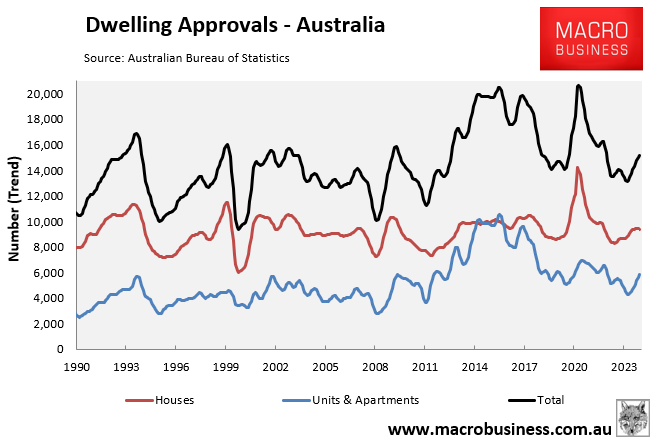

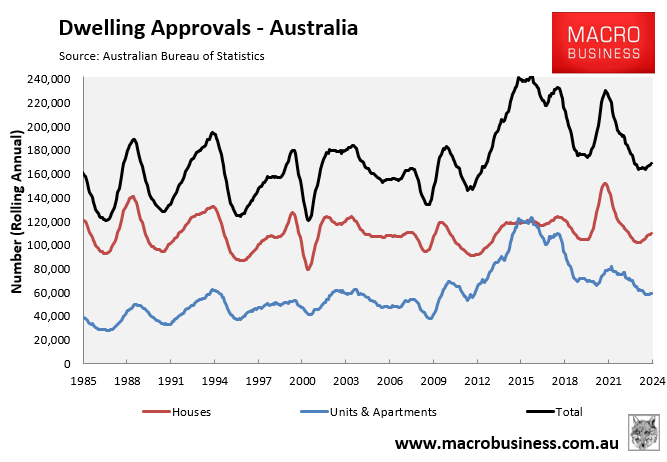

On Tuesday, the Australian Bureau of Statistics (ABS) released dwelling approvals data suggesting that the nation’s housing shortage continues to worsen.

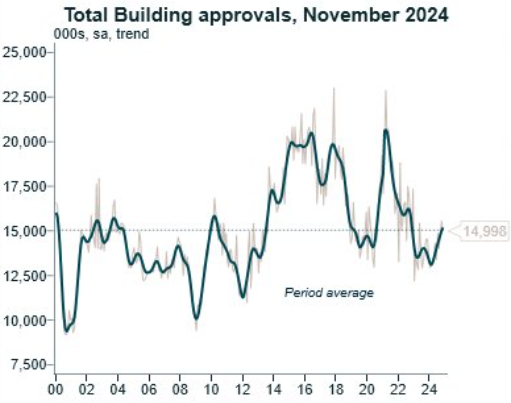

In the month of November 2024, 15,194 dwellings were approved for construction, roughly 25% below the Albanese government’s target of building 20,000 homes per month.

In the year to November 2024, 168,691 dwellings were approved for construction, around 71,300 (30%) below the Albanese government’s target to build 240,000 homes per month.

Alex Joiner, chief economist at IFM Investors, noted on Twitter (X) that trend approvals are currently sitting at long-term average levels, which is “not bad considering where interest rates are”.

Chart by Alex Joiner (IFM Investors)

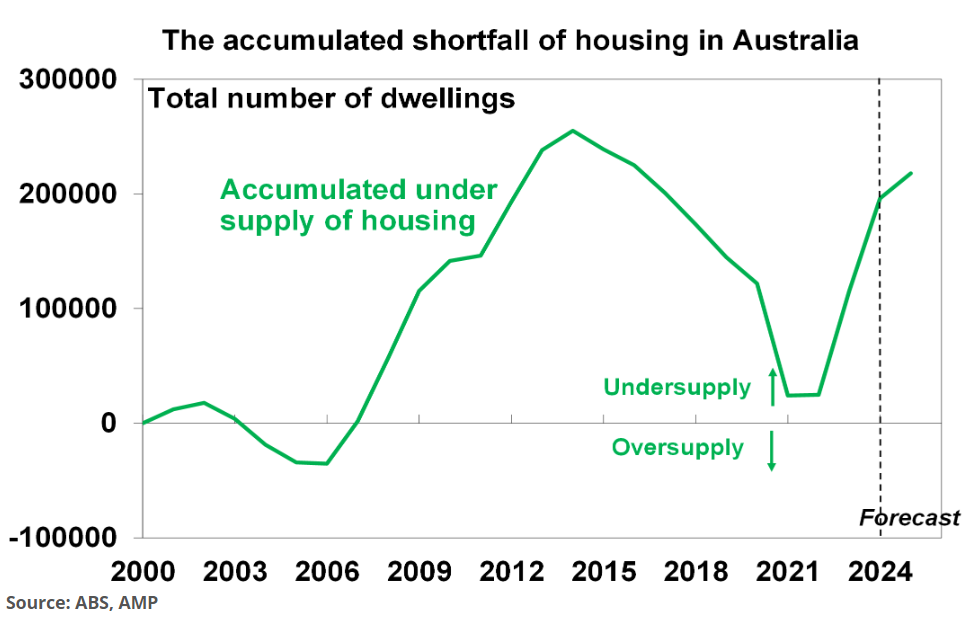

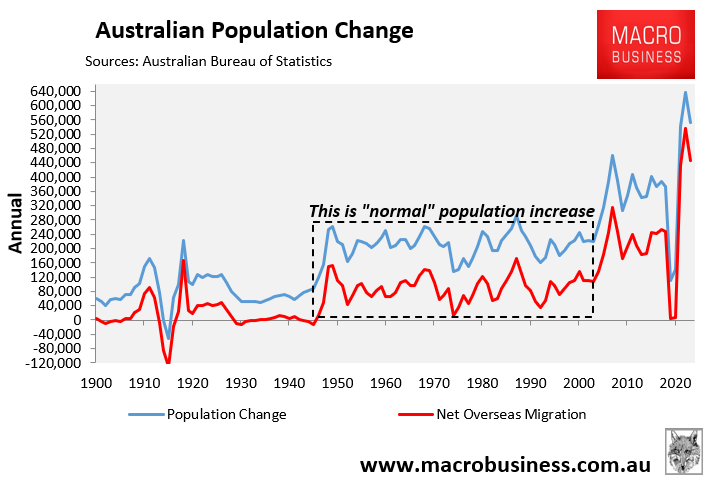

While that is true, as illustrated above, the problem is that Australia’s population growth via net overseas migration is running way above long-term average levels.

The outlook for housing construction is poor.

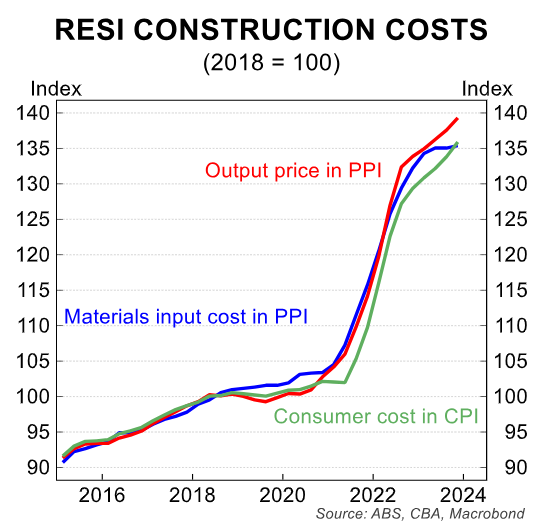

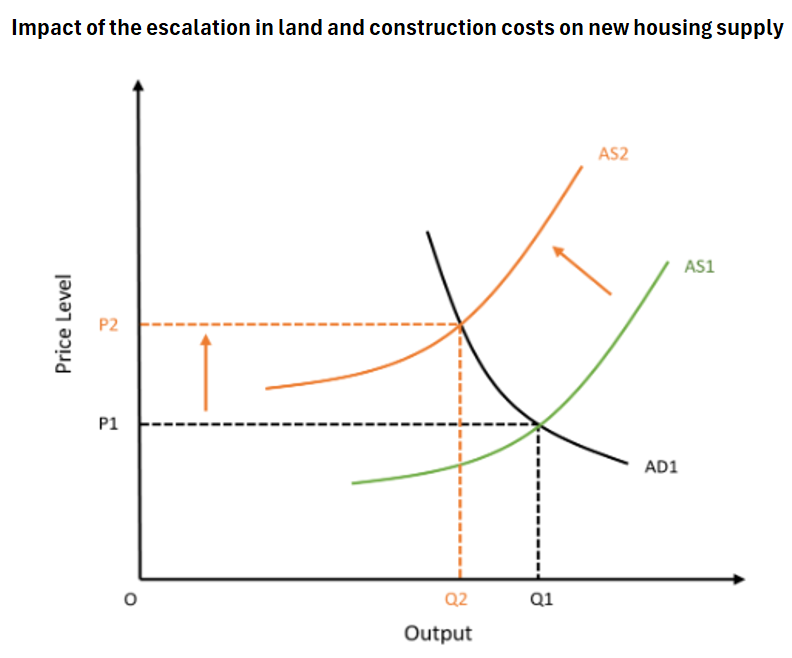

Residential construction costs have risen by around 40% since the beginning of the pandemic.

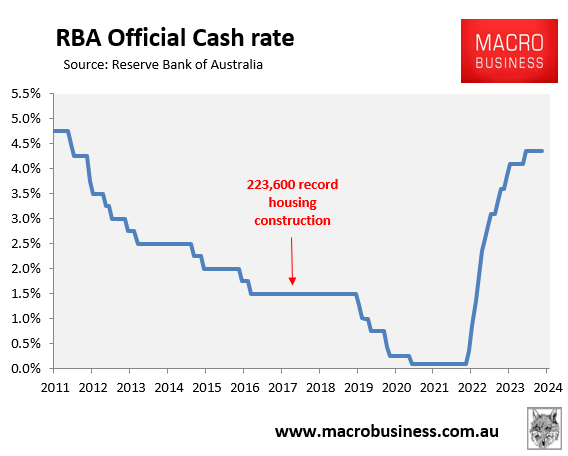

Interest rates are much higher than during last decade’s construction peak.

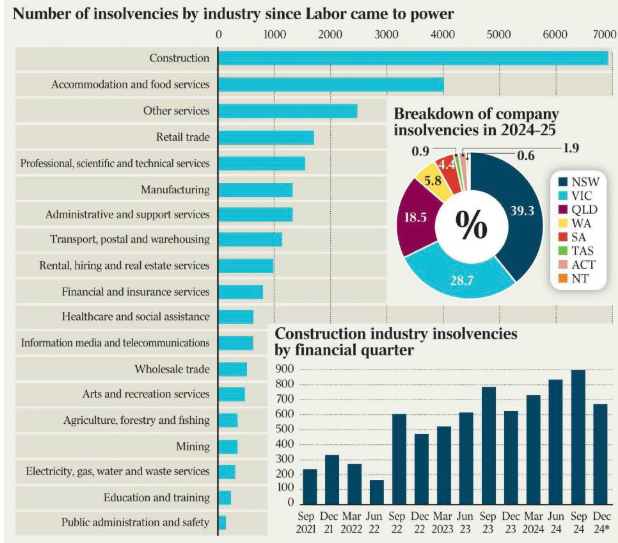

Thousands of construction firms have gone bust, reducing capacity across the industry.

Graphic by The Australian

Finally, developers are competing against state government ‘big build’ infrastructure projects.

The upshot is that the supply curve for housing has effectively shifted to the left, decreasing the volumes of homes that can be built and raising their cost.

Meanwhile, the federal government will continue to pump demand via excessive levels of immigration.

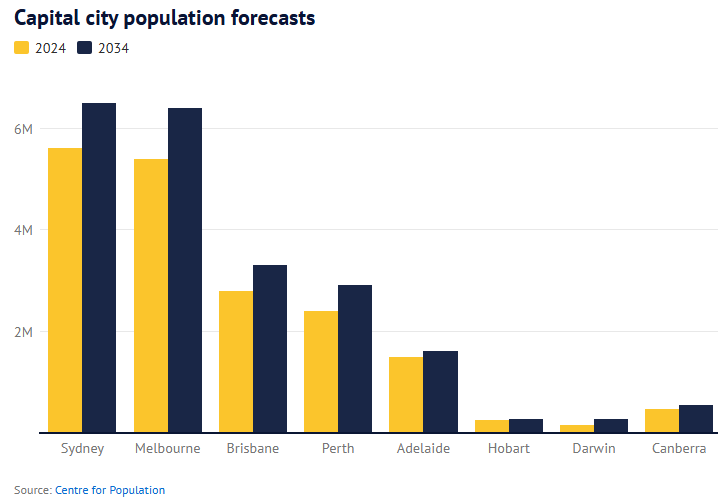

The Centre for Population last month forecast 410,000 annual population growth over the next ten years—roughly equalivalent to growing by a Canberra every year—ensuring that population demand would forever outstrip supply.

Melbourne’s population is projected to balloon by one million people over the coming decade, Sydney’s by 900,000 people, whereas Brisbane’s and Perth’s populations are projected to swell by 500,000 apiece.

As a result, Australia’s housing shortage will inevitably grow.