DXY is holding but looks vulnerable to more pullback.

AUD the opposite.

CNY pumped and dumped on tariff talk.

Oil is offering hope to risk.

All commods were whacked on Trump’s 10% China tariff threat.

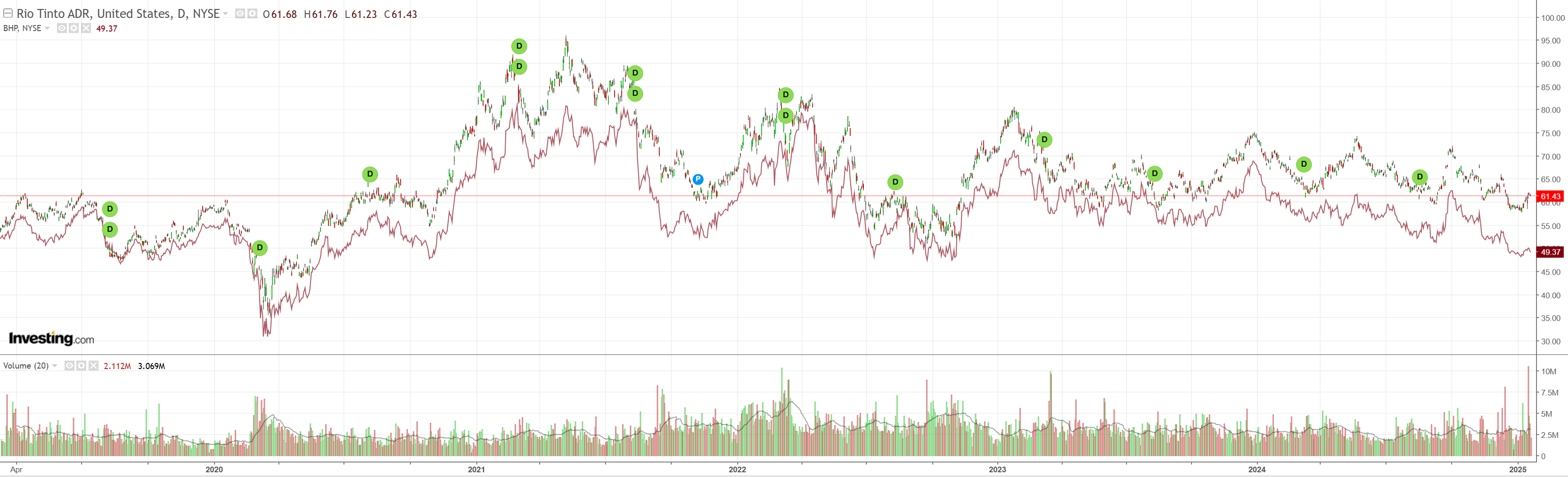

Big miners too.

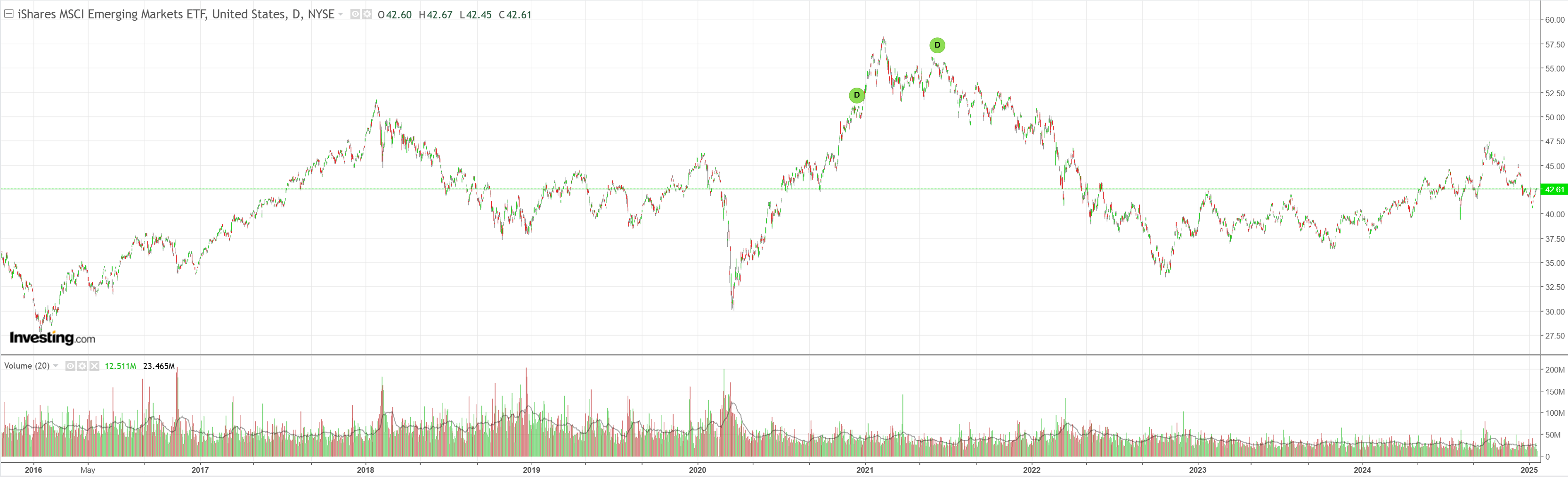

EM stocks are caput.

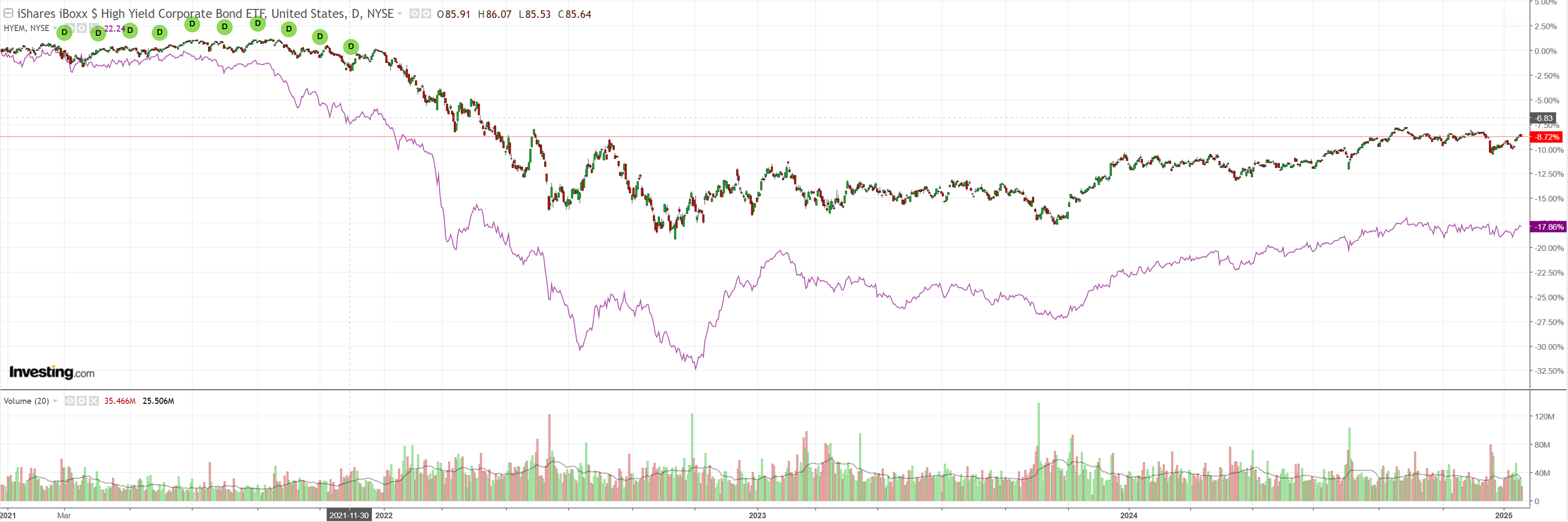

Junk is still stuck.

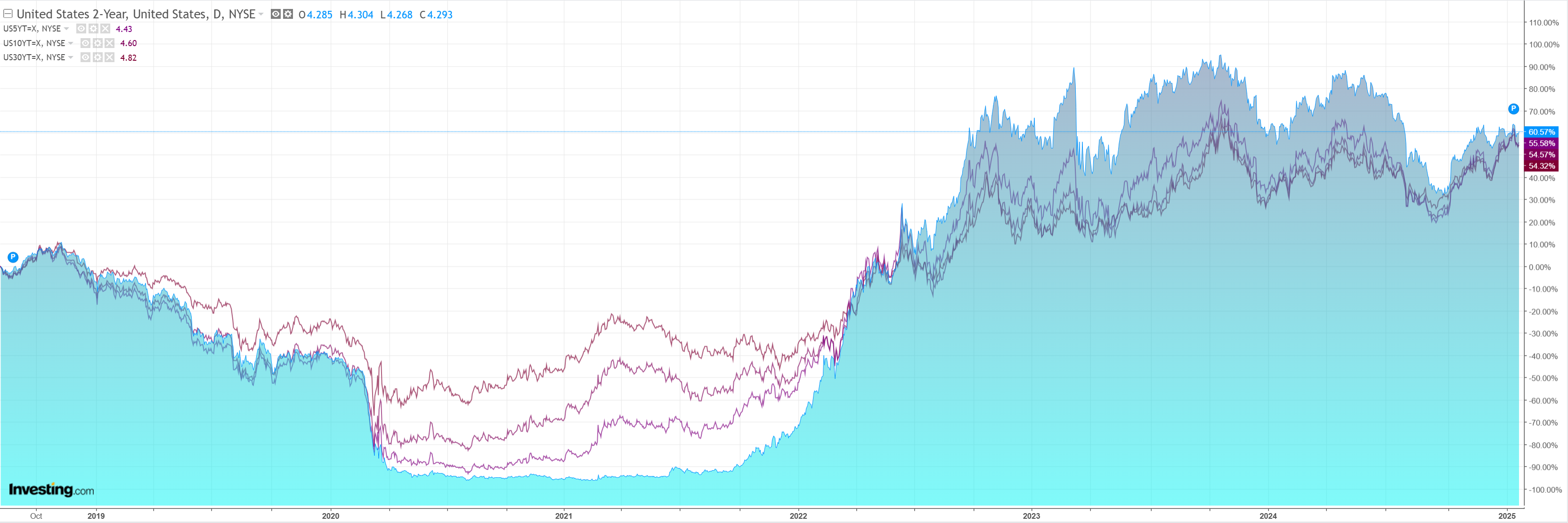

Yields are sticky.

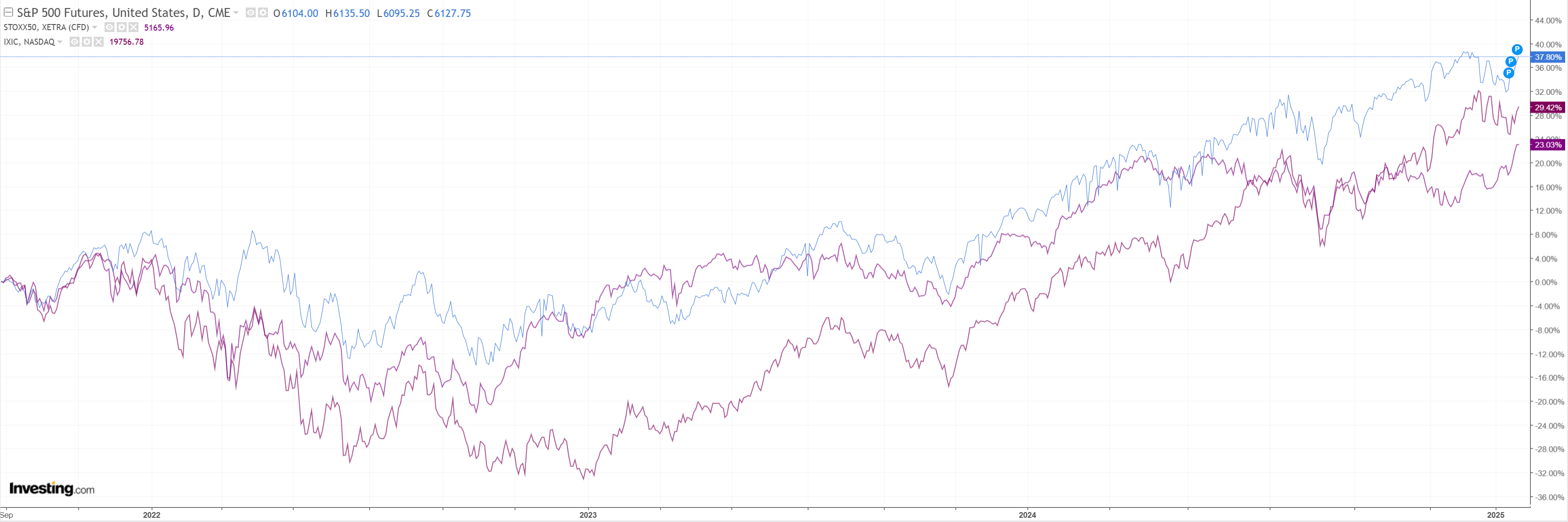

Stocks heading for new ATH.

Goldman makes an interesting point about the AUD collapse today.

The A$ has fallen 10% from its highs in September.

A peak to trough drawdown of this magnitude is not unusual (this isthe 12th >10% move over the past 25 years), but the current episode is an outlier for a few reasons.

Firstly, it is only the second time that the A$ has fallen against a backdrop of rising short-term rates (AU 2yr rates +28bps since Sept).

While the interest rate differential between Australia and the US has fallen over this period, the gap that has opened up is modest in the context of past cycles (US/AU rate differential has widened 35bps vs a historical average of 70bps).

Alongside rate differentials, commodity prices have been another major driver of the A$ over time.

Again, the pattern here is a significant departure from the standard set-up.

Industrial metals prices (using GSCI benchmarks) are down only 3% this cycle versus an average of 20% over the past 11 episodes.

Some of this is anticipation of Trump tariffs, which he has now threatened to start in February at 10%.

Some is falls in bulk commodities, which have dropped much more than industrial metals.

So, it is not quite as atypical as it seems.

But it does show that, for the moment, that the AUD has a lot of downside force priced into it, and if it does not arrive, it will bounce hard.