In December, Infrastructure Australia warned that Australia’s construction sector will suffer persistent ‘skills shortages and cost escalations’ in the years ahead.

“Construction materials on average cost around 30% more than they did three years ago and with ongoing skills shortages we simply don’t have the people power we need to get the job done on time”, noted Infrastructure Australia Chief Executive Adam Copp.

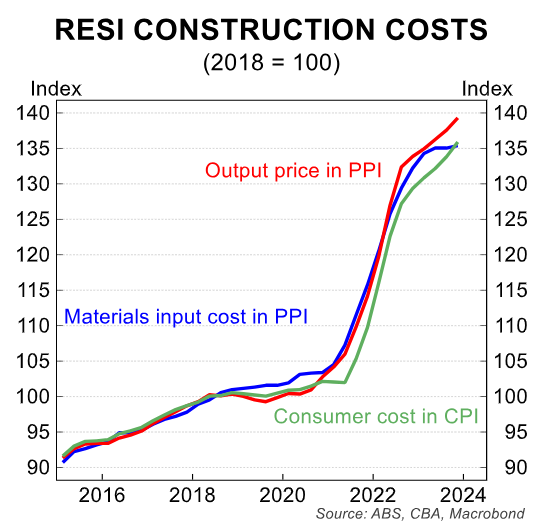

These constraints are most severe in the homebuilding industry, where residential construction costs have increased by around 40% since the start of the pandemic.

Builders are also competing for workers with state-run infrastructure projects.

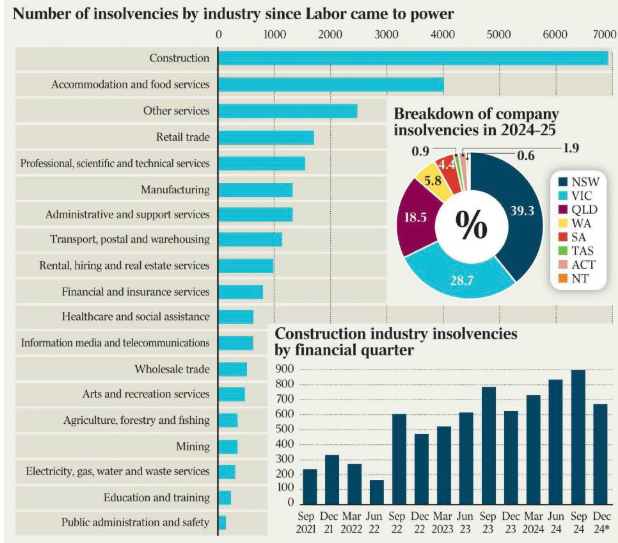

As a result, large numbers of homebuilders have collapsed, decreasing capacity throughout the industry.

Indeed, Bensons Property Group, a major Australian construction company, entered voluntary administration at the end of December amid “extremely difficult” conditions, leaving 1,337 unfinished homes in limbo.

“Currently BPG is employed to finish constructing 1,337 apartments across Queensland, Victoria and Tasmania worth about $1.5 billion”, Sky News reported.

Meanwhile, the founder of Harvey Norman and real estate developer, Gerry Harvey, warned that building costs will keep rising and make new property developments increasingly unviable.

“The biggest problem I have with property is I have a lot of developments I want to do but the … costs are too much, and I won’t make any money if I do the development”, he said. “It’s never been more difficult in that sense”.

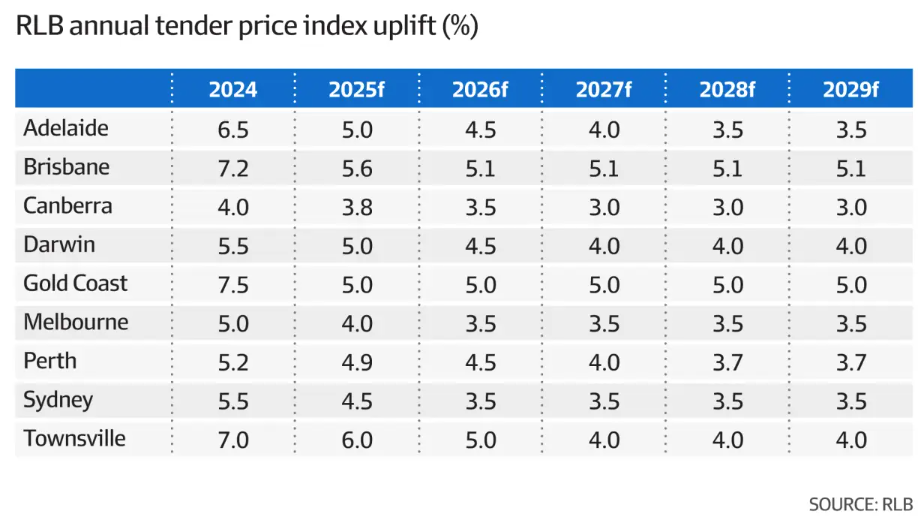

Ewen McDonald, RLB’s director of research and development, agreed with Gerry Harvey’s assessment.

“With the current climate indicating a slowing of residential and non-residential activity towards the end of 2025 and into 2026, there would be an assumption that professional jobs in the industry could be compromised”.

The below table from RLB shows that construction costs are expected to rise at an above-inflation rate.

“Developers are currently adopting a more cautious approach, which includes delaying or cancelling projects”, RLB said in its report.

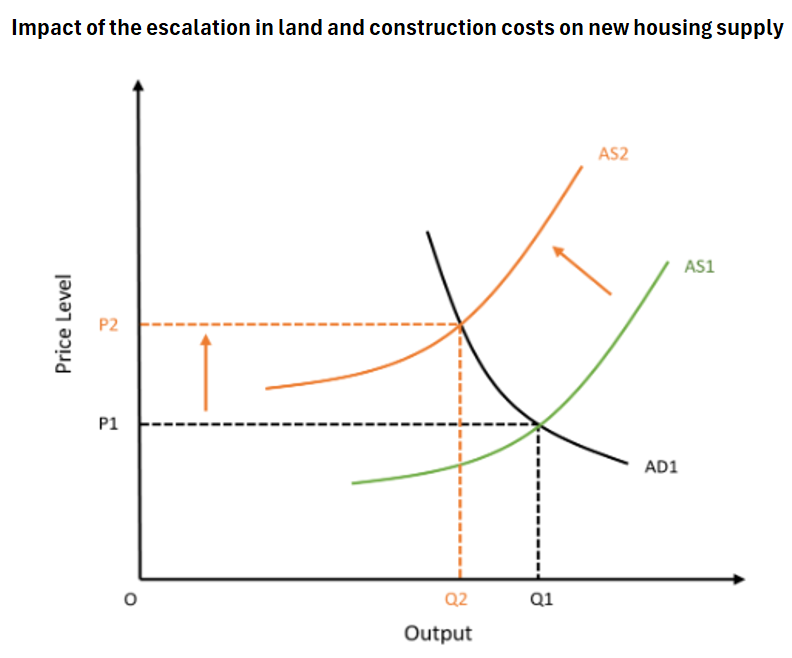

In economic terms, the supply curve for homebuilding has shifted to the left, meaning that fewer homes are able to be built at a higher cost.

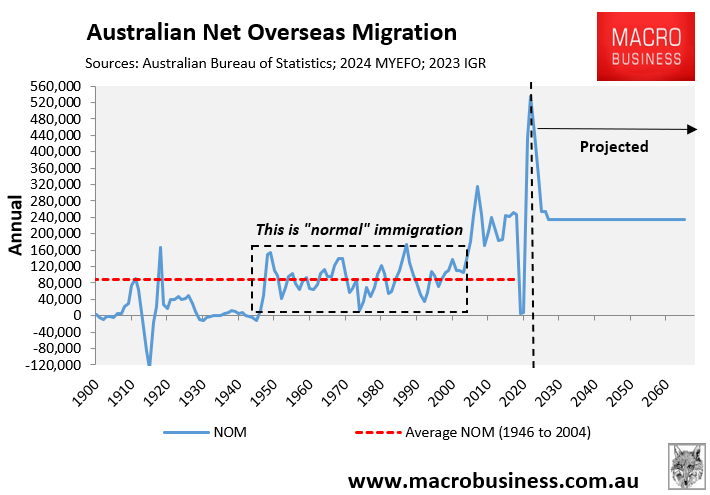

The sensible policy response would be to shift the demand curve to the left to match supply by limiting net overseas migration to a level comparable to the capacity to build dwellings.

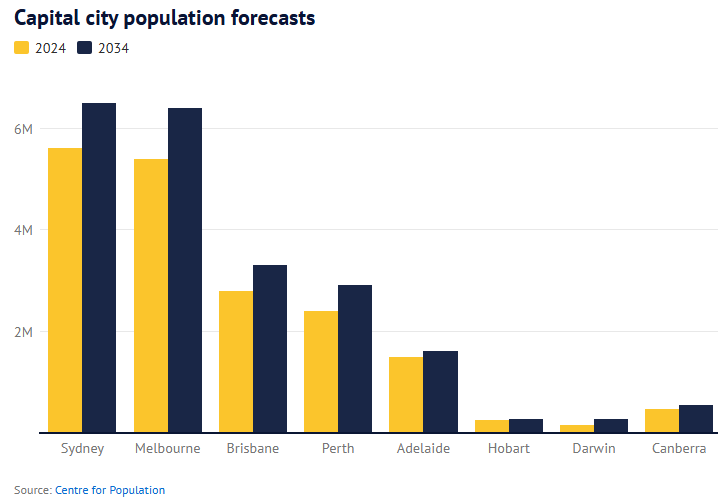

Instead, the Centre for Population has forecast 410,000 annual population growth over the next ten years—roughly equalivalent to growing by a Canberra every year—ensuring that population demand would forever outstrip supply.

Melbourne’s population is projected to balloon by one million people over the coming decade, Sydney’s by 900,000 people, whereas Brisbane’s and Perth’s populations are projected to swell by 500,000 apiece.

In doing so, our dishonest and incompetent federal government will guarantee that Australia’s housing crisis will continue indefinitely.

The wickedness of Australian policymakers is boundless.