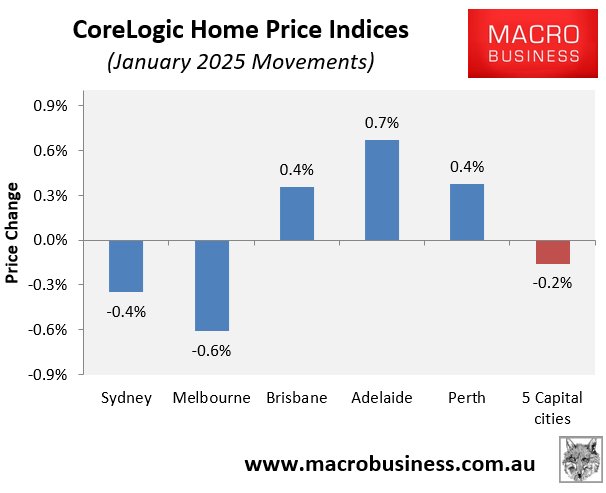

CoreLogic’s daily dwelling value results for January show that home values across the five major capital city markets declined by 0.2% over the month, driven by falls of 0.4% and 0.6% across Sydney and Melbourne.

By contrast, home values across Brisbane (0.4%), Adelaide (0.7%), and Perth (0.4%) rose in January.

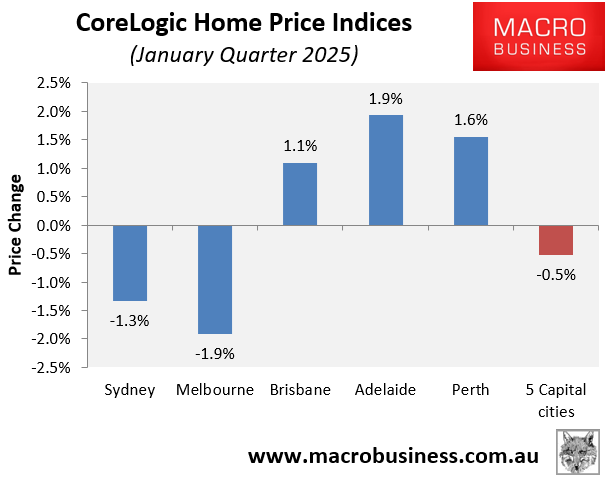

Over the three months to January, home values declined by 0.5% at the 5-city aggregate level, pulled lower by a 1.3% decline in Sydney and a 1.9% decline in Melbourne.

Brisbane (1.1%), Adelaide (1.9%), and Perth (1.6%) recorded value rises over the same three-month period.

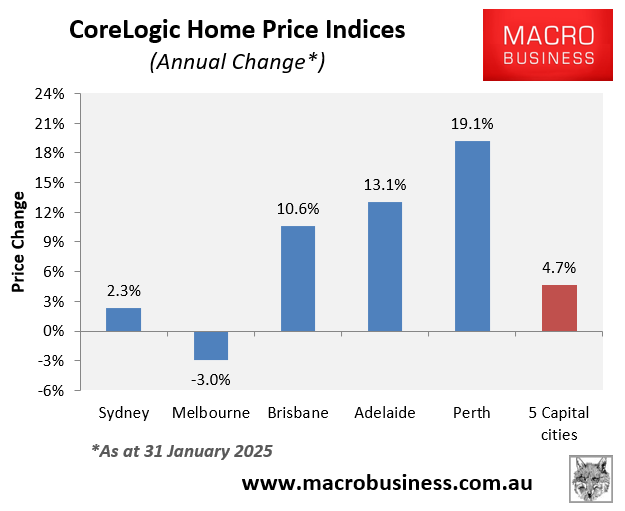

In the year to January 2025, home values at the 5-city aggregate level rose by 4.7%.

However, it was a two-speed market, with strong price rises recorded across Brisbane, Adelaide, and Perth offset by value losses in Melbourne and soft growth in Sydney.

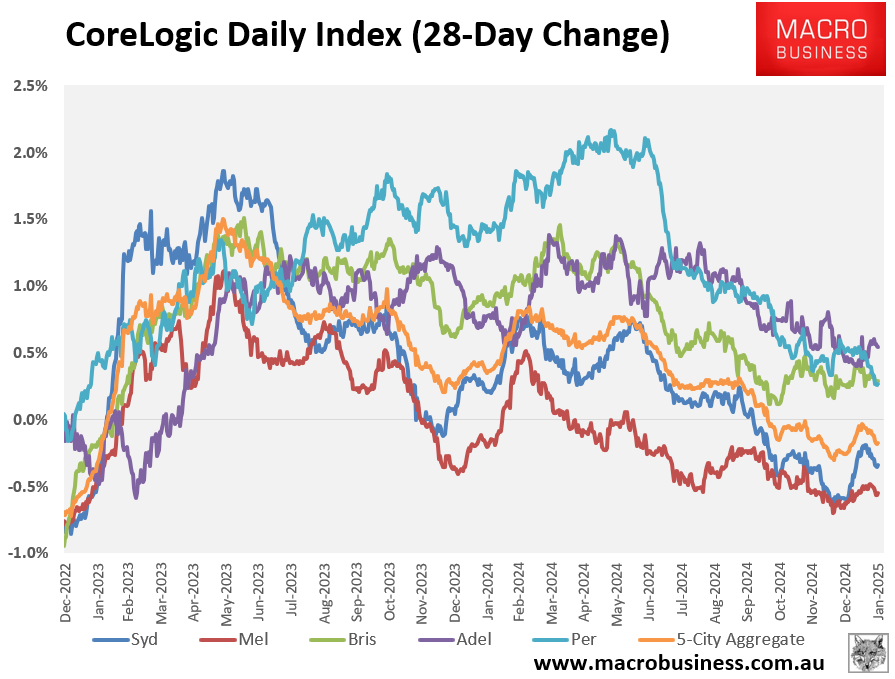

The following time series chart plots the 28-day change in home values across the five major capital city markets.

As you can see, price momentum faded across all markets from the second half of 2024.

The market will remain weak until the Reserve Bank of Australia (RBA) delivers a series of interest rate cuts.

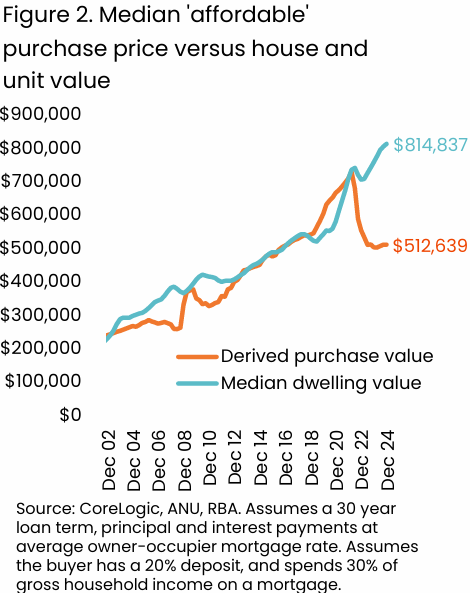

Affordability is at an all-time low, with a record gap between prices and borrowing capacity.

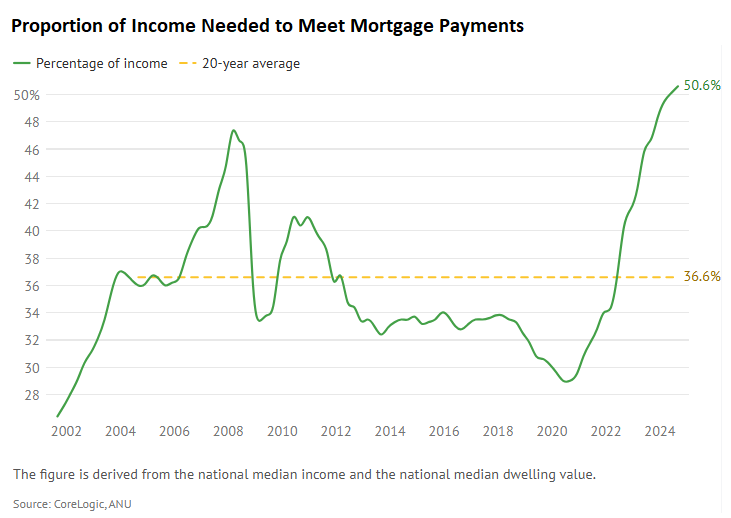

The share of median household income required to service a mortgage on the median-priced home is also tracking at an all-time high.

The RBA is expected to begin cutting interest rates at its 18 February monetary policy meeting, followed by further cuts throughout the year.

These rate cuts will improve mortgage serviceability and affordability and should bolster buyer demand.

As a result, rate cuts will likely push Australian home values to new heights.