Already? DXY is back.

AUD flamed out.

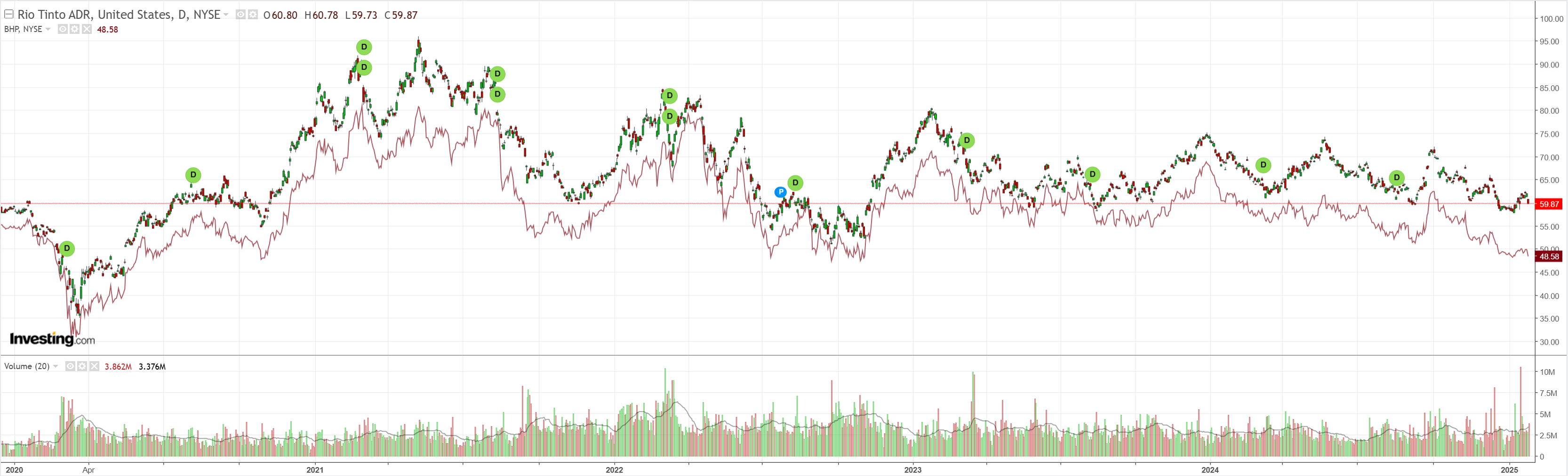

Auld lead boots is back.

Commods got tariffed.

Miners ouch.

EM so yetserday.

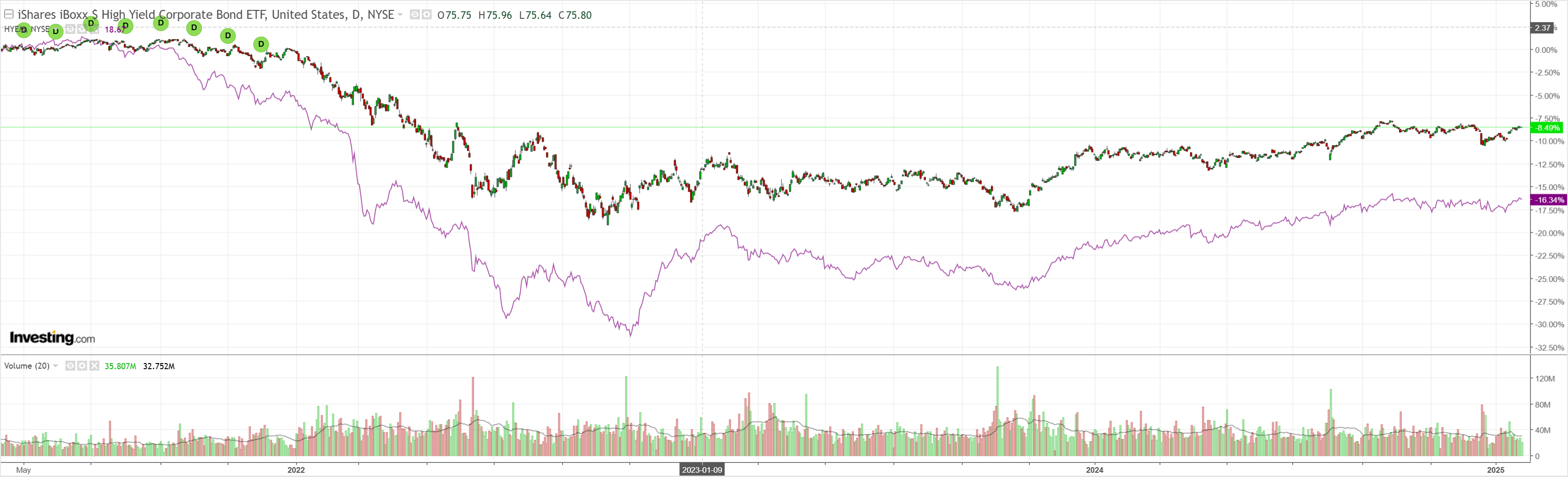

Junk trying to throw some fuel on risk.

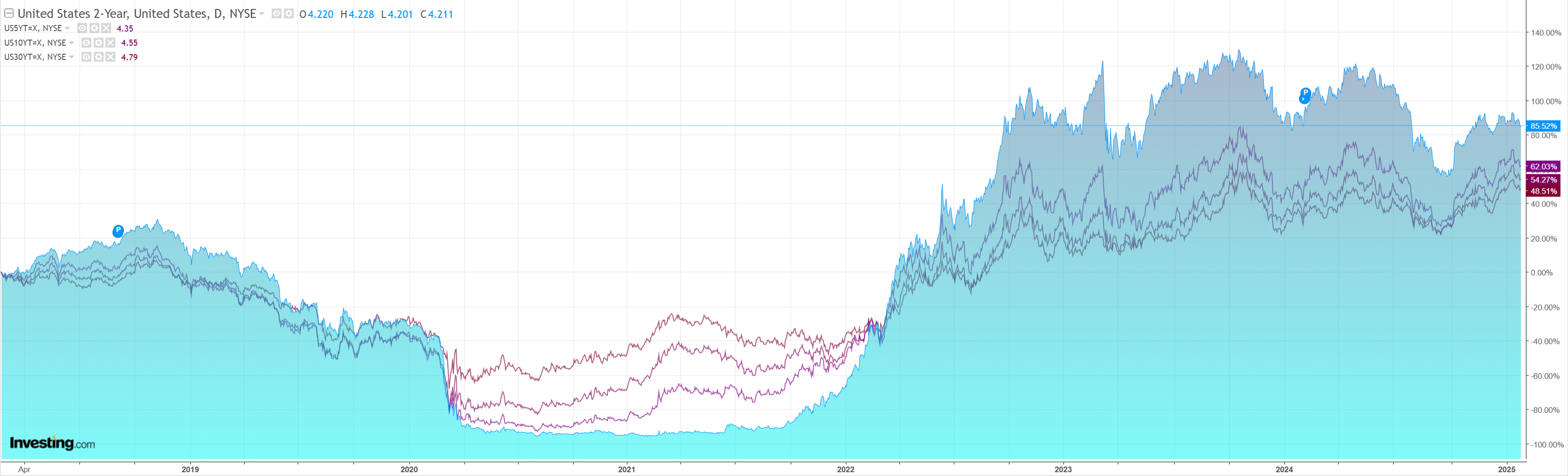

As yields ease.

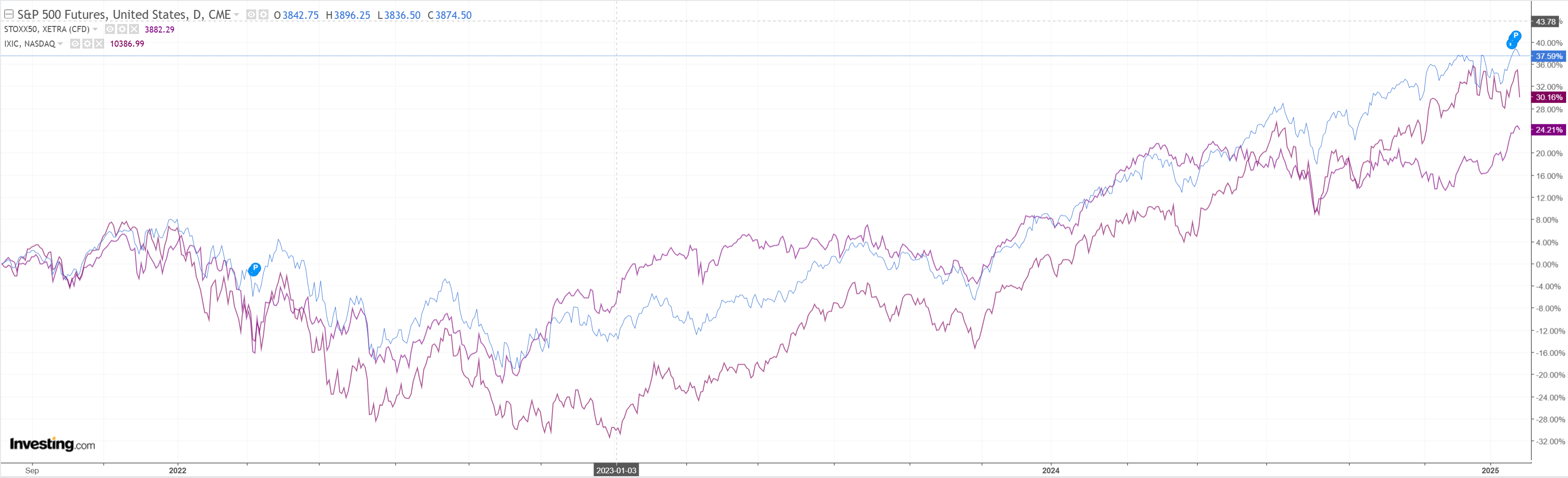

Stocks rebounded.

It’s hard to see how much further a DXY correction can get when El Trumpo fires off daily tariff warnings.

Credit Agricole notes that DXY is much closer to fair value than it was.

The FAST FX model made 1.63% last week being long EUR/USD, AUD/USD and NZD/USD.

All three trades hit their take-profit levels.

After being overvalued for several weeks, the USD is trading close to its fair value in the USD crosses covered by our model.

The FAST FX model has not identified any new trades this week and is up by 6.10% over the past year with a hit rate of 61%.

AUD/USD’s fair value fell from 0.6303 to 0.6263 due to falls in the Australian-US short-term rates spread and energy prices, which was partly offset by rises in the Australian-US box yield spread and metal prices. AUD/USD’s rise has caused it to become modestly overvalued.

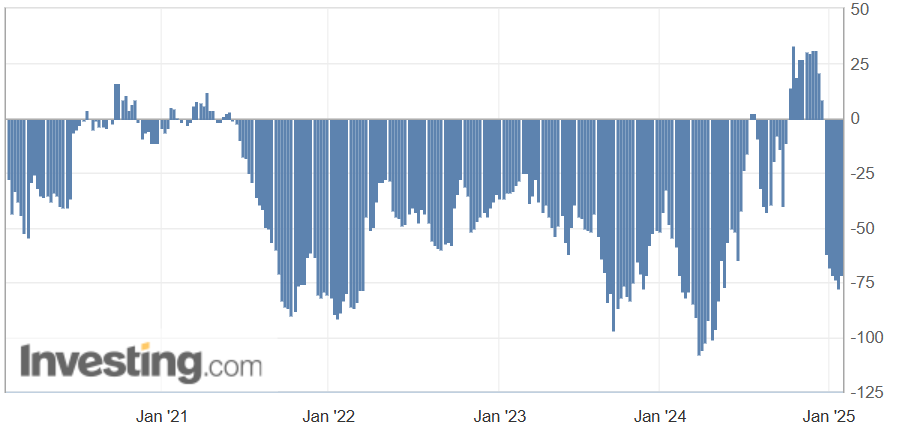

AUD overvalued! Hardly. However, the net short is still there and represents significant support for the currency.

It is not easy to push the currency materially lower into this.

I still think there is more wood to chop before AUD can lower later this year.