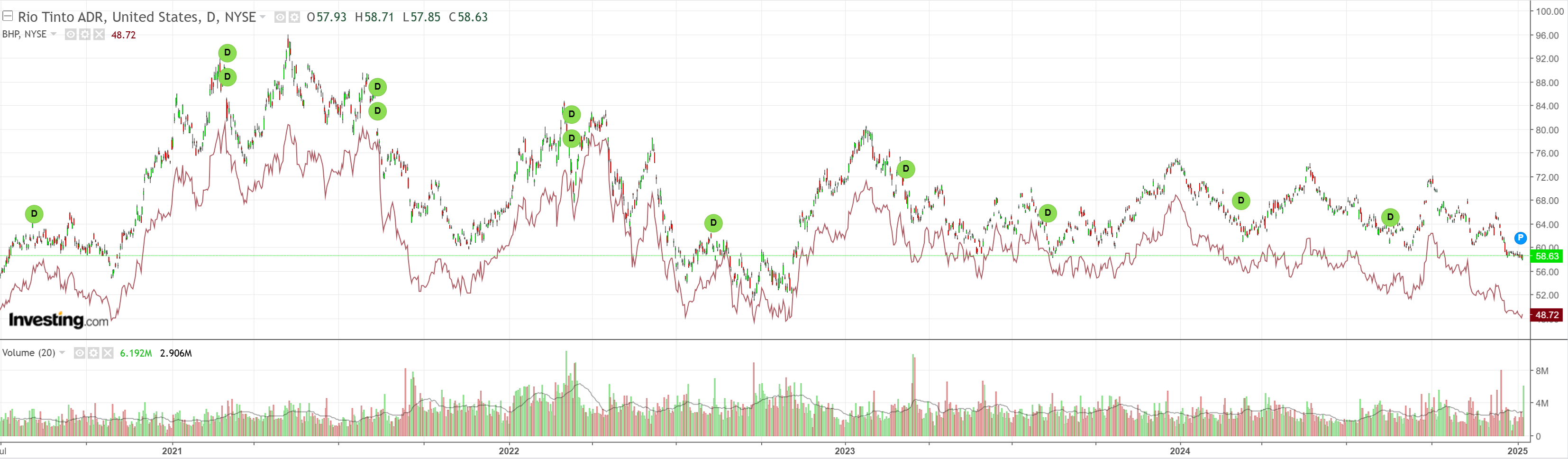

Miner not!

EM cactus.

Advertisement

Junk is weighing everything down.

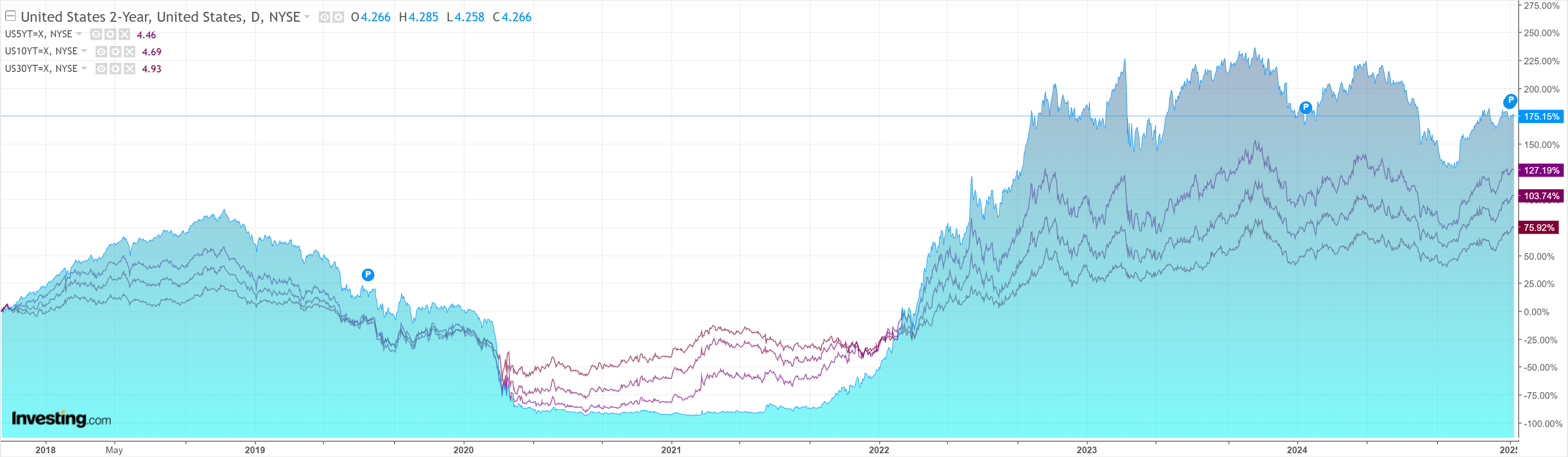

As the yield bear steepening continues.

Stocks were shut.

Advertisement

Check this out.

The Chinese long-bond yield is in freefall as deflation embeds. This is pressuring CNY which, in turn, is pressuring AUD.

And note, this is during stimulus, tariff front-running and a decent global economy.

Advertisement

What happens here when the tariffs drop, front-running turns demand air pocket, stimulus is insufficient, and the global economy is rocked?

Lower CGB yields. Lower CNY. Lower AUD.