DXY is back.

AUD is buggered again.

But auld lead boots got Deepsuckered.

The oil pop was specs.

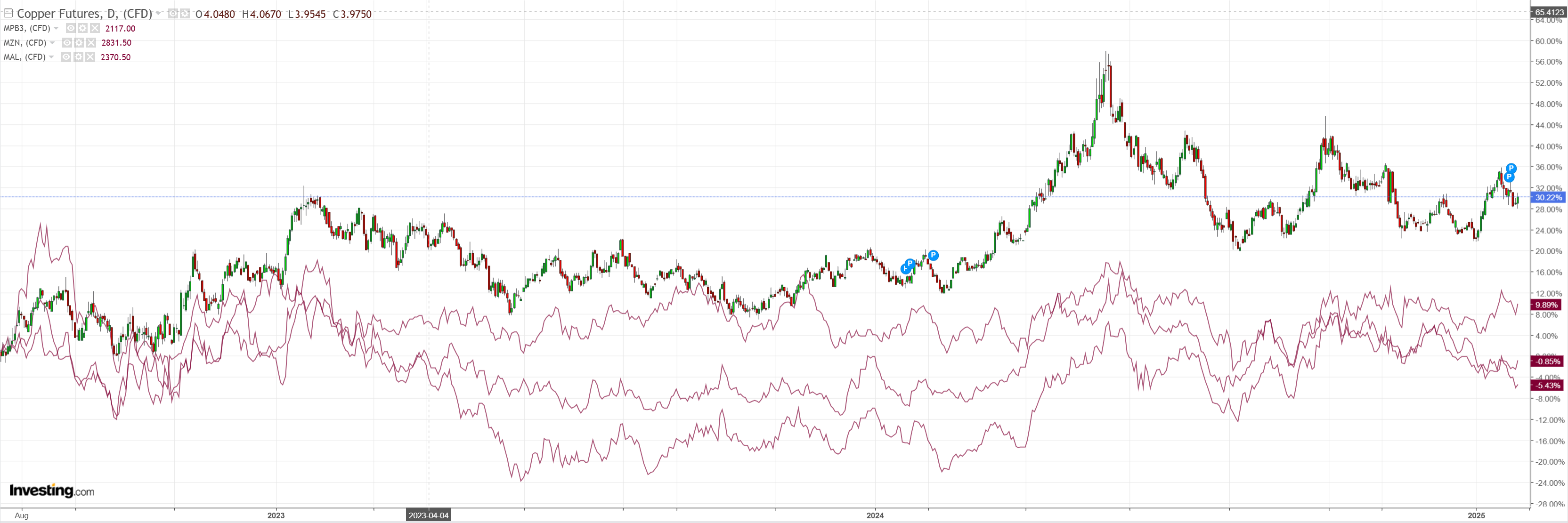

Dirt dead cat.

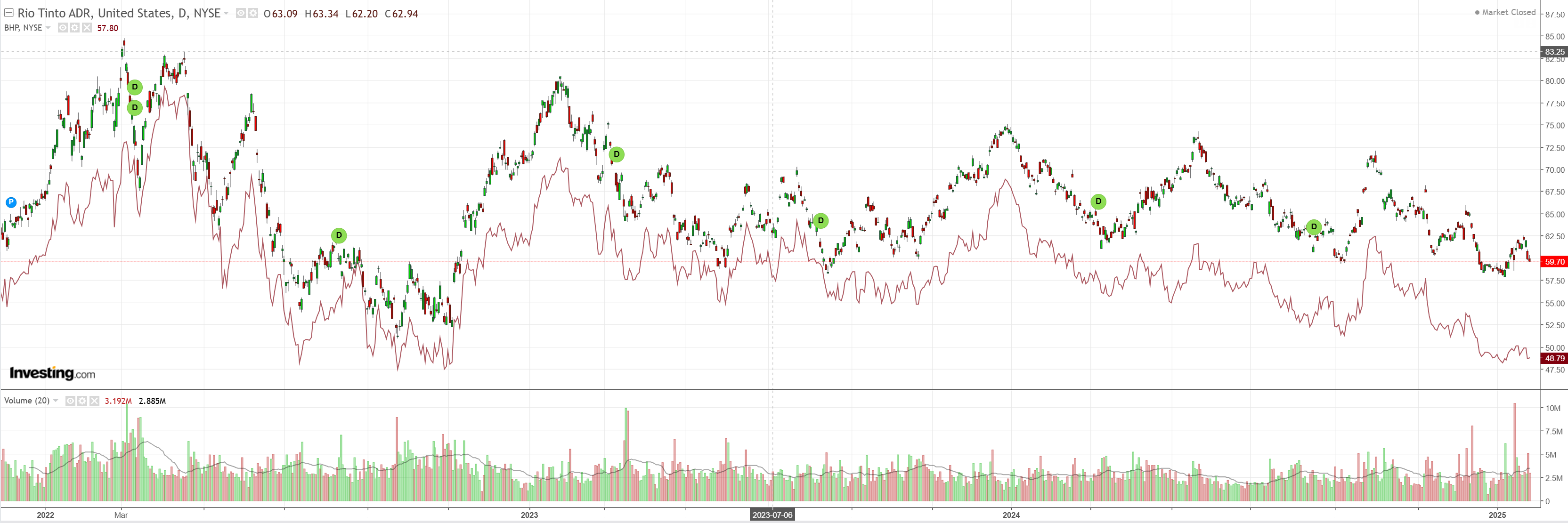

Mining meh.

EM meh.

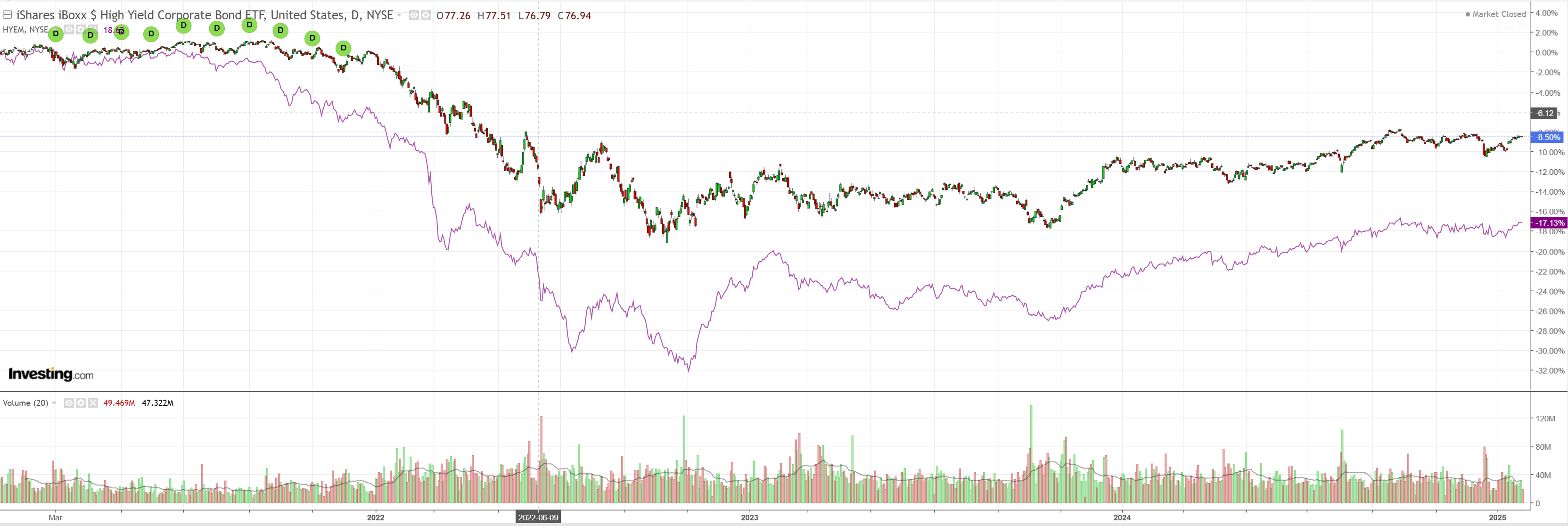

Junk thinks it can.

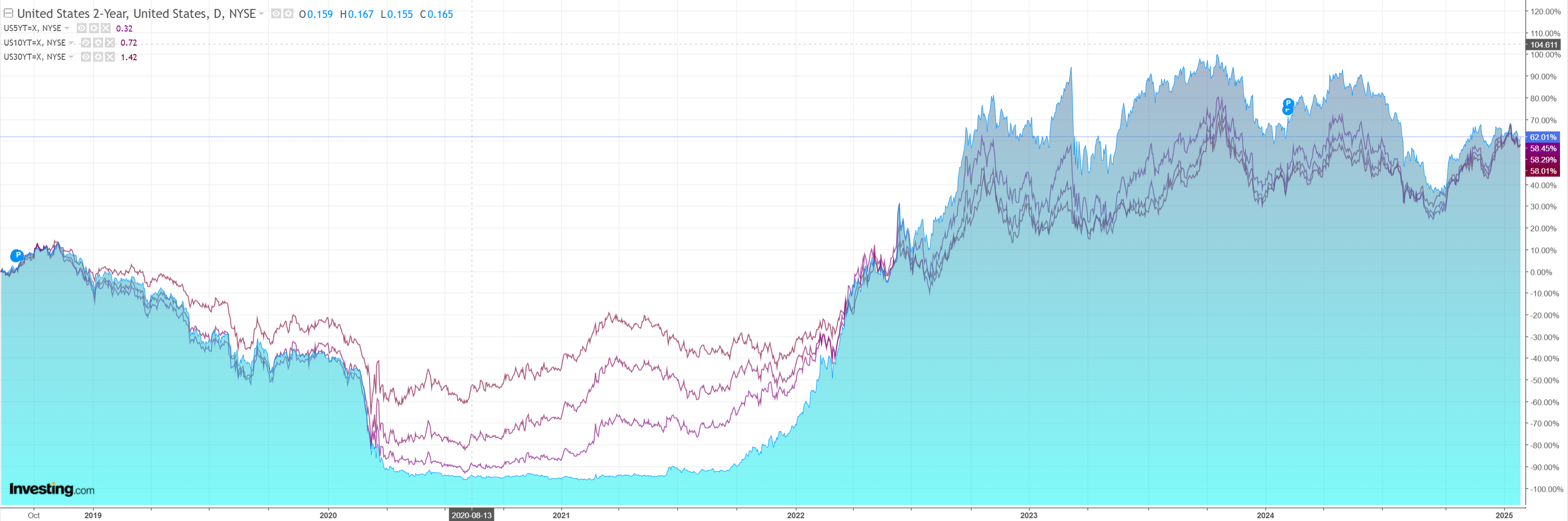

Bear flattener!

Stocks no likee.

The Fed has pivoted again.

Federal Reserve Chair Jerome Powell said officials are not in a rush to lower interest rates, adding the central bank is pausing to see further progress on inflation following a string of rate reductions last year.

“We do not need to be in a hurry to adjust our policy stance,” Powell said Wednesday, noting that the economy remains strong and interest rates are no longer restraining the economy as much as they had been.

“The committee is very much in the mode of waiting to see what policies are enacted,” Powell said. “We need to let those policies be articulated before we can even begin to make a plausible assessment of what their implications for the economy will be.”

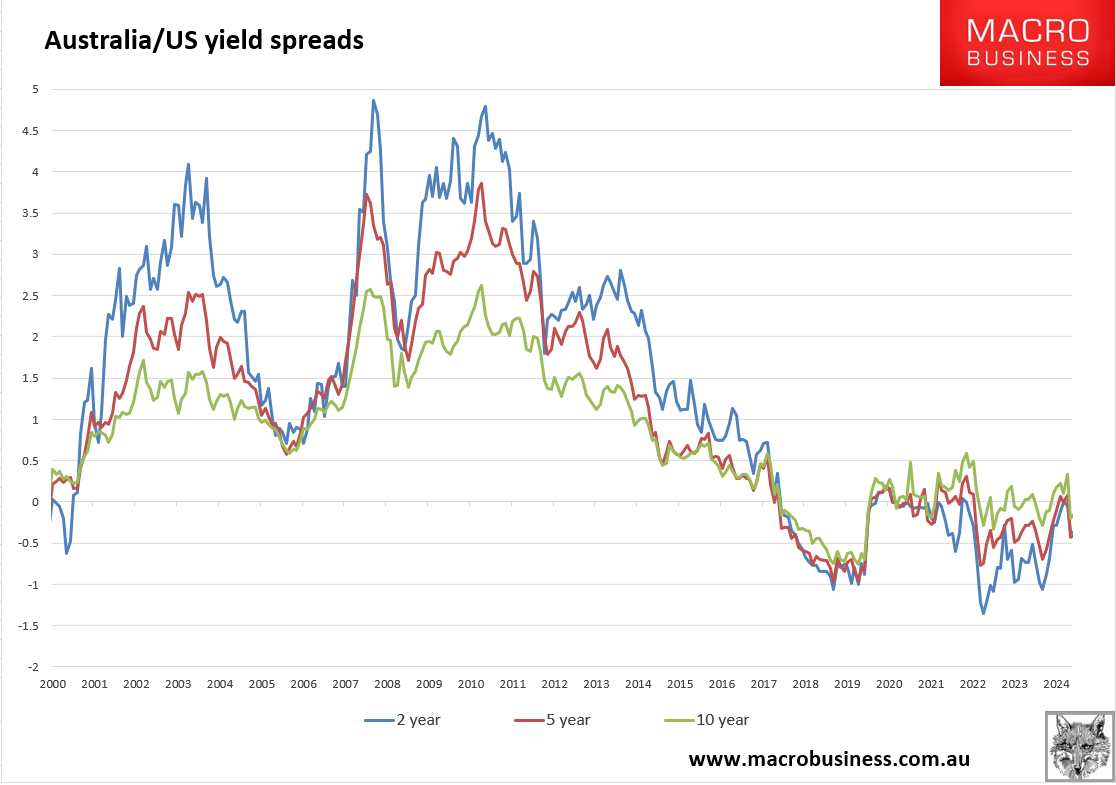

All eyes are on the AUD/USD yield spread now as Fed goes hawkish and RBA goes dovish.

Expect it to get more negative for the battler.