The FT with the story.

Donald Trump’s Treasury secretary Scott Bessent is pushing for new universal tariffs on US imports to start at 2.5 per cent and rise gradually, said four people familiar with the proposal.

The 2.5 per cent levy would move higher by the same amount each month, the people familiar with it said, giving businesses time to adjust and countries the chance to negotiate with the US president’s administration.

The levies could be pushed up to as high as 20 per cent — in line with Trump’s maximalist position on the campaign trail last year.

But a gradual introduction would be more moderate than the immediate action some countries feared.

Two people familiar with the discussions said it was unclear if Bessent had convinced other central stakeholders, including Howard Lutnick, Trump’s pick for commerce secretary, to adopt his proposal.

I can see how the incremental approach will give Trump the chance to do bilateral deals, but it sure won’t calm markets as they hand on every utterance instead of pricing more certain outcomes.

In other news, Bessent was confirmed as Treasury Secretary and the AUD was walloped.

I do not think that a 20% China tariff is fully priced. Neither does Goldman.

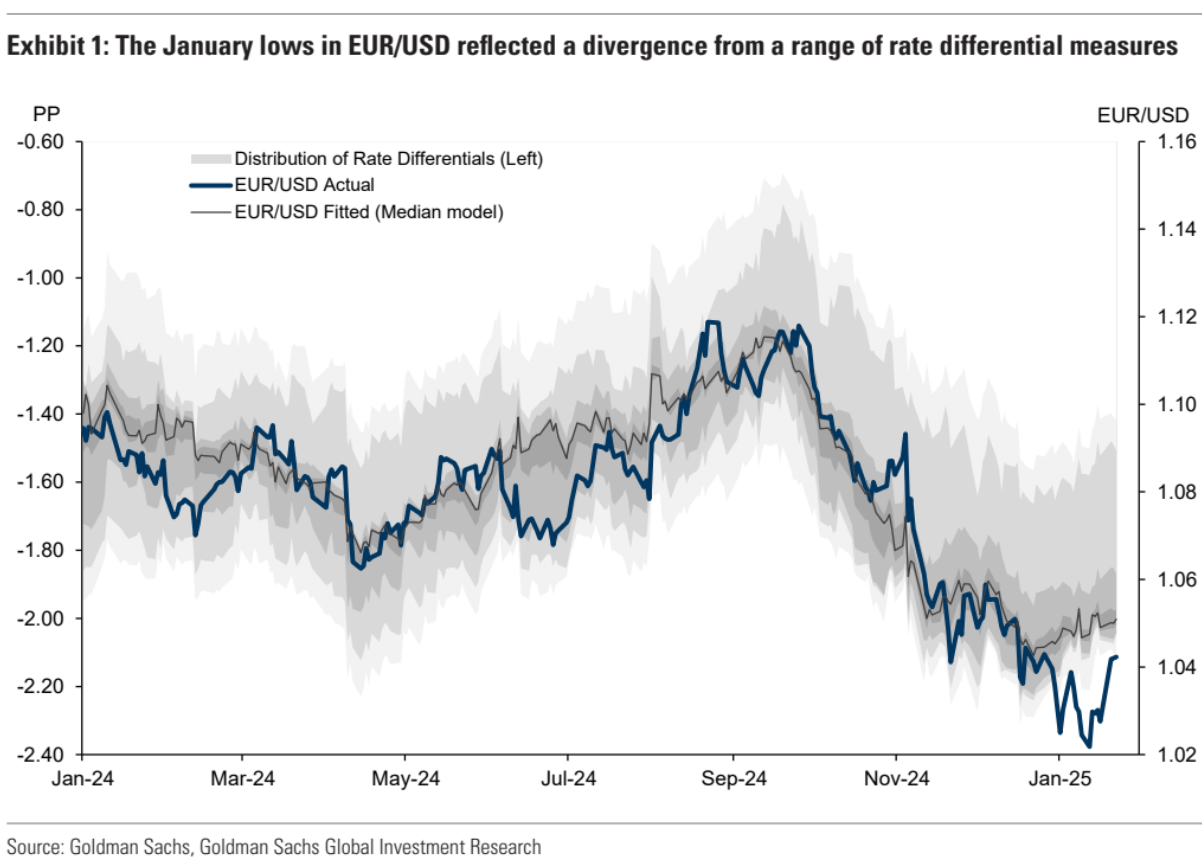

We think recent market moves are instructive in three respects (Exhibit 1). First, EUR/USD moved closely with rate differentials up until about a month ago, when the Dollar began nto outperform.

This is likely indicative of tariff-specific risks being priced, in line with our impression of market expectations.

Second, the moves this week unwound about two-thirds of that risk premium, which is much more than our own expectations shifted but consistent with a positioning-driven reset.

Third, there was some risk that we were “double counting” the tariff premium if rate differentials were also embedding a significant tariff premium, and differently from in the 2018-19 trade war.

But rate differentials were little changed on the week, which gives us some comfort that the Dollar can outperform rate differentials similarly to last time if tariff expectations are realized.

Taken together, we see the moves this week as a reset from expectations that had built too much for immediate action, but think the macro fundamentals that drove the majority of the Dollar’s rise in recent months still put a floor under the Dollar, and the reset in the tariff premium has moved further than we think policy outcomes have likely shifted.

That’s forex for ya. Write a bullish piece on Monday. Bearish egg on the face Tuesday!