Westpac with the note.

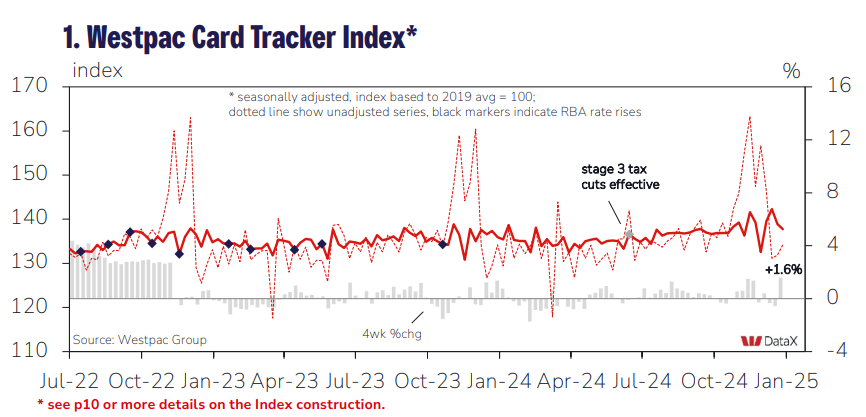

The Westpac Card Tracker Index* has come off a volatile Christmas-New Year period, retracing 4.5pts over the last two weeks to 137.8. The latest Index read is now slightly below the Dec month average (noting that all figures are adjusted for regular seasonal fluctuations). Underlying momentum has remained steady but unspectacular through the summer ‘doldrums’.

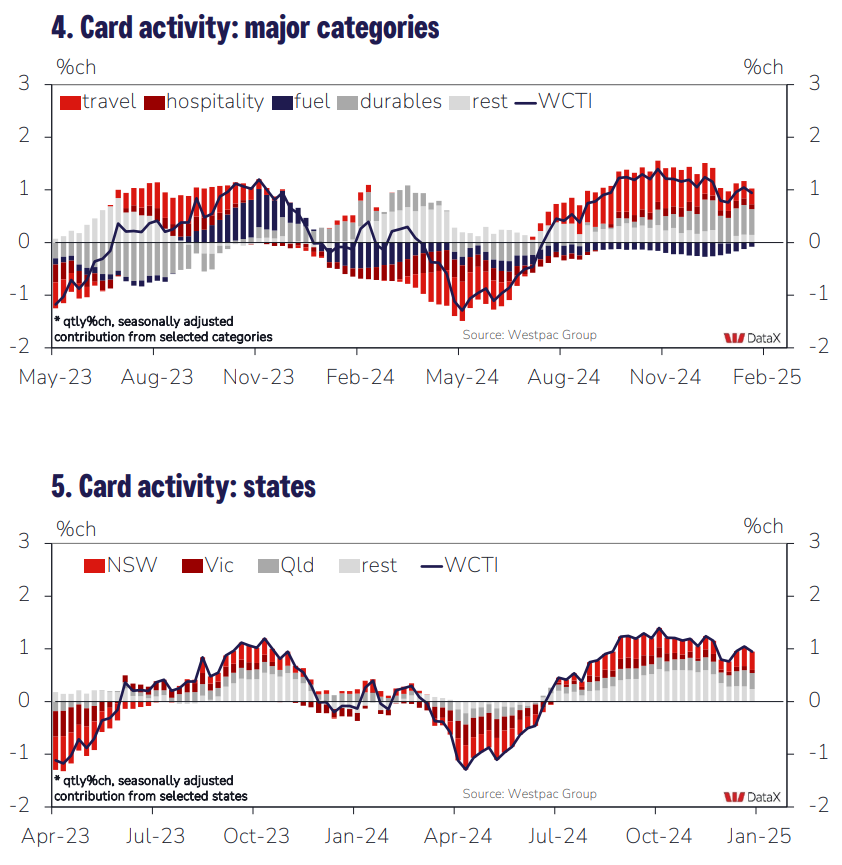

Quarterly measures show growth tracking around 0.9%qtr, in line with the improved pace seen through the second half of last year but not overly strong. The latest monthly pulse is a little more positive but less reliable due to high volatility around the turn of the year. In non seasonally adjusted terms, card activity over the two weeks to Jan 18 – the January low – is just 0.9% higher than in the same period last year. Note that revisions to seasonal adjustment have marked up the estimated pace since Nov, removing most of what had previously been a more pronounced softening.