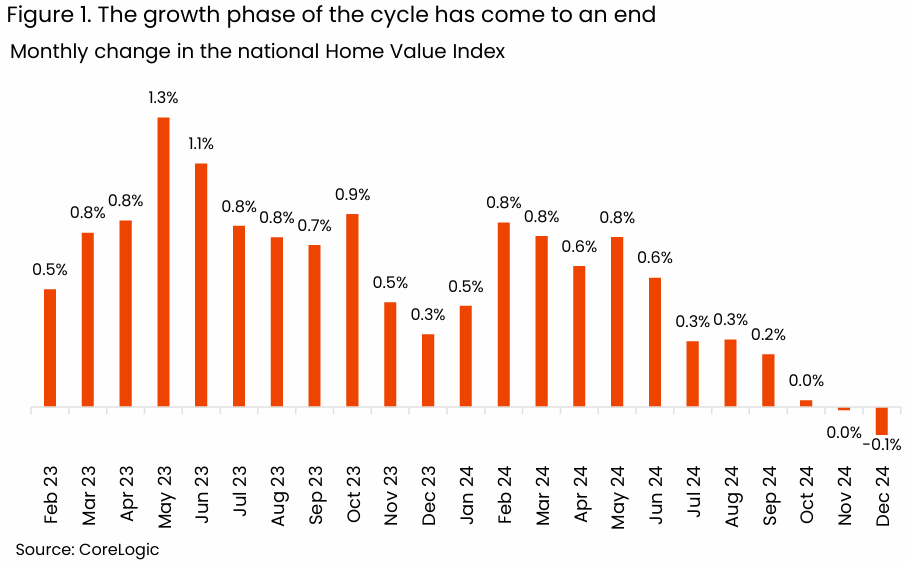

CoreLogic’s head of research, Eliza Owen, published a report on Australia’s housing market, arguing that record low affordability is behind the nascent correction in values.

“Home values and interest rates are too high for buyers”, Owen wrote.

“Housing demand has slowed amid a growing gap between income, borrowing capacity, and home values, exacerbated by slowing economic growth and ‘higher-for-longer’ interest rates”.

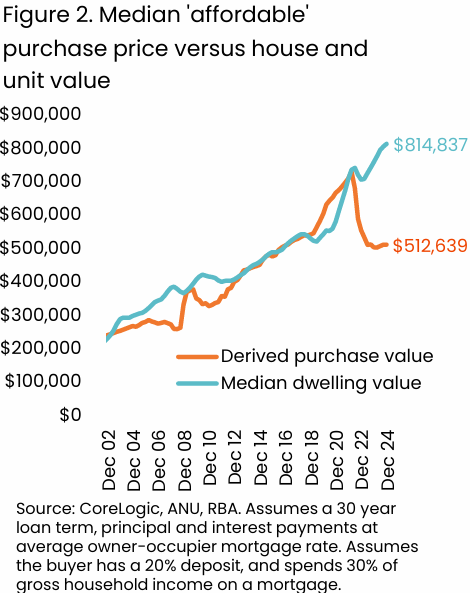

The following chart from Owen highlights the fundamental problem.

The median-income household in Australia can currently afford a home valued at $513,000. However, this is around $300,000 below the current median dwelling price of $815,000.

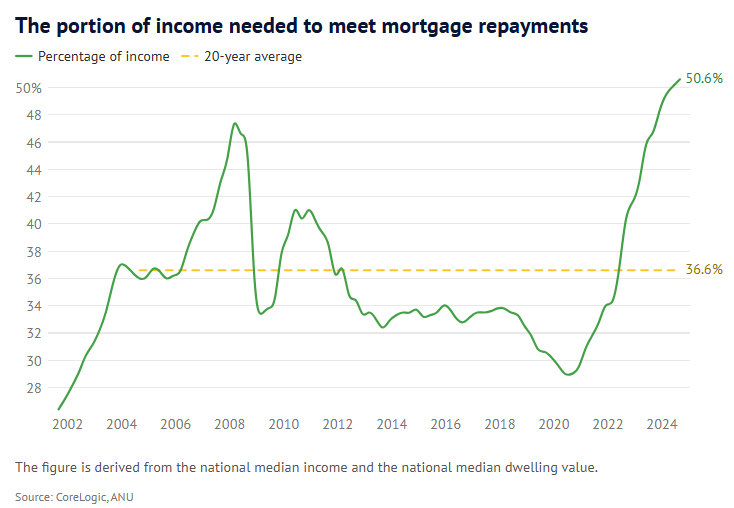

Separate analysis from CoreLogic told a similar story, with the proportion of income required to meet mortgage repayments hitting a record high 50.6%.

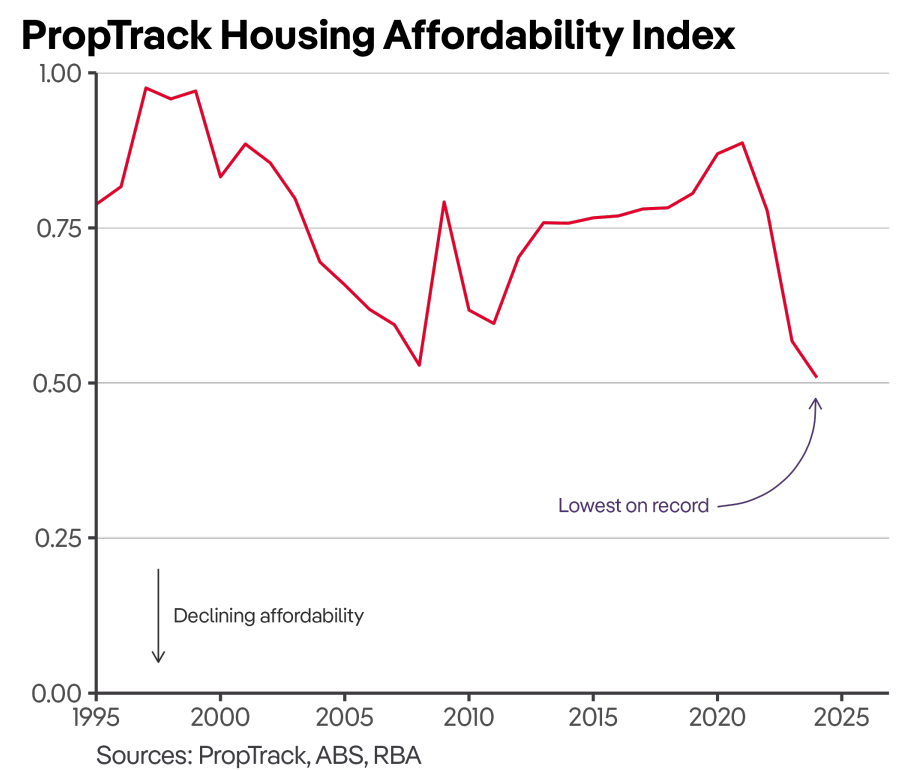

PropTrack has also estimated that Australian housing affordability is tracking at a record low level.

Despite the woeful affordability, Eliza Owen predicts only a moderate price correction.

“Growth in real incomes may support more buyer demand as inflation moderates, and a reduction in interest rates would boost borrowing capacity”.

“Underlying these economic factors is also a fundamental shortage of homes relative to the population, and the squeeze on the delivery of new housing amid weak capacity in the construction sector”.

“Given these factors, the downturn is housing values is likely to be shallow and short lived”, Owen wrote.

At the same time, future price growth is likely to be restrained by the lack of affordability.

“Its hard to see any material growth returning to housing values, at least at a macro level, until housing affordability and loan serviceability improves more substantially”, Owen wrote.

The historical relationship between mortgage rates and home values is reasserting itself amid the slowing of net overseas migration and the rise in for sale listings.

Australian home prices should, therefore, continue to decline until the RBA cuts interest rates, boosting borrowing capacity and mortgage affordability.