With an official unemployment rate of only 4.0%, you would be forgiven for thinking that Australia’s labour market is booming and incredibly tight.

However, new data from Seek, NAB, and Jobs & Skills Australia contradict this view.

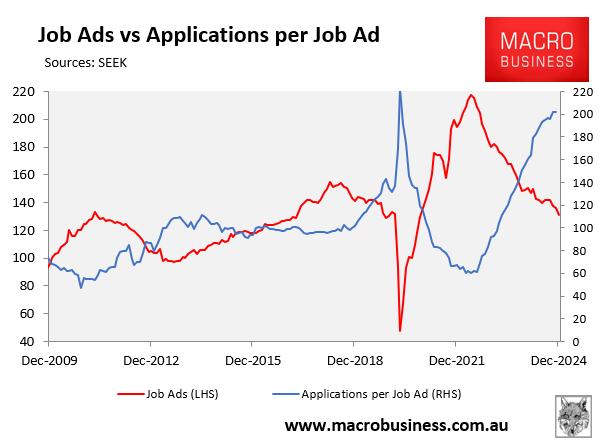

Seek’s employment report for December revealed that the number of job ads fell by 3.0% over the month, were down 5.1% in Q4 2024, and plunged by 12.2% over the calendar year.

Seek also reported a hefty increase in the number of applications per job ad, as illustrated below.

“Ad volumes began the year from an elevated base, and despite the downward trend, the market remains broadly balanced”, noted SEEK Senior Economist Blair Chapman.

“Applications per job ad remain very high, highlighting strong competition for open roles”, he added.

Seek’s advertised salary index has also trended lower over 2024 and is now tracking at around late-2021 levels.

“Advertised salary growth was around 1 percentage point lower over 2024 than it was in 2023”, Chapman noted.

“Employment growth has slowed, and job ads have declined over the past year which suggests that advertised salary growth is likely to resume growing over the coming months as labour demand eased a lot over 2024”.

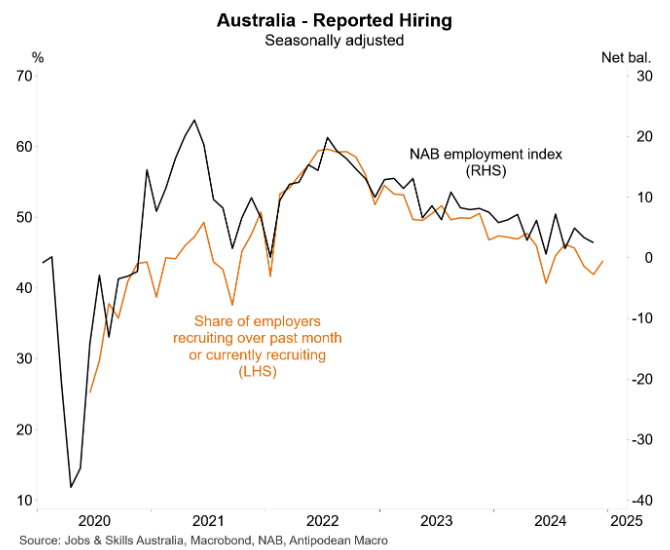

Separate reported hiring data from NAB and Jobs & Skills Australia, compiled below by Justin Fabo from Antipodean Macro suggest that firm hiring intentions stalled late in 2024.

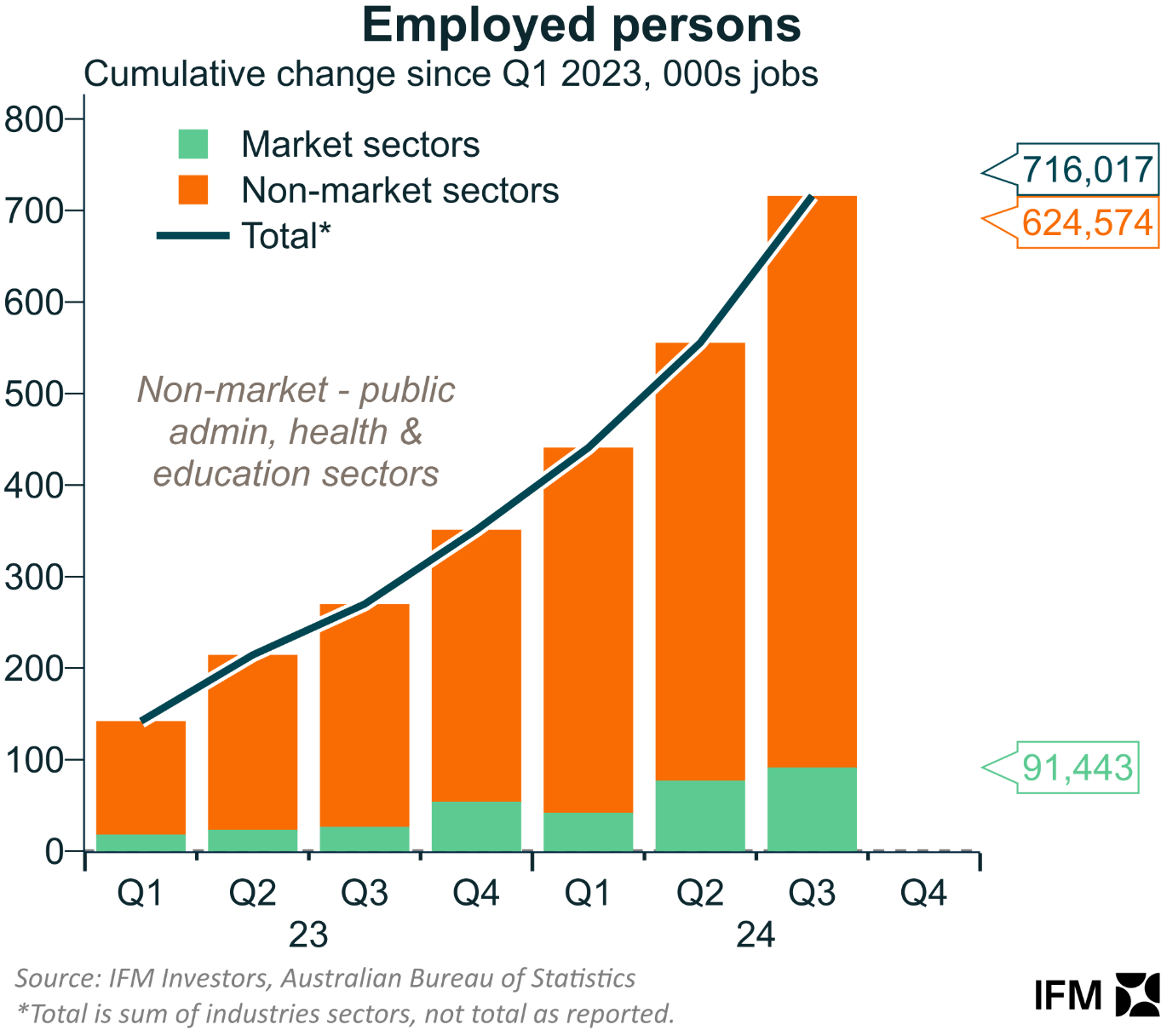

The reality is that the main factor keeping Australia’s unemployment rate low is the unprecedented boom in government-funded non-market jobs, driven by the NDIS.

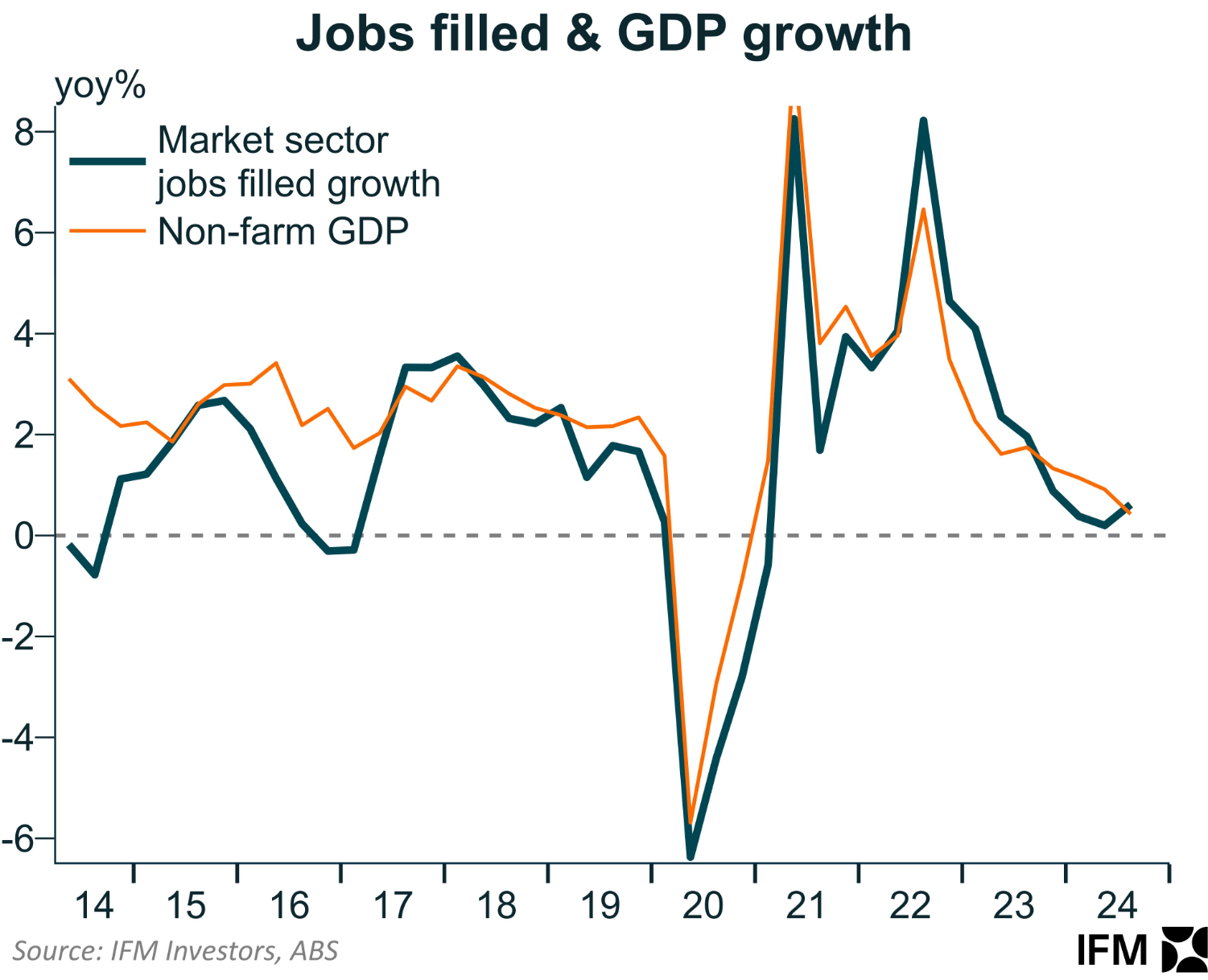

The above chart from Alex Joiner from IFM Investors shows that the non-market sector has created 624,574 jobs since Q1 2023, accounting for 87% of Australia’s total job growth.

By contrast, job growth in the market sector is moribund and reflects the collapse in non-farm GDP.

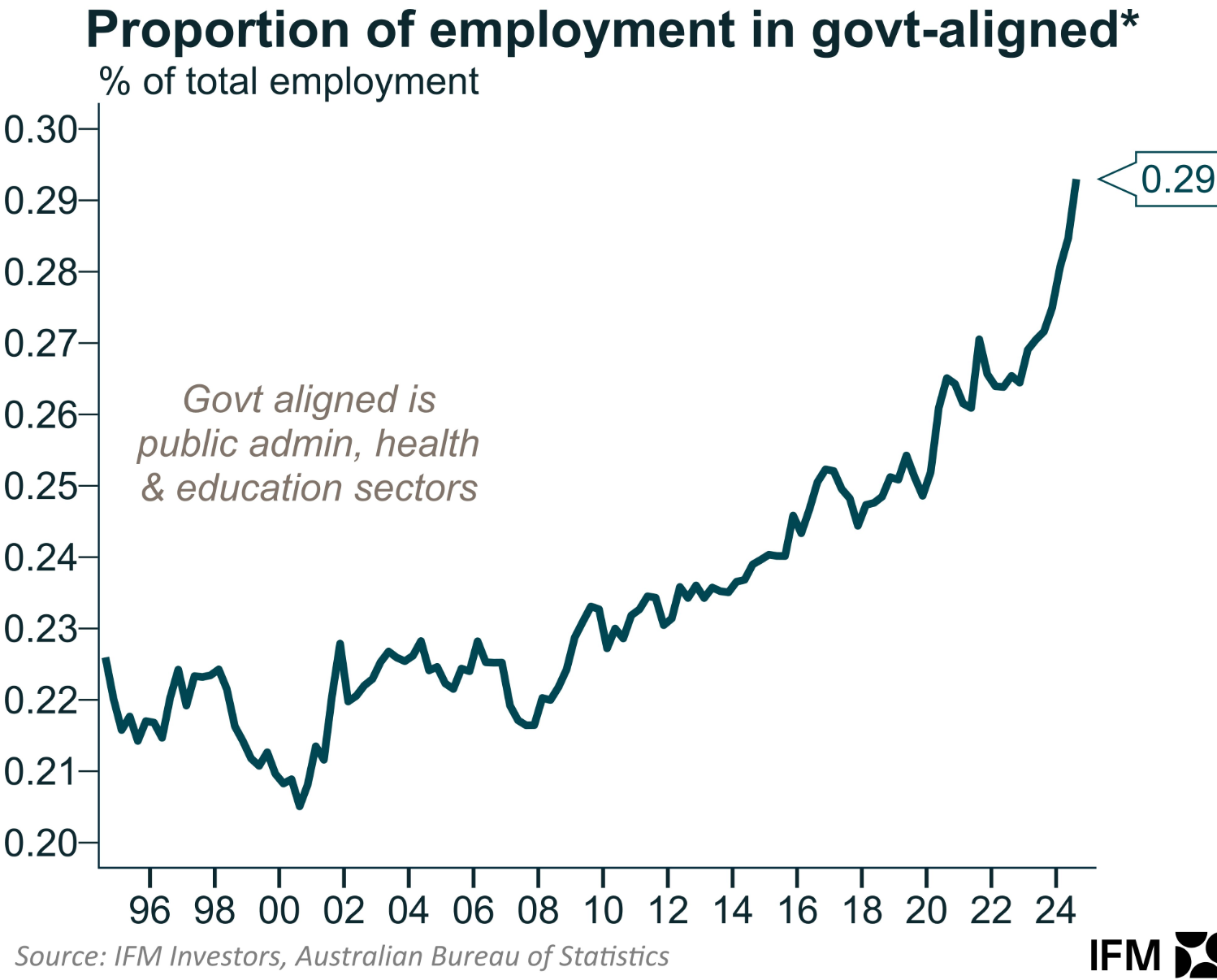

Government-aligned jobs have climbed to a historic 29% of overall employment, up from around 23% in 2006.

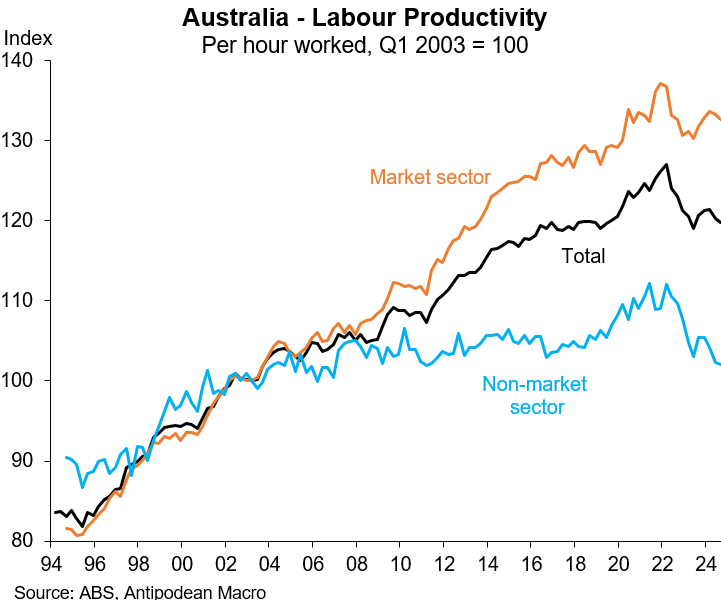

This increase in non-market jobs has contributed to the recent reduction in Australia’s labour productivity, which has plummeted to 2016 levels.

As shown above, labour productivity in the non-market sector is roughly equal to 20 years ago.

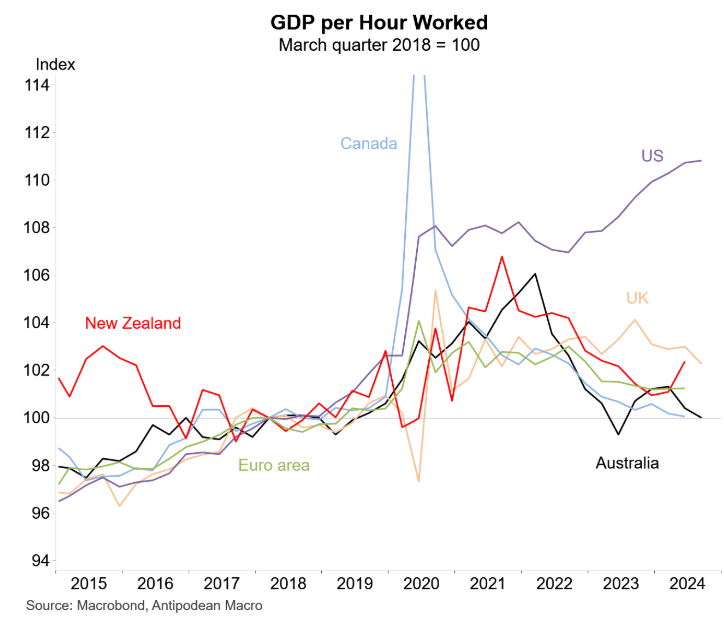

The above chart helps to explain why Australia has seen one of the steepest drops in labour productivity in the developed world since 2018.

Australia’s living standards will continue to decline until productivity growth accelerates.

However, it is difficult to see how Australia’s labour productivity can rebound as long as policymakers continue to support mass immigration and raise energy costs through failed gas and ‘net zero’ policies, further deindustrialising the country.