Analysis released last week by the Daily Telegraph showed that the average mortgage interest bill in Australia has tripled since the Reserve Bank of Australia (RBA) began raising interest rates in May 2022.

“National Accounts figures show Australians paid a total of $31.2 billion in mortgage interest rates across the entire economy as of the September quarter this year, almost triple the $10.9bn paid in the March quarter of 2022”.

“The highest extra interest bill of $50,000 was in NSW where the average mortgage was $780,000 in 2022″…

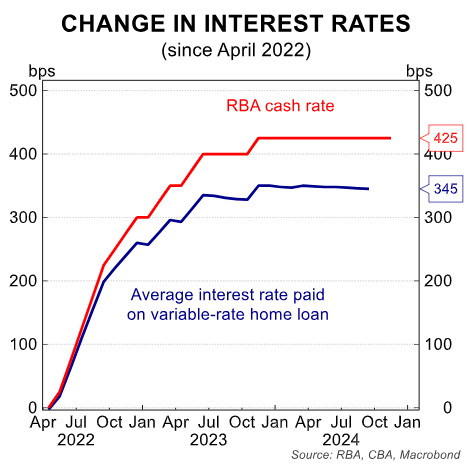

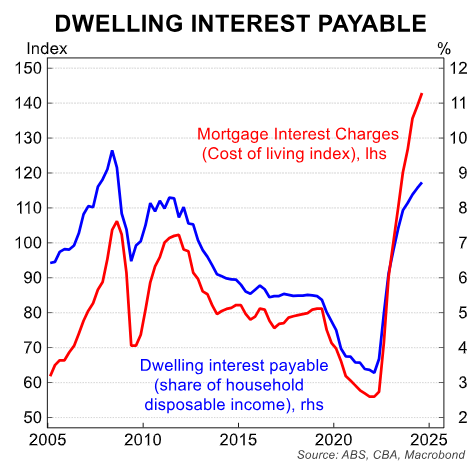

The following charts from CBA illustrate the situation.

According to the Australian Bureau of Statistics’ Q4 nation accounts, the aggregate share of household disposable income paid in mortgage interest has increased from around 3.5% to just under 9%.

Although the RBA has not increased the cash rate since November 2023, mortgages continue to roll-off ultra low fixed rates, increasing the interest burden.

“There was a 3ppt decline in the share of owner-occupier home loans on fixed rates in Q3 24, to 17%”, CBA noted.

“The fixed-rate roll-off will continue for some time, as new housing lending is currently almost entirely at variable rates”.

Coalition Treasury spokesman Angus Taylor said that Australian families have made “great sacrifices” to keep a roof over their heads.

“Many have postponed family holidays, have cut back on essentials like food and clothing, have put off seeing a doctor, some have even been forced to take on a second job”, he said.

“These sacrifices are a constant reminder of the toll Labor’s homegrown inflation is having on Australian households”.

While that may be true, what would a future Coalition government do about it?

Leader Peter Dutton has walked back commitments to slash net overseas migration, suggesting that immigration would remain high under the Coalition (albeit likely lower than under Labor).

The Coalition is also looking to strip the Australian Prudential Regulatory Authority (APRA) of some of its powers to regulate mortgage borrowing and overhaul credit laws to make it easier to borrow for housing.

Easing credit would obviously inflate prices.

The truth is that our political leaders do not genuinely want more affordable housing because it would require lower prices.

Instead, they pretend to care about affordability by providing false solutions and hope to prospective first-home buyers while driving the cost of housing higher through stimulatory demand-side measures.