Westpac with the note.

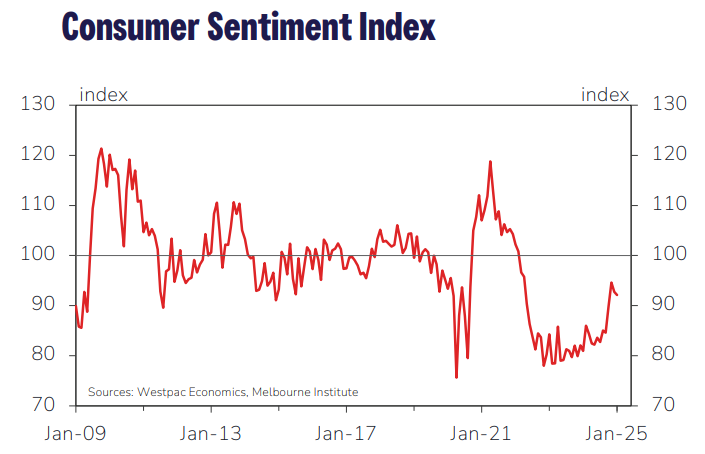

- Westpac Consumer Sentiment declines slightly (–0.7%) in January to 92.1.

- Consumers remain less pessimistic than a year ago.

- But assessment of family finances reversed December’s gains.

- Expectations mostly stable, but unemployment expectations worsen.

The consumer mood has soured for two months in a row and remains on the pessimistic side. The survey results were also weaker later in the survey period than in the first two days. However, sentiment is still less negative than a year ago and some components suggest that consumers expect things to continue to improve from here.

The headline Consumer Sentiment Index is a composite measure based on five sub-indexes: two tracking current conditions and three tracking expectations. In January, the two sub-indexes tracking current conditions declined while the forward-looking ones were flat or increasing, a reversal of the pattern in December.

The survey was in the field during 6–9 January. While the results are already adjusted for usual seasonal variation, it is noteworthy that all of the five sub-indexes were weaker in the last two days of the four-day survey window than they were over the first two days. Unlike in November, there was not an obvious geopolitical event to point to as a driver of this result. As well as the ongoing unsettled global backdrop, it is possible that consumers were reacting to news about the depreciation of the Australian dollar against the US dollar, which resulted in some negative headlines about the outlook for interest rates and the broader economy.

Consumers’ assessment of their finances compared with a year ago reversed the gains in December, falling 7.8% in the month to 77.7. The declines were particularly marked for outright homeowners. Renters also recorded a small decrease in the month in this component, while homeowners with a mortgage saw a 15% increase, which took this component back to 2022 levels for this group. Mortgagors are less likely to be retired than the other two groups and thus more likely to have benefited from last year’s tax cuts. Still, the result highlights that the positive impact of the tax cuts on take-home pay needs to be balanced against all the other factors that have been dragging on families’ finances, including ongoing cost-of-living pressures.

Forward-looking measures were more stable, as was consumers’ assessment of whether now is a good ‘time to buy a major household item’. Expectations about family finances over the next 12 months reversed last month’s decline, while confidence around the outlook for the economy in the coming year was unchanged following the fall in December. Views about the economy in five years’ time improved a little – up 0.7% in January – but at 96.6, this component remains below November’s level.

It isn’t exactly a rocket recovery.