Bloomberg loves a good old Chinese booster.

China said it has sufficient fiscal firepower to respond to external challenges, vowing to better execute pro-growth measures ahead of Donald Trump’s return to the White House later this month.

The country has “ample fiscal policy room and tools to deal with new domestic and external problems,” Vice Finance Minister Liao Min said at a briefing on Friday. He repeated a pledge that the 2025 deficit-to-GDP ratio will rise, adding details will be announced after due legal process.

…“The direction of fiscal policy in 2025 is clear, very proactive,” Liao said. “We will provide strong support for economic and social development.”

The government has said it will sell more special sovereign and local bonds this year to fund various programs, including subsidies for buying smartphones and cars. Part of the funding will also be used to rein in local governments’ debt risks and recapitalize banks to beef up their lending ability.

My god, what a bore. To wit:

- Locally produced phones and EVs do nothing for net global demand.

- Deleveraging local governments does very little for commodities.

- Greater leading capacity amid widespread debt revulsion is useless.

As Goldman says:

In the Ministry of Finance (MOF)press conference today, senior officials reiterated their easing stance for fiscal policy, and offered slightly more clues on the 2025 budget planning and local government debt resolution, although they didn’t announce any specific budget numbers (as expected).

We view the press conference today as largely in line with market expectations.

The real problem, real interest rates that are far too high amid a raging balance sheet recession, is still not being addressed.

In fact, the PBoC shot itself in the head.

- China’s 10-year bond yield plunged to a record low this month, while the Chinese currency traded in Hong Kong on Wednesday hit its weakest against the U.S. dollar in more than a year.

- The People’s Bank of China is “trying to cool down the market by suspending gov[ernment] bond buying,” said Larry Hu, chief China economist at Macquarie.

It’s trying to protect CNY, which is not going very well.

China’s “impossible trinity” is breaking its economy. It can only control two of three macro variables in currency, capital flows and interest rates.

It is choosing the first two and so embedding deflation via too high real interest rates.

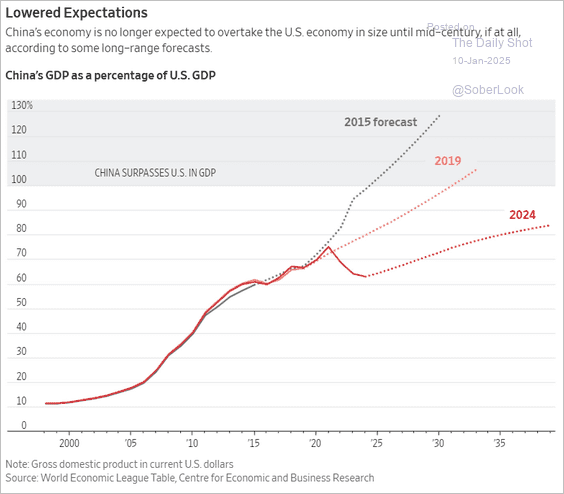

Thus we are watching the end of the Chinese dream in real-time.