DXY is taking a breather.

AUD is ripping into a short-squeeze.

But it is wearing CNY concrete boots.

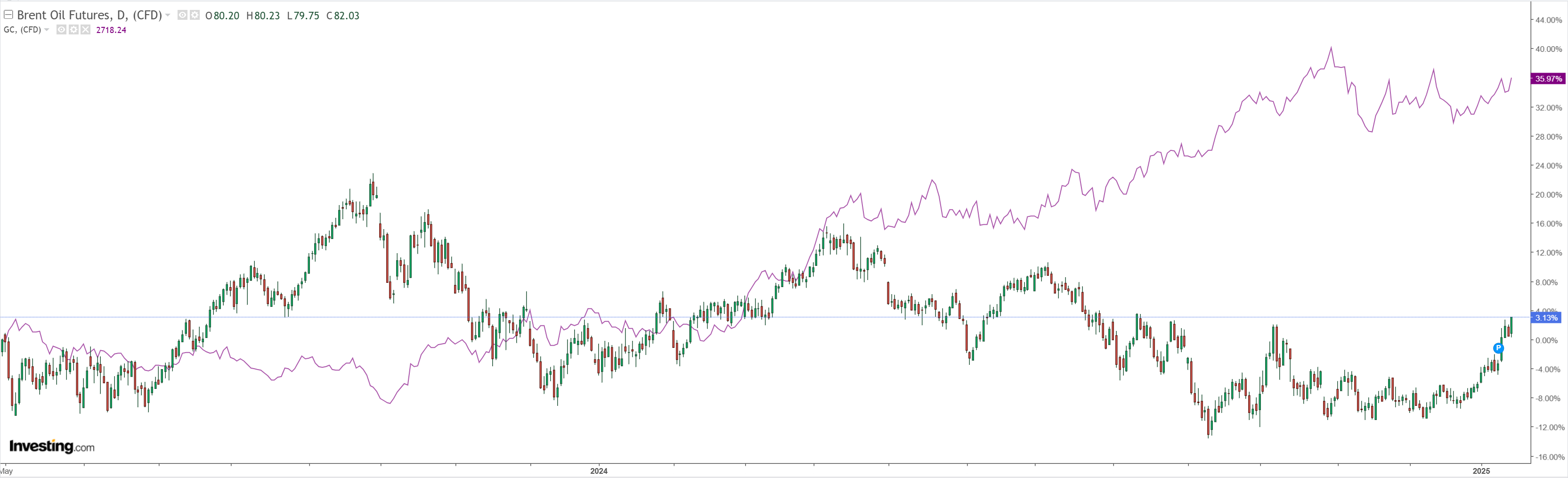

Oil is a problem for markets.

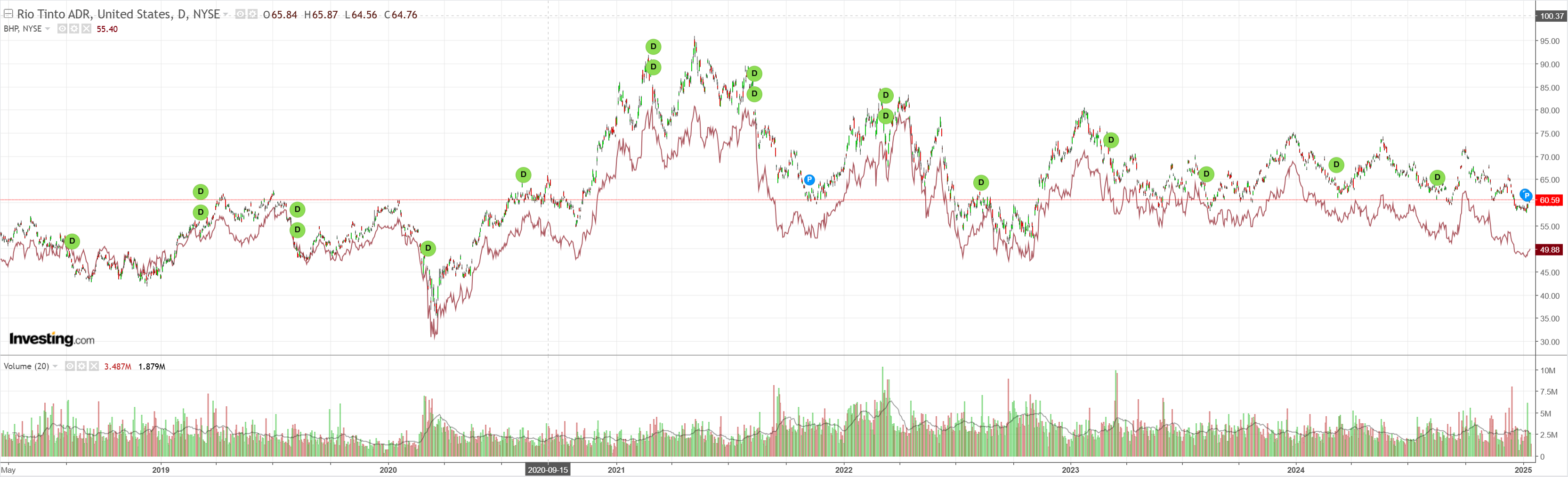

Dirt meh.

Miners soggy bounce.

EM likewise.

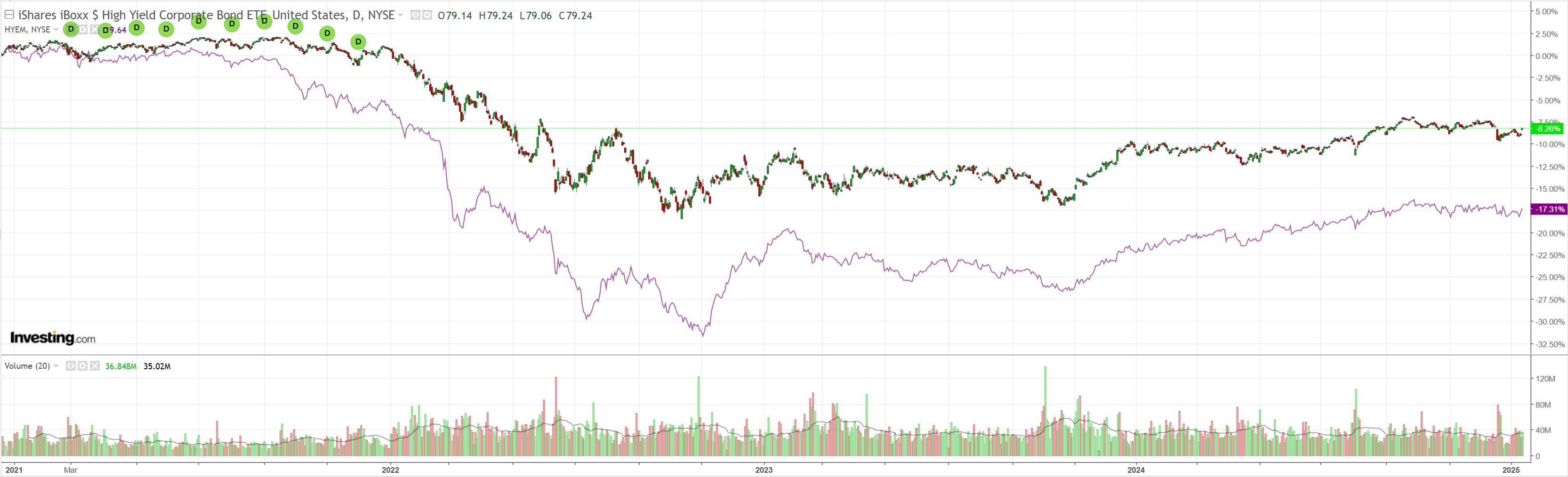

Junk jump.

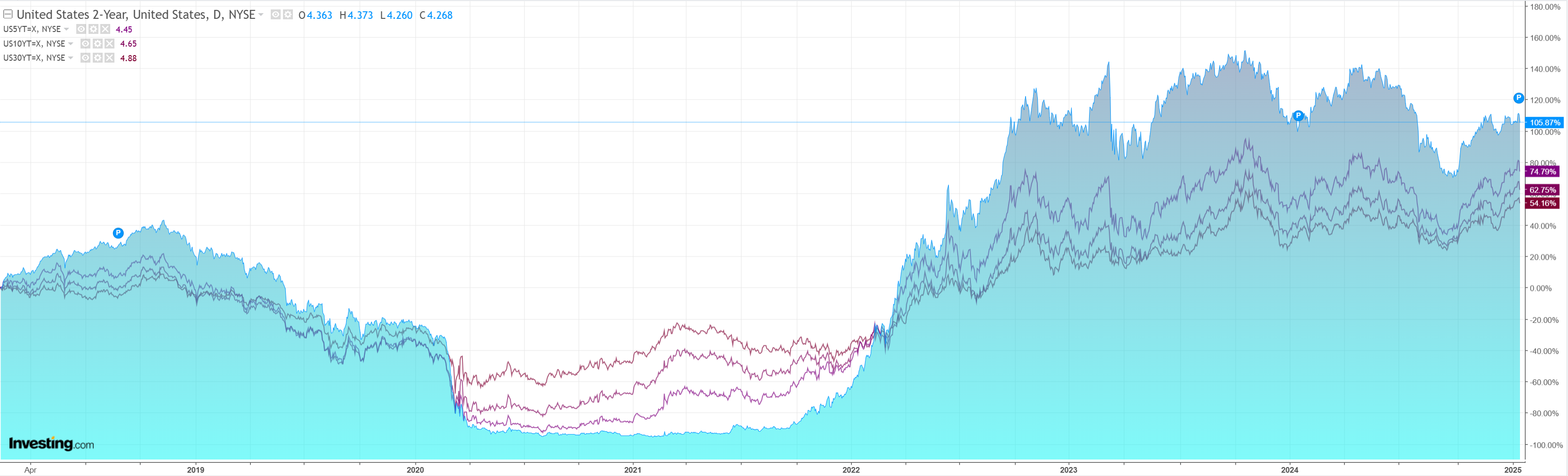

Yield dump.

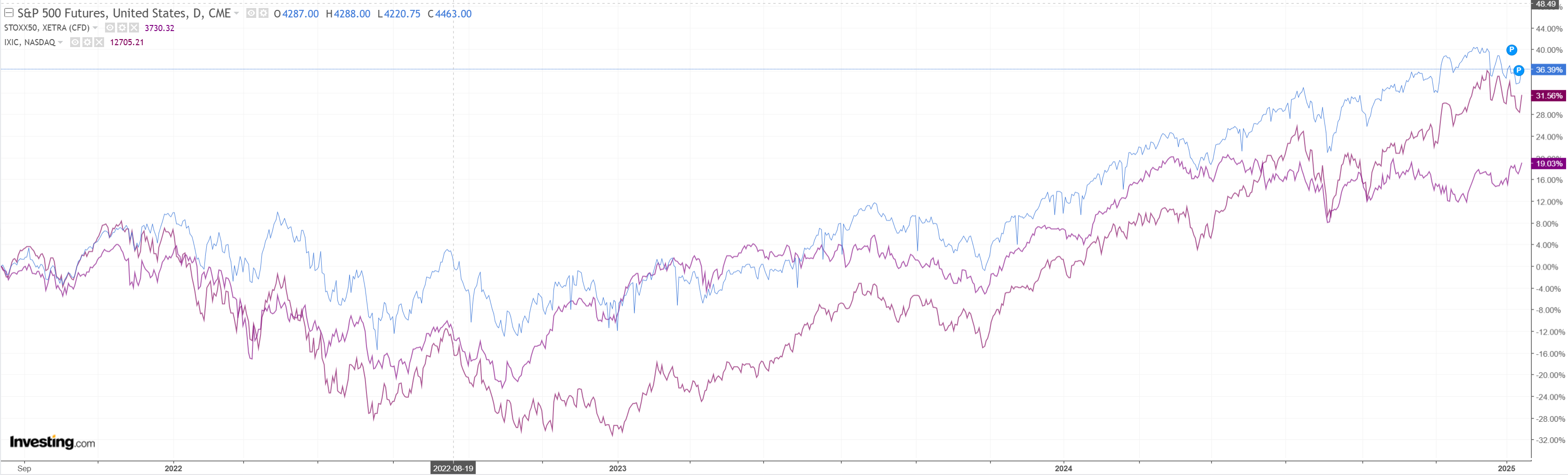

Stocks pump.

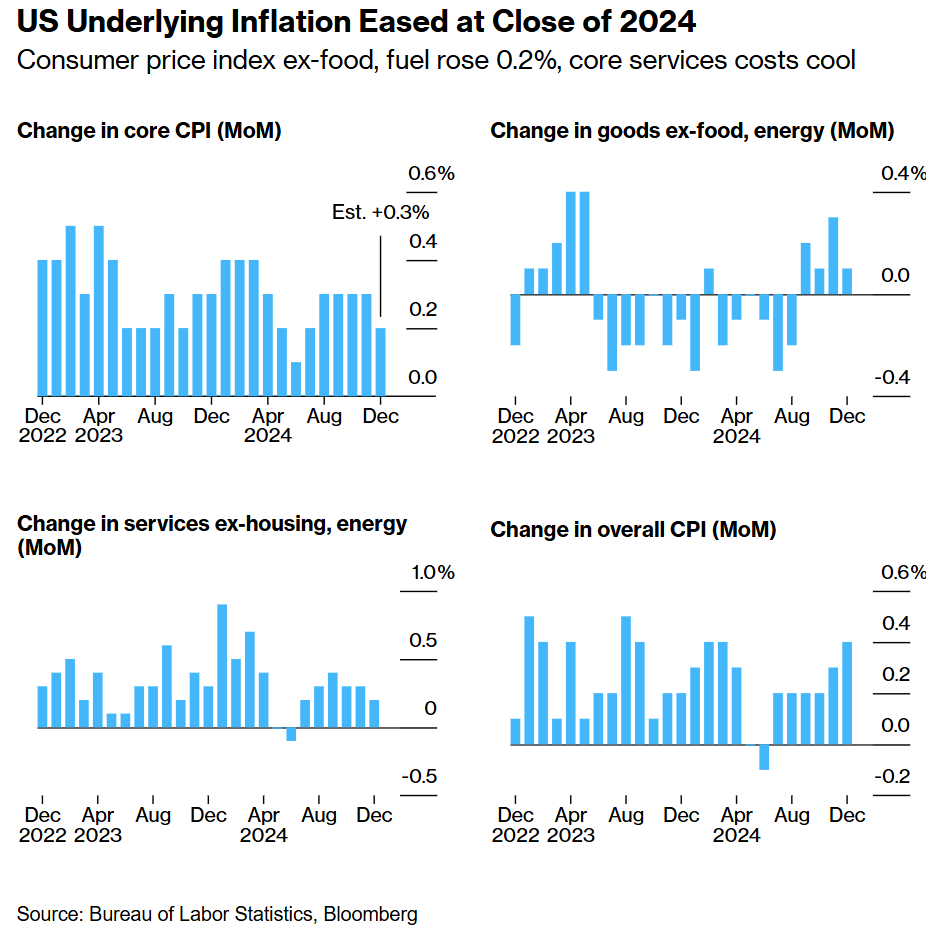

The US CPI was rocket fuel, as expected.

The so-called core consumer price index — which excludes food and energy costs — increased 0.2% after rising 0.3% four straight months, Bureau of Labor Statistics figures showed Wednesday.

That marked the first stepdown in the rate in six months. Cheaper hotel stays, a smaller advance in medical care services and relatively tame rent increases helped restrain the December figure.

That’s a good print with more disinflation ahead via rents in particular.

There may be enough here for a solid counter-trend rally especially if the leak about Trump’s incremental tariff ratchet mechanism plays out.

Some of the excesses for AUD weakness can be worked off.