DXY is a runaway freight train. EUR is a damsel tied to the tracks.

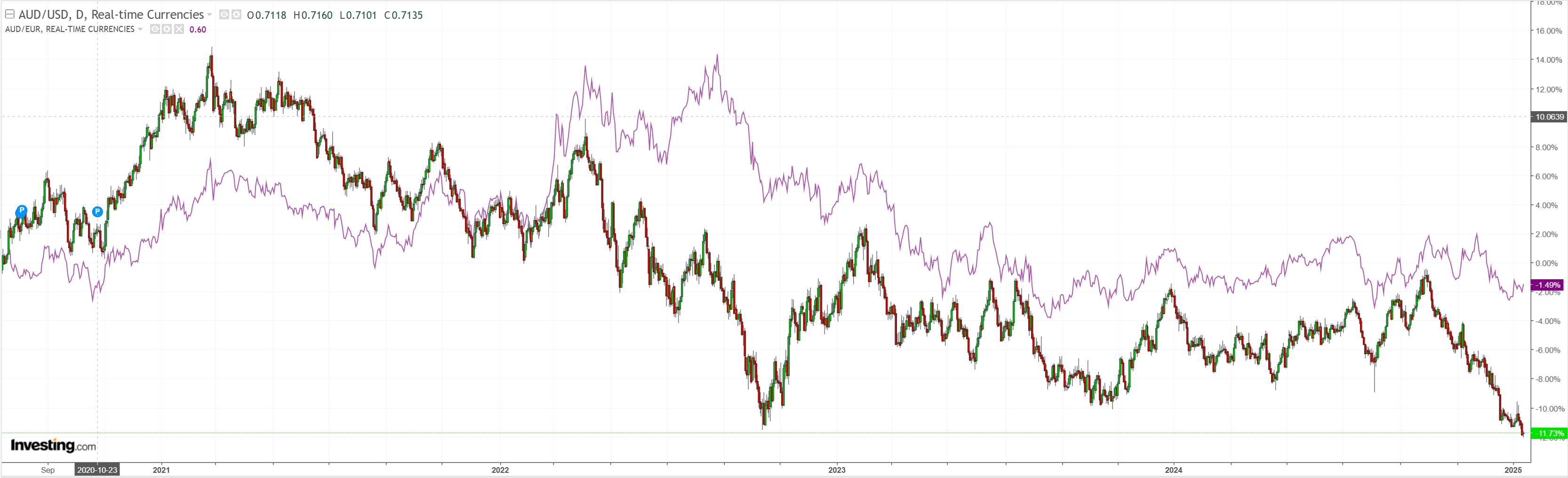

AUD held on for a day.

Aided by CNY’s losing battle.

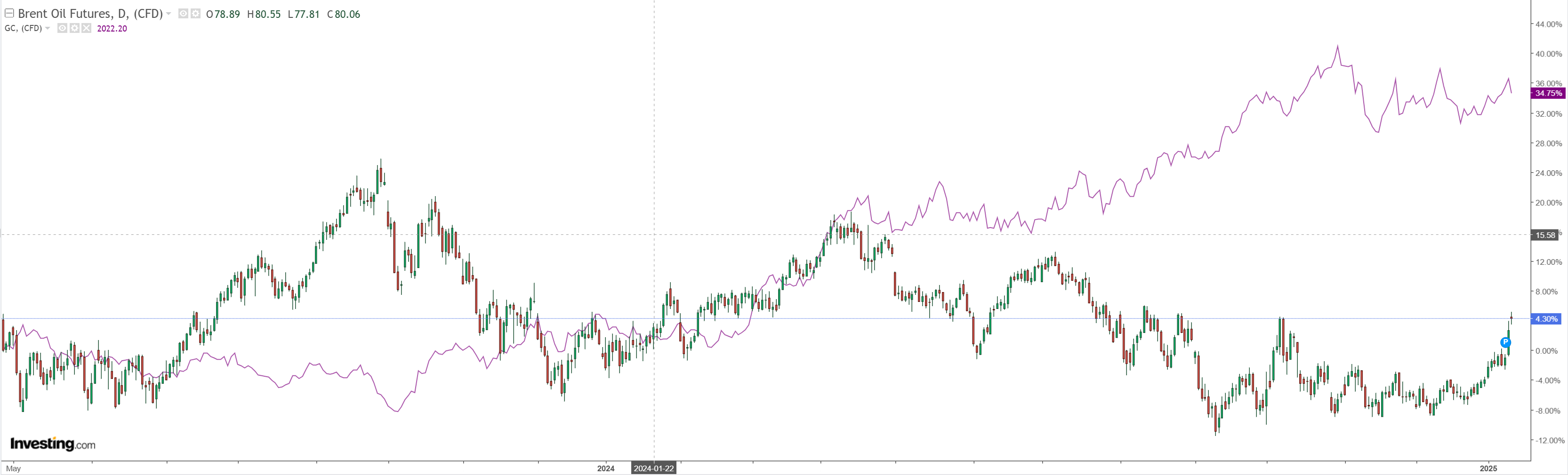

Oil is pure DXY rocket fuel.

It is helping dirt.

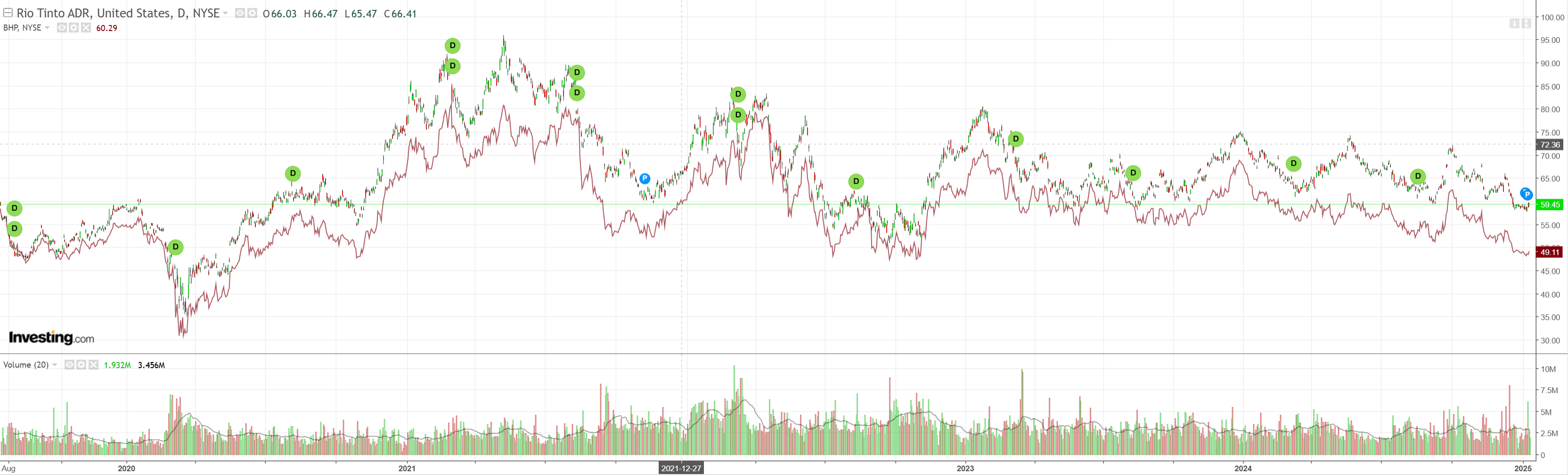

And miners a little.

The Chinese equity market has zero credibility.

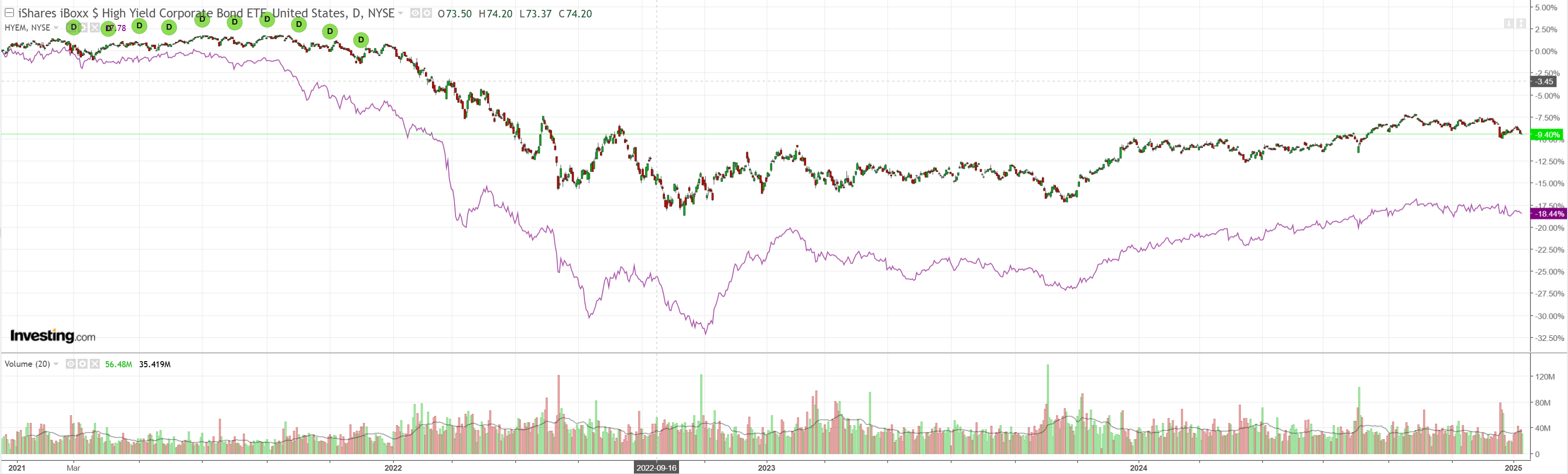

Junk needs a good flush to end the funk.

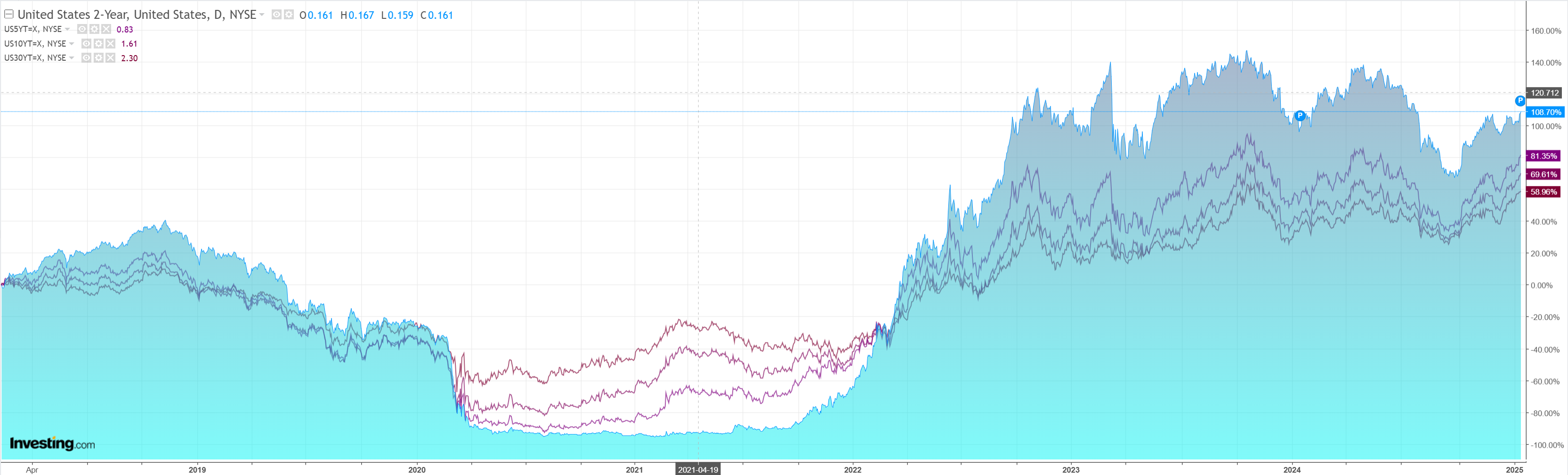

As the bear steepening in the curve continues.

Hurting stocks, especially duration, again.

Credit Suisse says its time to buy oversold AUDs though, it is a notably short-term trade.

FAST FX Fair Value Model09:45CET13 January 2025

The FAST FX model lost-1.03% last week being long EUR/USD. The model has identified AUD/USD as significantly undervalued this week triggering a buy trade.

The FAST FX model is up 3.74% over the past year with a hit rate of 57%.

AUD/USD’s fair value fell slightly from 0.6273 to 0.6272 due to falls in the Australian-US short-term rates spread and the Australian-US box yields pread, which was almost offset by rises in energy and metal prices.AUD/USD’s decline has caused it to become more than 1.5 standard deviations undervalued.

The FAST FX model has triggered a long AUD/USD trade with a stop-loss of-1.7% and a take-profit level of 0.6272.

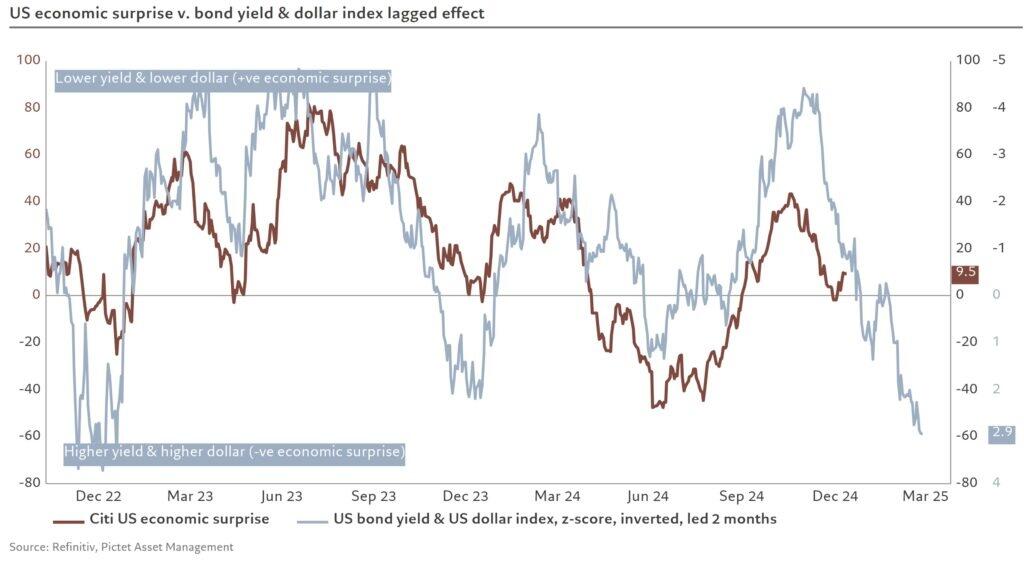

An interesting chart from Pictet supports the idea of an AUD reversal.

It describes the lag between tightening financial conditions and economic data.

I still think we go lower unless or until markets break the Trumpian agenda, but we are reaching the point where the damage needed to do so is meaningful.

Equities are the key. One good flush and Trump’s history suggests he will rethink everything.