DXY held on.

AUD firmed.

CNY did not.

Oil fell on Trump comments.

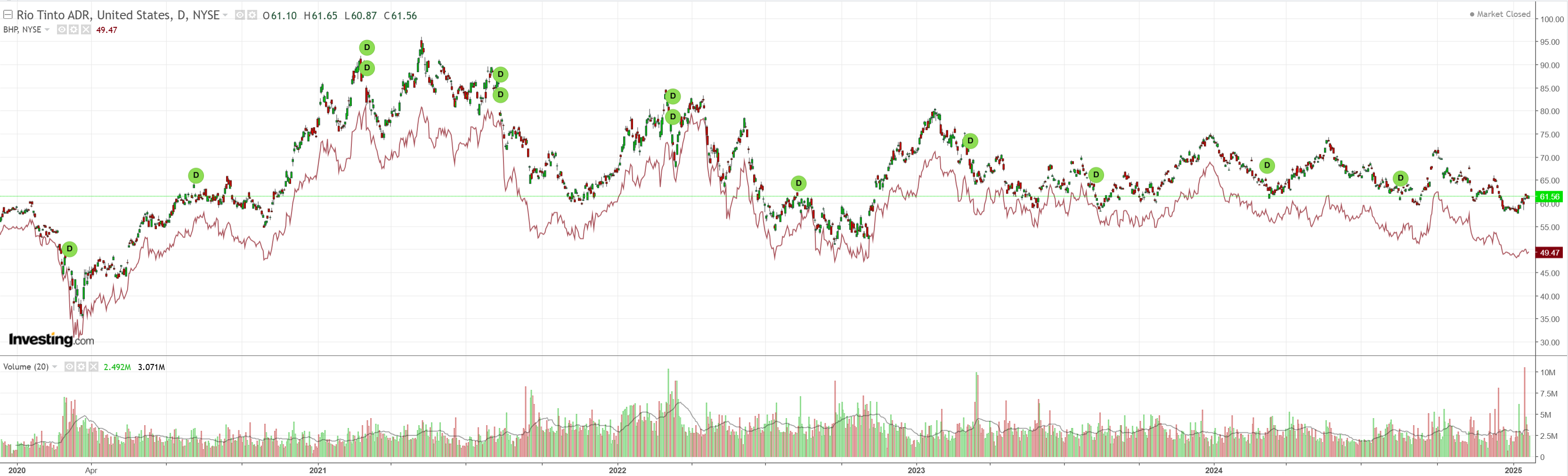

Metals followed.

Miners edged up.

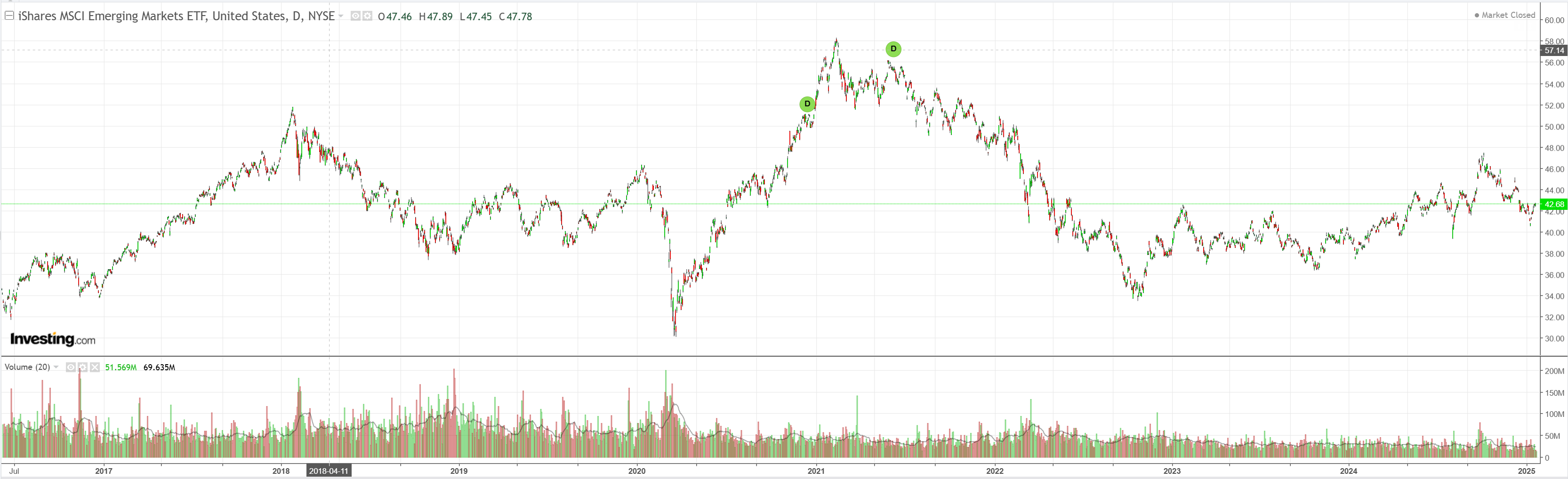

Who needs EM when there’s Fartcoin?

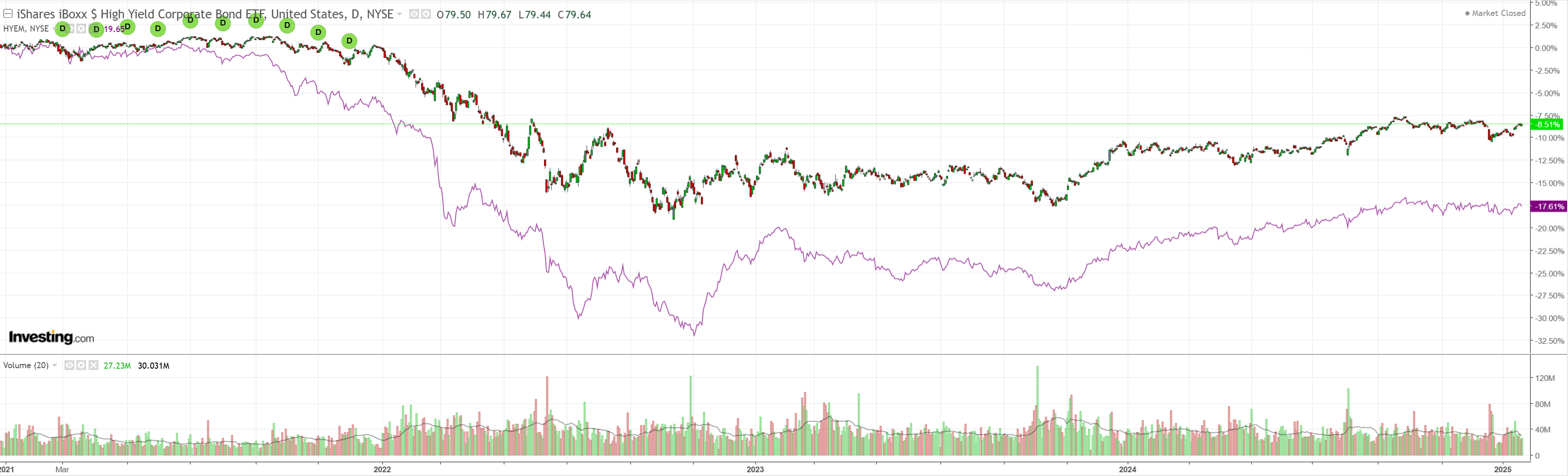

Junk is really stuck.

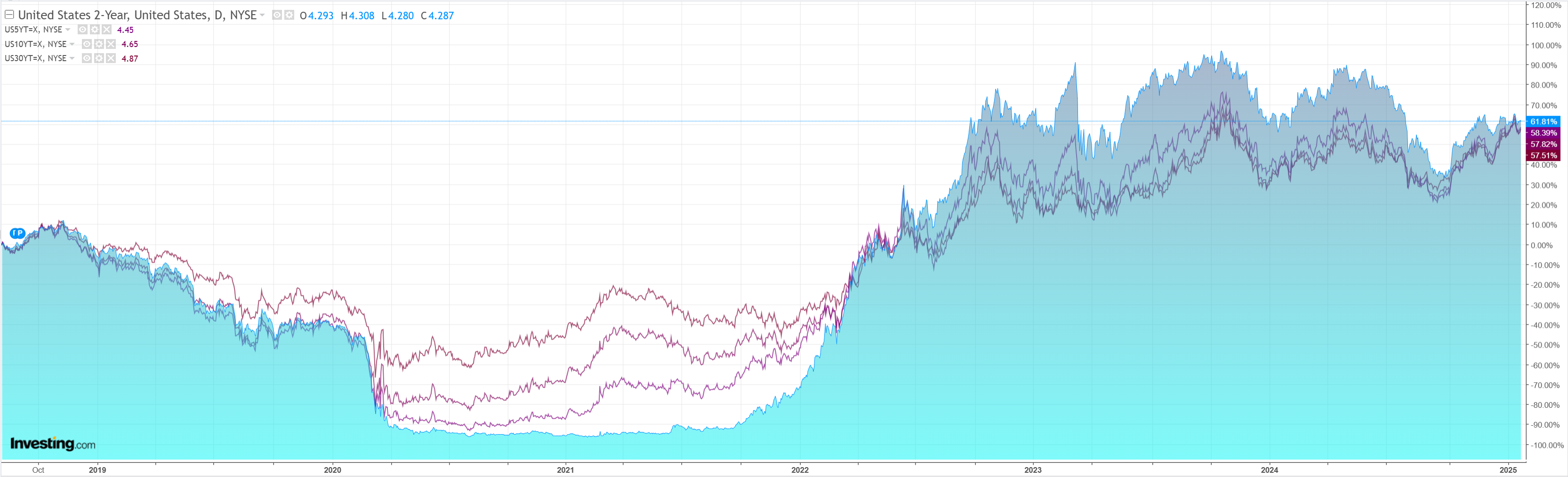

Yields lifted.

Stocks too.

The AUD counter-trend move continues as the market toys with less severe tariff outcomes. Citi has more.

We recently flipped from bullish to neutral USD as a new DXY range is established.

Despite hawkish rhetoric from President Trump, internal debates around tariffs may have led to a more muted starting point and gradual implementation for now.

Headline risks around tariffs will remain high, but there are early signs that markets are taking out this risk premium.

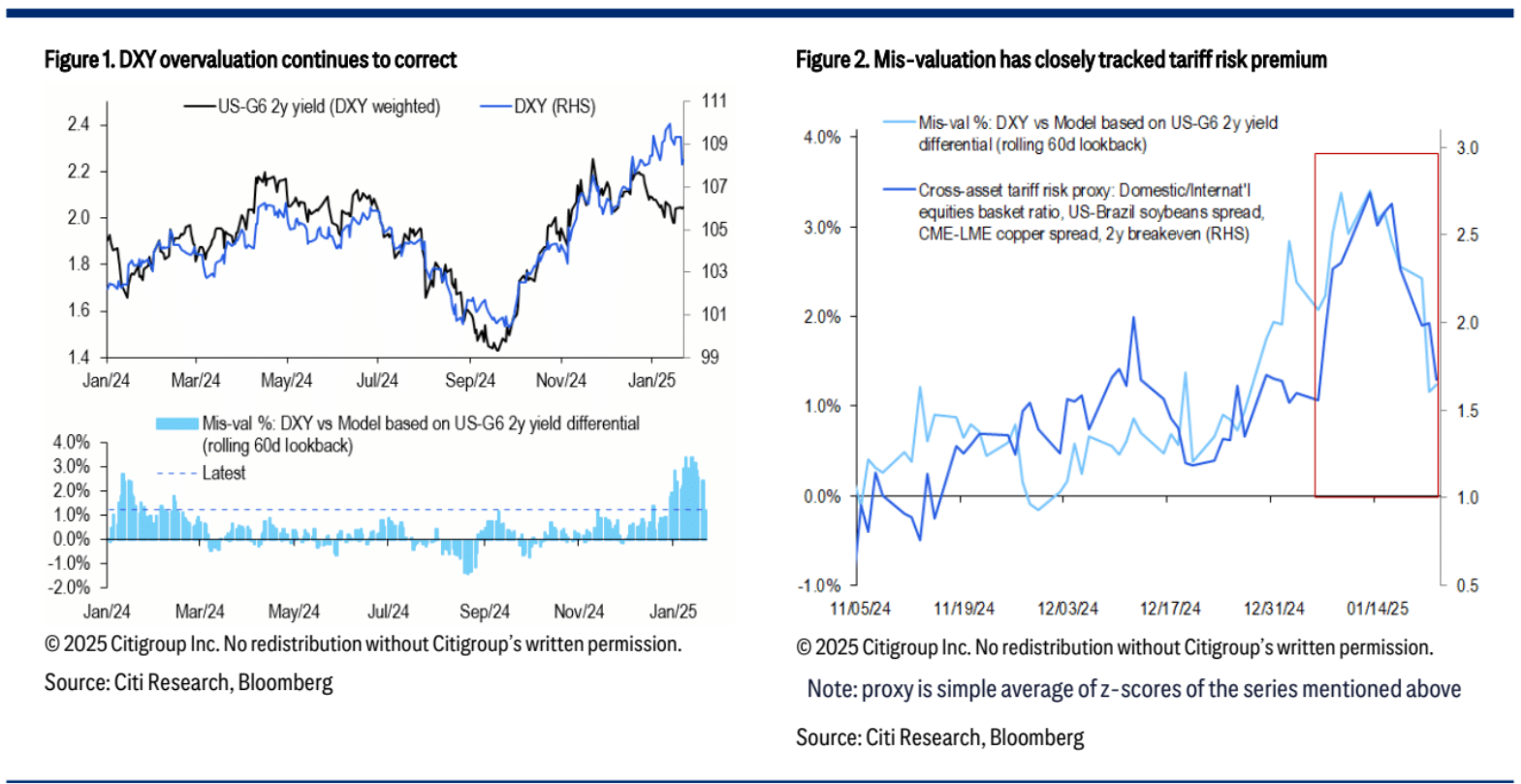

Our widely featured DXY fair value model suggests DXY overvaluation continues to correct (Figure 1), where this mis-valuation has closely tracked a market-based proxy of tariff risk premium (Figure 2).

This measure tracked Trump’s win probability in the period before the US election, suggesting it is a decent measure for capturing such risks.

We do not include FX series in our tracker to remove any ‘built-in’ correlation to DXY.

The takeaway is such risk premium is rolling over, which could mean further valuation corrections ahead.

(If tariff risks re-emerge, the speed of any correction could be more limited.)

We closely monitor our model residual and tariff risk proxy, particularly as Citi’s FX Positioning data indicate trimming of USD longs.

That sums it up nicely. Current tariffs are priced. More aggressive, not so much.

I am still bullish on an AUD bounce short term then lower later.