DXY held its losses.

AUD most of the gains.

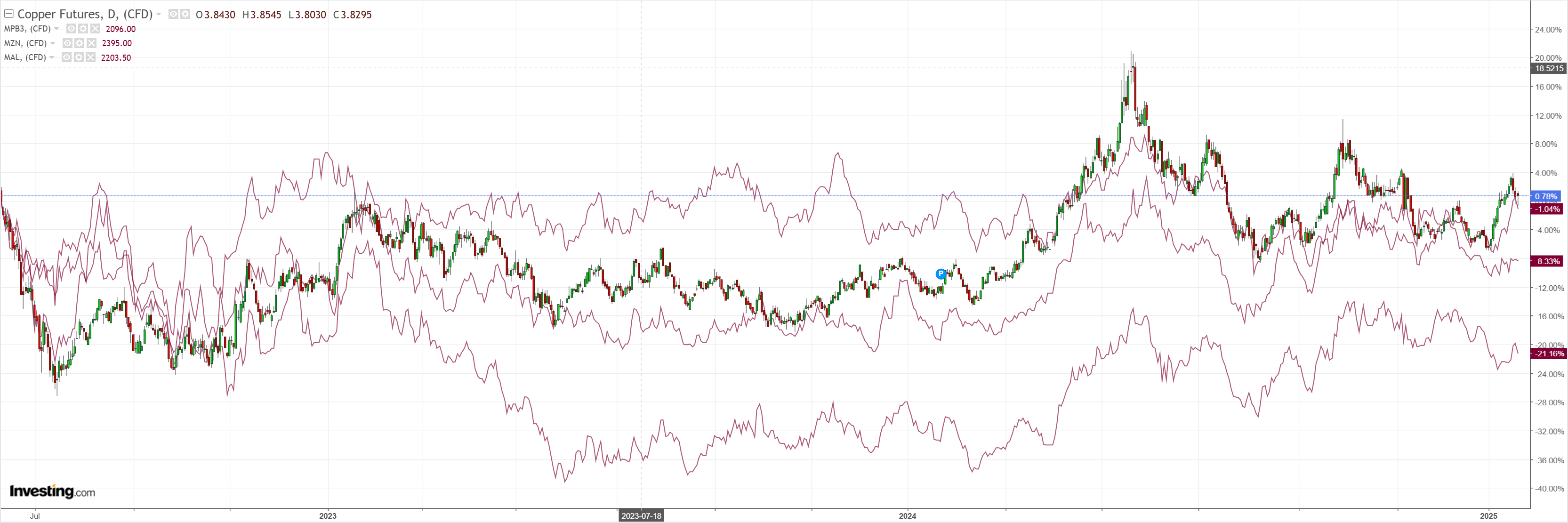

Chart of the day goes to lead boots.

Commods took softer than expected tariff signals as less than expected stimulus.

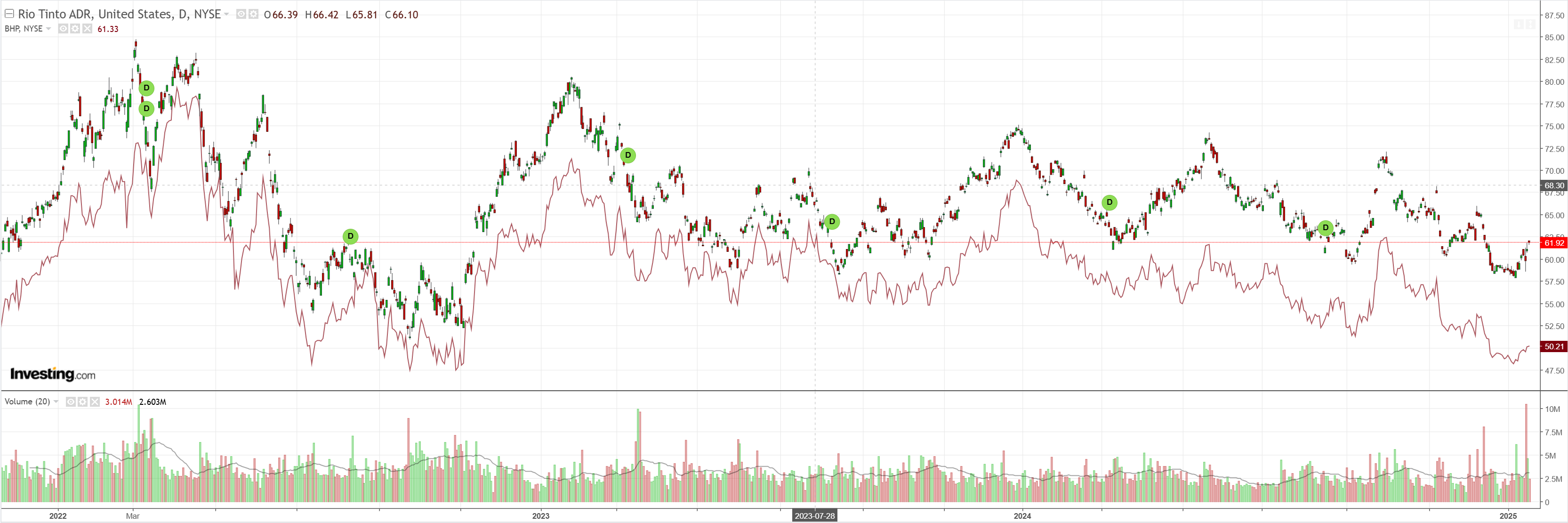

Miners grinded higher.

EM too.

Junk better.

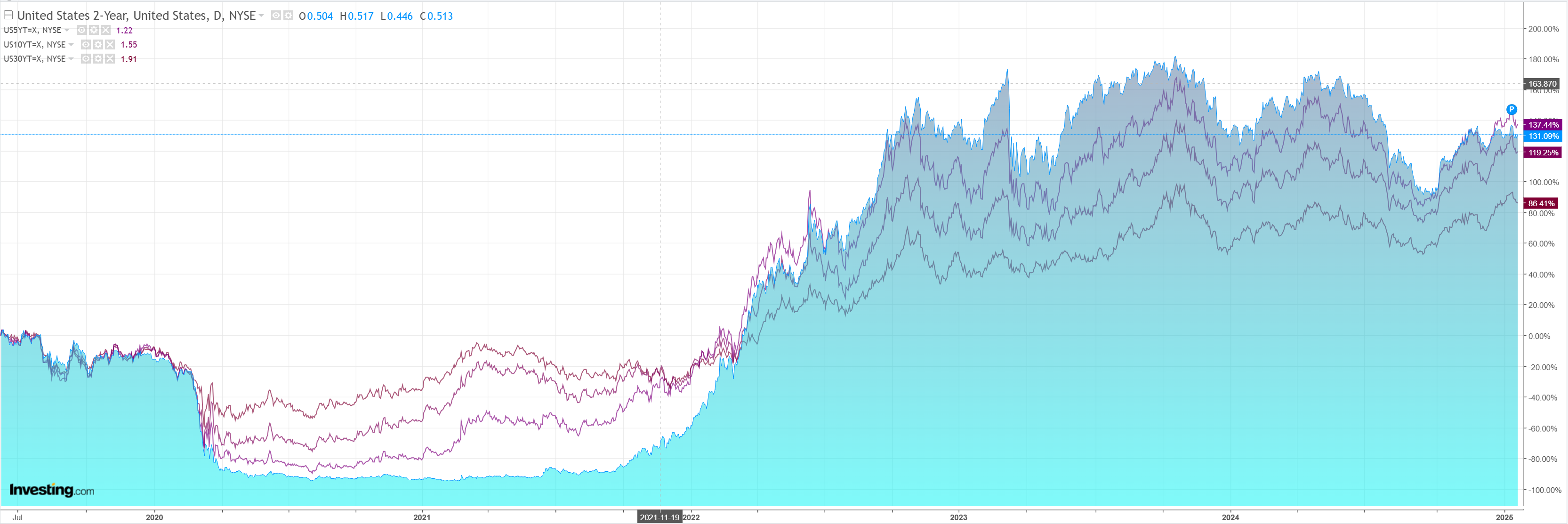

Yields unconvinced.

Stocks march on.

El Trumpo half upset the applecart by declaring 25% tariffs on Canada and Mexico were likely for February.

That stopped the rout DXY but it remains very overbought. Market Ear has more.

Huge levels

The EURUSD touched the massive trend line, as well as it tried the 50 day for the first time since the euro puke started. 1.045 is the big short term level to watch. Let’s see how this plays out, but reversing down trends takes time…and what would you rather own than the dollar?

Source: Refinitiv

Big moves

The EURUSD made the biggest 1 day up move since late 2023 yesterday, but part of the move has already been reversed.

Source: Refinitiv

The long

The dollar long is very long….especially among hedge funds.

Source: GS

Source: GS

Stretched

DXY is stretched when looking at rate differentials.

Source: Soc Gen

Regardless of

Dollar strength continued regardless of US backend yield differentials tightening versus other G4.

Source: Goldman

Hail the King

“The so-called ‘Trumptrade’ is based on the market expectation that Trump’s policy mix of fiscal stimulus and deregulation at home as well as tariffs against the US trading partners could boost the US relative growth outlook, make the US inflation stickier and cut short the Fed easing cycle. Much like in Trump 1.0, the USD’s appeal comes from:

(1) its safe-haven appeal as investors fret about tariffs

(2) its yield appeal as tariffs and loose fiscal policy threaten higher US inflation and yields

(3) the appeal of US assets due to investor hopes of deregulation and US economic outperformance”

(David Forrester, Credit Agricole)

Parity

Nordea macro on the dollar: Strong US economic performance and global weakness are likely to strengthen the dollar. Pro-growth US policies and political instability in Europe could widen the economic gap, increasing the US-EU interest rate differential. EUR/USD is expected to fall to parity or below.

We cannot say the AUD has bottomed yet, but I think there is more squeeze ahead before we go lower.