The data flow in Australia this week centres on Wednesday’s vitally important Q4 24 CPI release.

This inflation print will make or break the case for the Reserve Bank of Australia (RBA) to deliver an interest rate cut at its next meeting on 18 February.

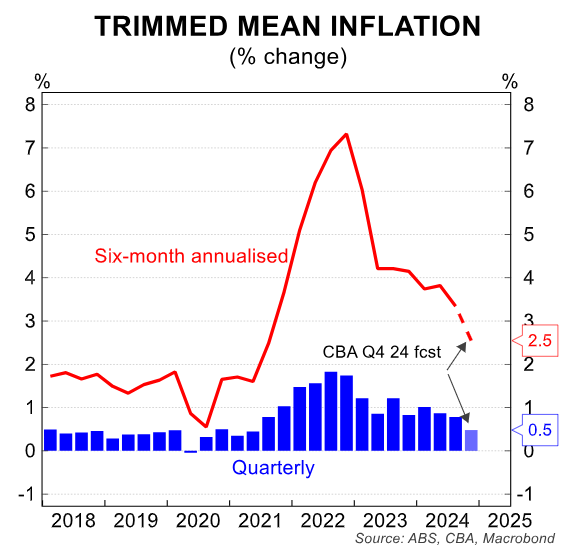

CBA estimates that the policy-relevant trimmed-mean CPI rose by 0.5% in Q4, easing the annual rate to 3.2%. That would be the lowest quarterly result since Q2 2021.

On a six-month annualised basis, CBA forecasts that trimmed mean inflation was 2.5%, i.e., the midpoint of the RBA’s 2-3% inflation target.

CBA’s expectations for headline and trimmed mean inflation are both 0.2% below the RBA’s latest estimates (2.6%/yr for headline and 3.4%/yr for the trimmed mean).

“With headline inflation already in the target band, the expected undershoot on underlying inflation relative to the RBA’s latest forecasts is likely to prompt a re-assessment of the extent of inflationary pressures in the economy”, CBA senior economist Stephen Wu noted.

“A low inflation read will greenlight a February rate cut by the RBA in our view. For the details around our inflation forecast”.

ANZ also expects trimmed mean inflation of 0.5% in Q4 2024, which would prompt an interest rate cut in February.

“With the RBA board’s post-meeting statement in December noting it was ‘gaining some confidence that inflation is moving sustainably towards target’, we think that a downside surprise to the RBA’s published forecasts … will see the RBA cut in February”, the ANZ economists said.

AMP chief economist Shane Oliver agreed, adding that “if the trimmed mean inflation rate cools in line with our expectations, it will be very hard for the RBA not to cut rates at its February meeting”.

Even if trimmed mean inflation prints at 0.5% for Q4 2024, there is a strong chance that the RBA will keep rates on hold pending the results of the Q4 wage price index (due 19 February) and the January Labour Force Survey (due 20 February).

As noted by Alan Kohler over the weekend, “Right now, the unemployment rate is falling, not rising: it was 4.1% last January, 4.2% in July, and the latest number (December) is 4%. So rate cuts now are almost certainly out”.

“In the past 50 years, the RBA has only ever cut interest rates twice while unemployment declined — during the Asian crisis and US tech boom in the late 1990s, which then sent the Australian dollar to a low of US48c, and between 2014 and 2019, when inflation was too low — 1.6% on average for five years — and the central bank was trying to raise it”.

“Neither of those things applies at the moment. It’s true that the Aussie dollar has been falling, but nowhere near as much as in the late 90s, and it seems to have stabilised lately”.

“And right now, inflation is too high, not too low”, Kohler argued.

Whatever the case, we are approaching D-Day for rate cuts. We will likely see them in April or May if they don’t arrive in February.

The Albanese government, facing electoral defeat due to the cost-of-living crisis, is hoping for rate cuts in February and April before the mid-May election.