Independent economist Chris Richardson has warned that it could take a decade for Australian living standards to recover from 2021–22 levels, noting that the “free ride on the back of the rise of China” is over.

“It’s a grind, there is no magic wand”, Richardson said. “We are now starting to turn in the right direction but it will be slow, and the pace will disappointing. We get our living standards back when we get our courage back”.

“But China is becoming increasingly a problem,” he said. “In other words we can’t slipstream somewhere else for our living standards to go up”.

“We need to become more productive; that’s what will return our living standards. And you turbocharge productivity to some extent through bipartisanship, through both sides agreeing such and such is a mess and needs to be fixed”.

“Our difficulty is there is no common ground … And so we don’t get the extra boost from a political process that we once did”, Richardson said.

Coalition Treasury spokesman Angus Taylor said that projecting out MYEFO forecasts showed that per capita living standards would conservatively not recover until the 2029–30 fiscal year.

By 2030, Australia’s population will have reached almost 30 million and growth in per-capita living standards will be close to zero, according to the Coalition’s analysis.

“Under the Albanese Labor government hardworking Australians are enduring the steepest decline in living standards on record”, Taylor said.

“Not only is this completely unprecedented in our history, it’s also unparalleled anywhere else in the world”.

“Under the government’s own failing plan for our economy, Australians will not see a recovery in their standard of living until at least the end of the decade”, he said.

If anything, the above assessment is likely to be optimistic.

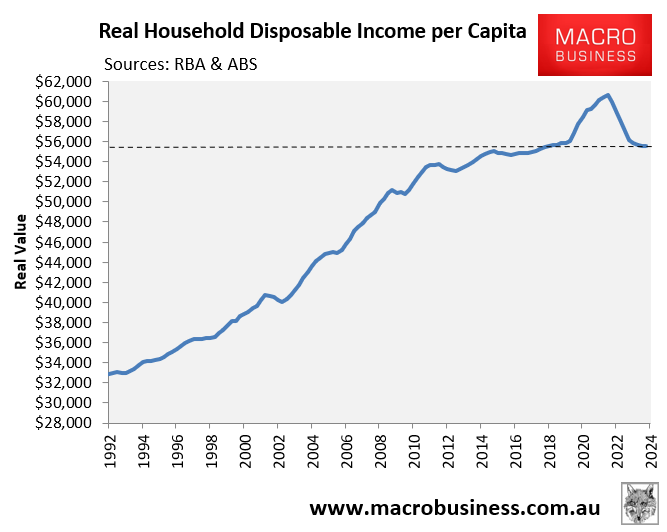

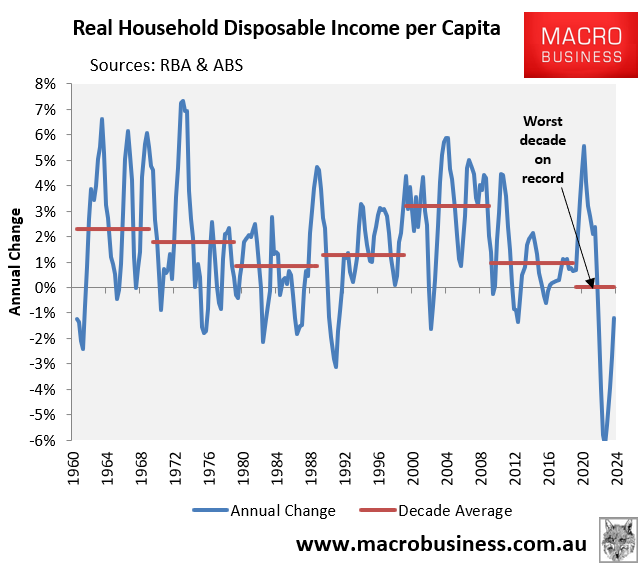

According to the Q3 national accounts, Australian real per capita household disposable income was tracking 8.4% below the Q2 2022 peak and was only 2.2% higher over the decade.

The 2020s were also shaping as a ‘lost decade’ for Australian households, with real per capita incomes experiencing zero growth so far—the worst decade average growth in more than 60 years of data.

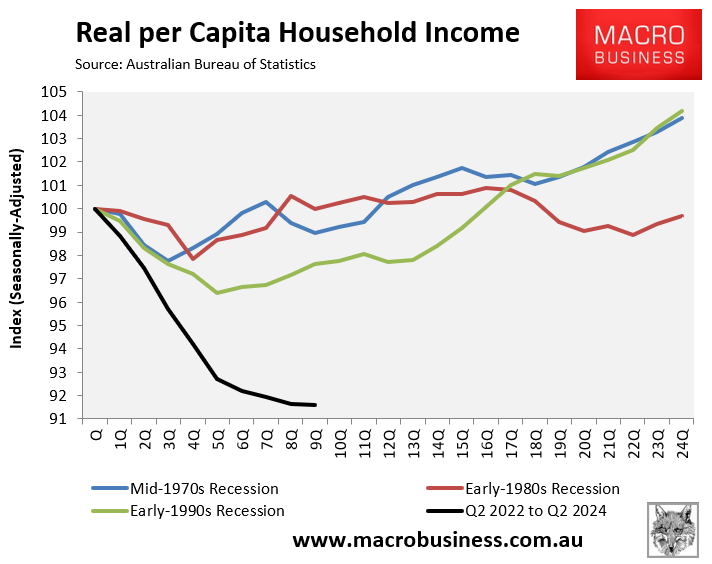

The chart below compares the present fall in real per capita household incomes to past downturns.

As you can see, the current 8.4% loss is unusual and easily exceeds the 3.6% peak-to-trough decline experienced during the early 1990s technical recession.

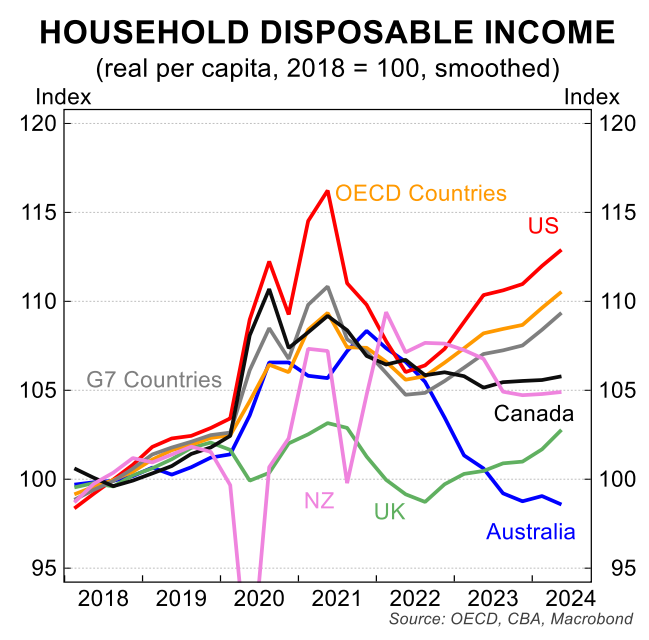

Australia has also experienced the steepest decline in real per capita household incomes among developed countries.

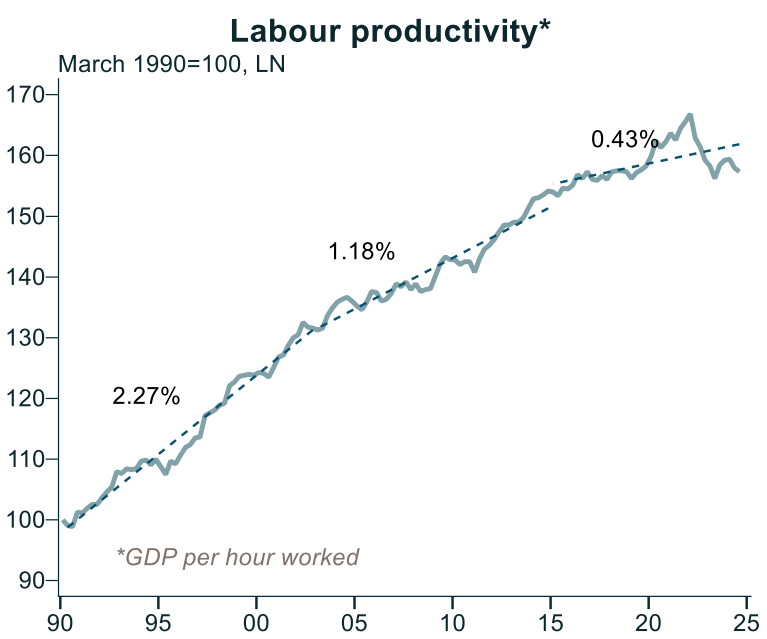

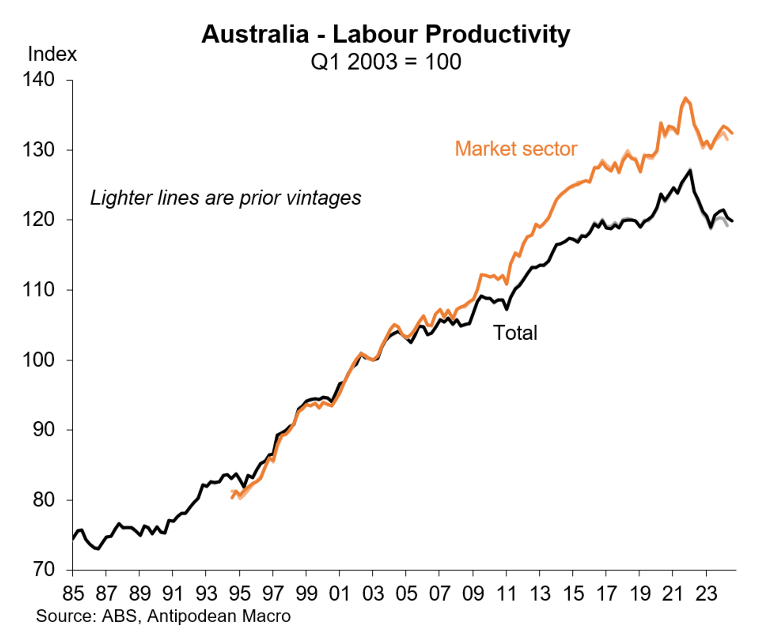

The recovery from the income recession is expected to be slow and painful due to Australia’s historically low labour productivity growth, which has plunged to 2016 levels.

Source: Alex Joiner (IFM Investors)

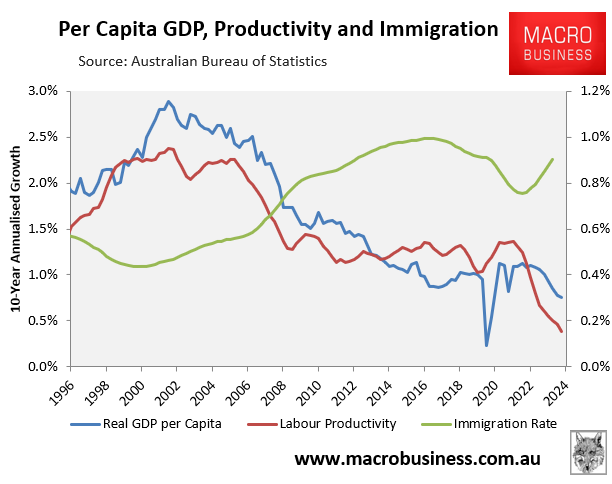

The Australian economy remains overly dependent on the public sector and population expansion (immigration).

This has resulted in an excessive number of low-productivity, non-market sector jobs.

It has also resulted in persistent capital shallowing, as population growth has outpaced infrastructure, business, and housing investment.

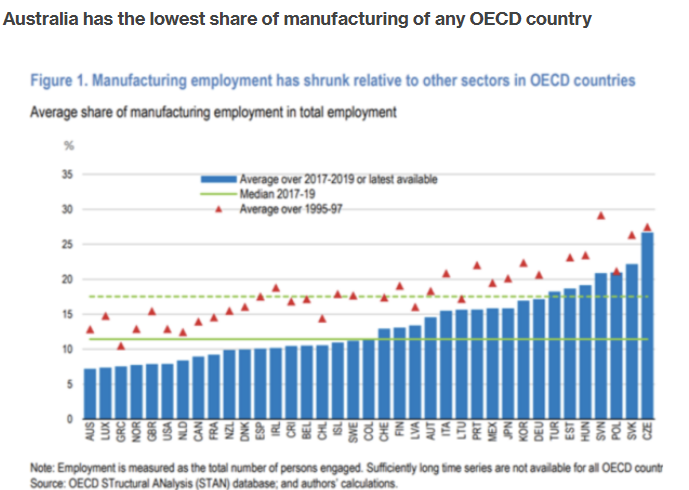

High energy costs have also shrunk Australia’s manufacturing base, further stifling productivity.

If Australia continues to operate under the same paradigm, it will remain a low-productivity, low-income growth economy.

As a result, Australians will experience a slow grind out of recession.