DXY rallied back.

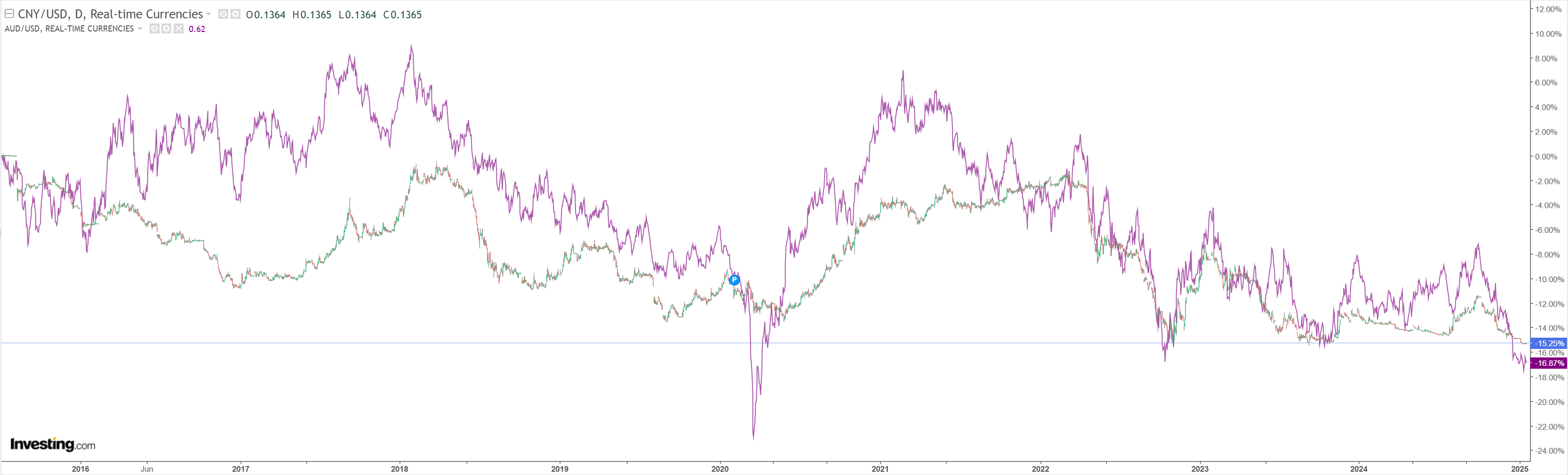

AUD barely hanging on to COVID lows.

CNY got nuthin’ from GDP lies.

Oil is overbought. Gold is getting flirty.

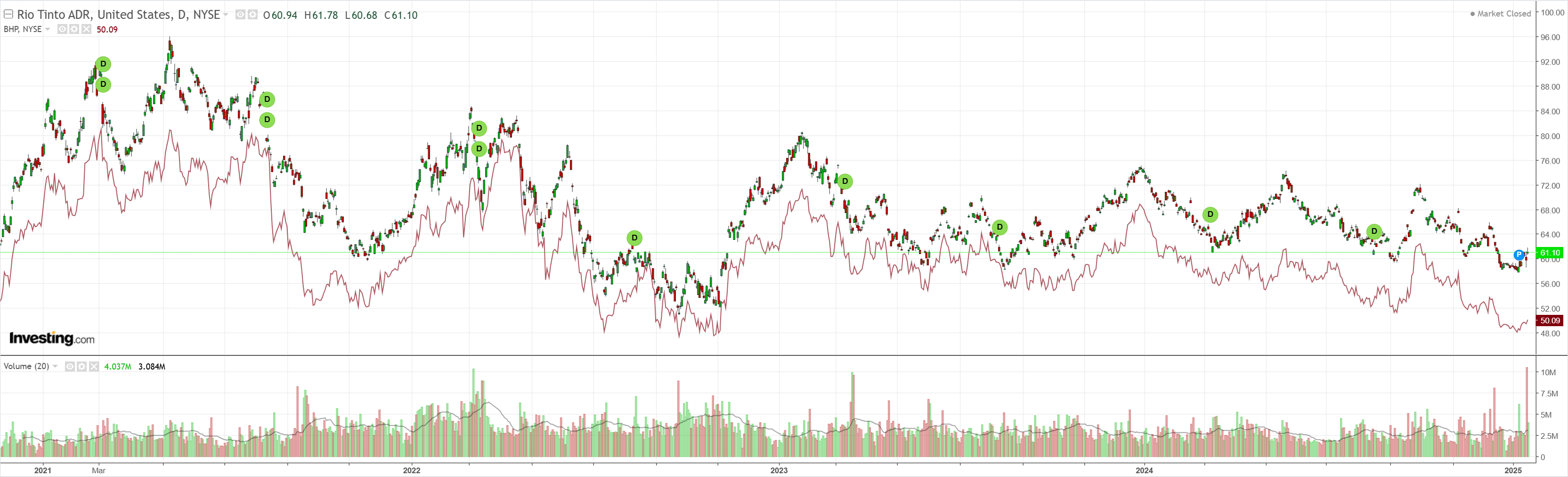

So is dirt.

Miners firming. I’m licking my chops to load up on shorts if these runs.

EM stocks meh.

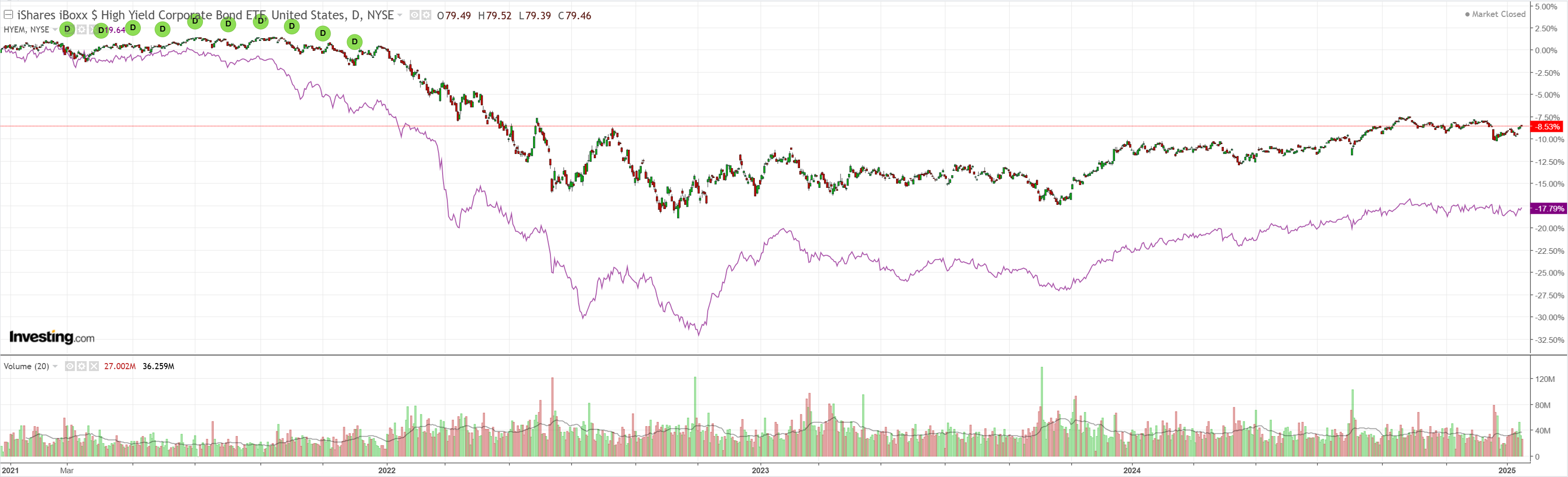

Junk wants run but…

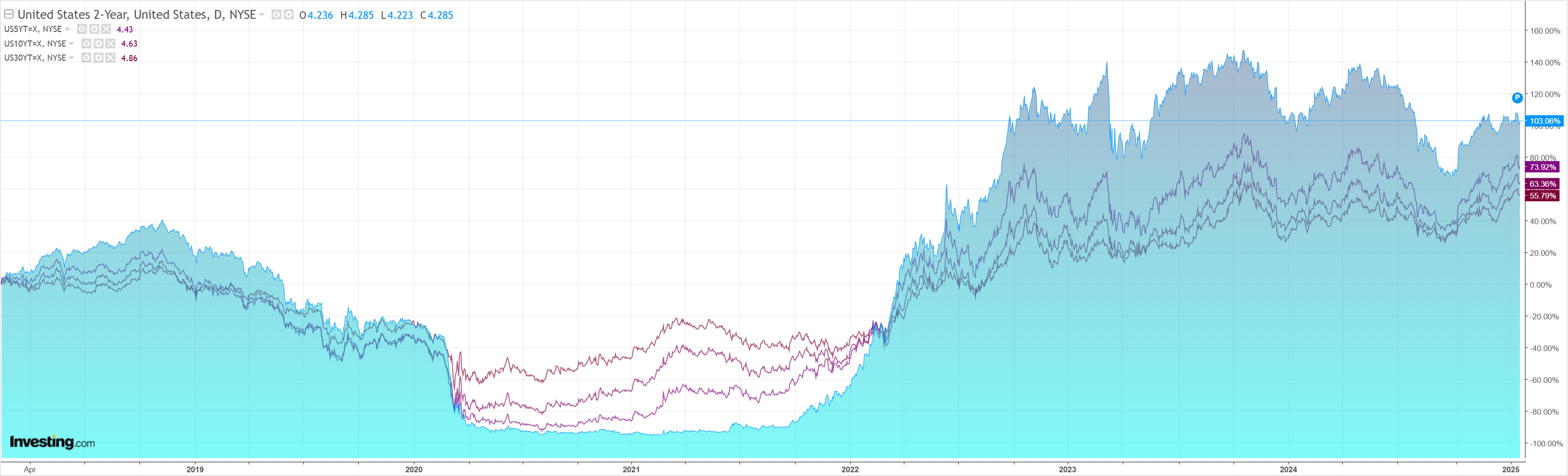

…it’s all about duration, which is still threatening.

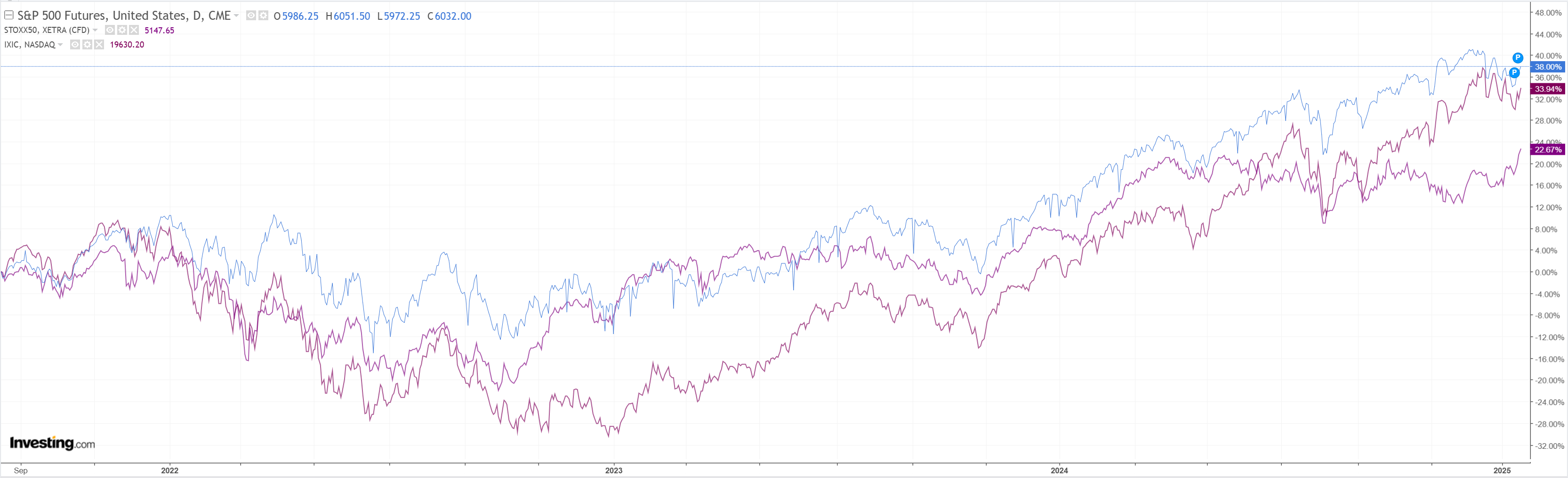

Stocks rediscovering hope post-CPI. Europe running on German election hopes for more fiscal.

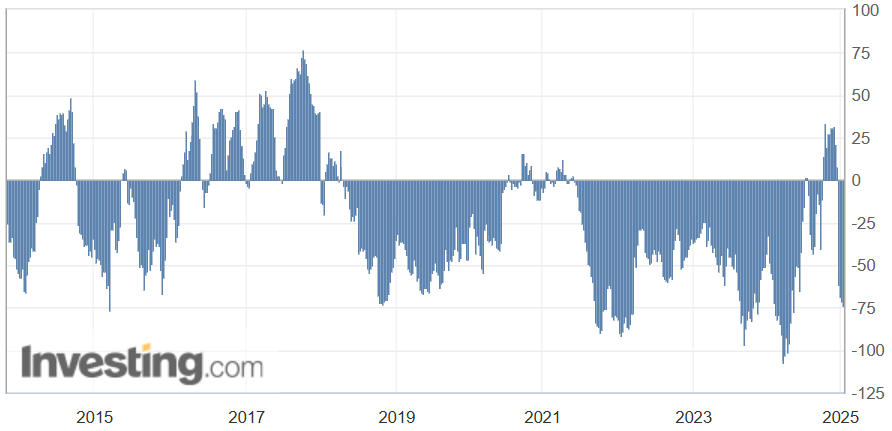

AUD is shorter still on CFTC this week.

At this level of shorts, it becomes quite difficult for the market to drive AUD lower and much easier to drive it higher.

Deutsche is also seeing downside risks to DXY.

A conflict between Trump and the Fed could appear sooner than expected given the upside risks to US inflation/yields.

The US current account deficit is in our view the single most important variable in determining Trump policy success. A widening would signal cyclical over-heating and boom-bust dynamics that would eventually turn much more negative on the dollar.

Finally, the German election. A policy shift is a necessary but not sufficient condition to allow Europe to escape from what we consider to be a newly-emerging secular stagnation trap. If by the summer there is no sign of movement in German policy the medium-term diagnosis for Europe would be grim (and European real rates would be far too high).

There is nothing there that spooks me for the DXY. More important is Trump’s Treasury Secretary, Scott Bessent.

He appears determined to shave off the sharp edges of the Trump agenda. In his final newsletter at KeySquare he writes.

Another differentiated view that we have is that Trump will pursue a weak dollar policy rather than implementing tariffs. Tariffs are inflationary and would strengthen the dollar — hardly a good starting point for a US industrial renaissance. Weakening the dollar early in his second administration would make U.S manufacturing competitive. A weak dollar and plentiful, cheap energy could power a boom. The current Wall Street consensus is for a strong dollar based on the tariffs. We strongly disagree. A strong dollar should emerge by the end of his term if the US reshoring effort is successful.

We have already seen this play out as possible incremental tariffs versus the upfront bombshell Trump prefers.

BofA shows how DXY is vulnerable:

US dollar appreciation since mid-December has been greater than rate differentials would imply. This likely represents looming possibility of US tariff escalation. Near-term risk of USD pullback if tariff hikes do not come soon after inauguration.

Although I still think tariffs will come and AUD will fall with CNY, there is a lot of policy risk right now.

Taking profits here on AUD shorts is not stupid.