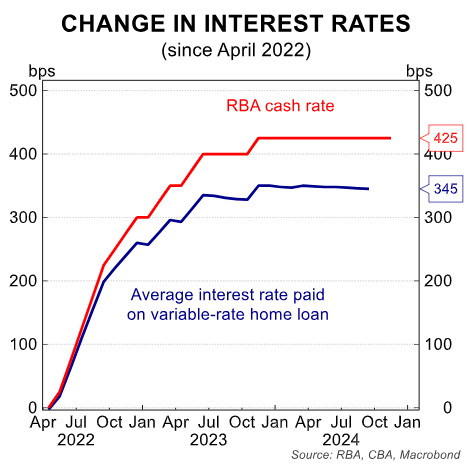

Australian housing values unexpectedly rose over the past two years despite 4.25% of interest rate hikes by the Reserve Bank of Australia (RBA).

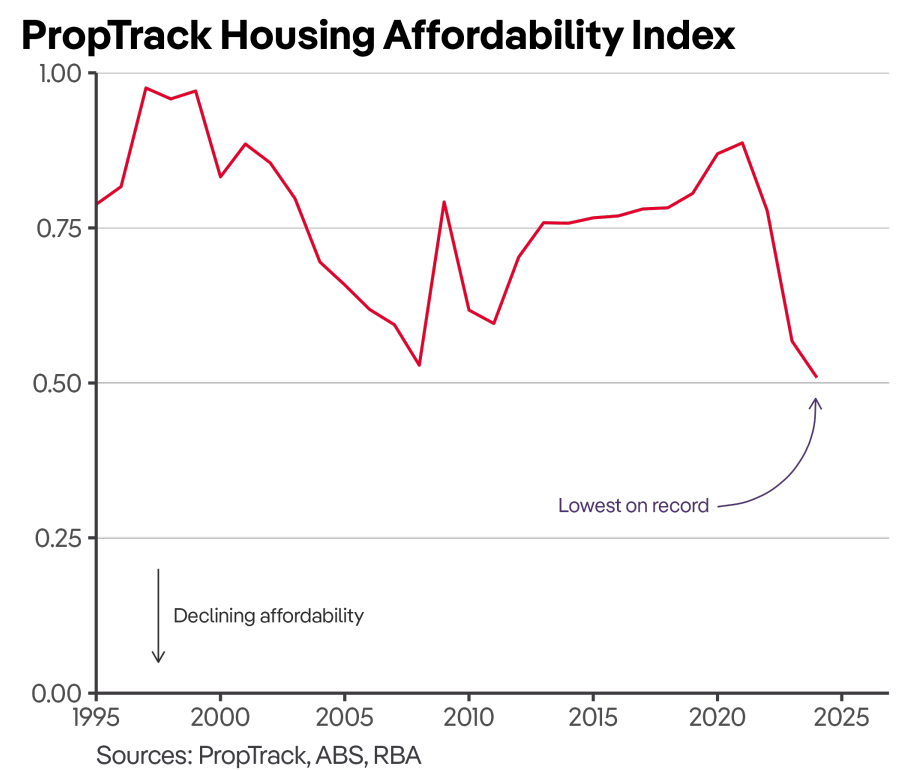

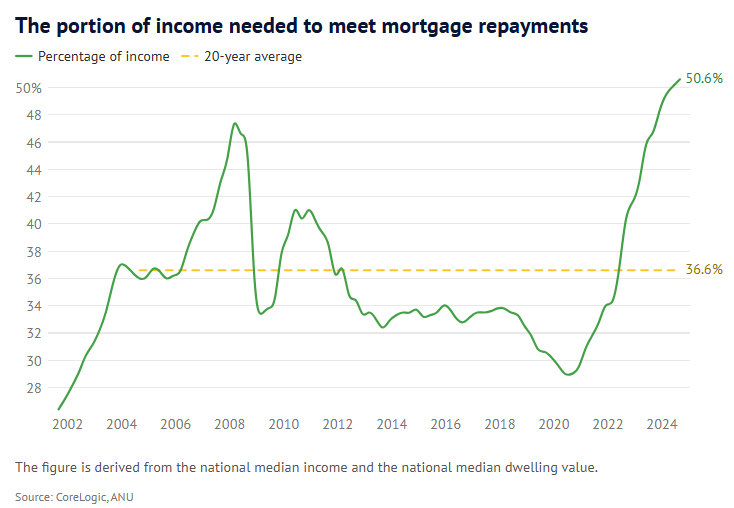

The rise in prices combined with higher mortgage repayments meant that Australian housing affordability collapsed to an all-time low.

“Housing affordability is currently at its worst level since 2008, with 47% of gross household income required to service a mortgage nationally”, Oxford Economics Australia’s senior economist Maree Kilroy told The AFR over the weekend.

“This ongoing constraint on buyers continues to divert demand towards properties at lower price points”, she said.

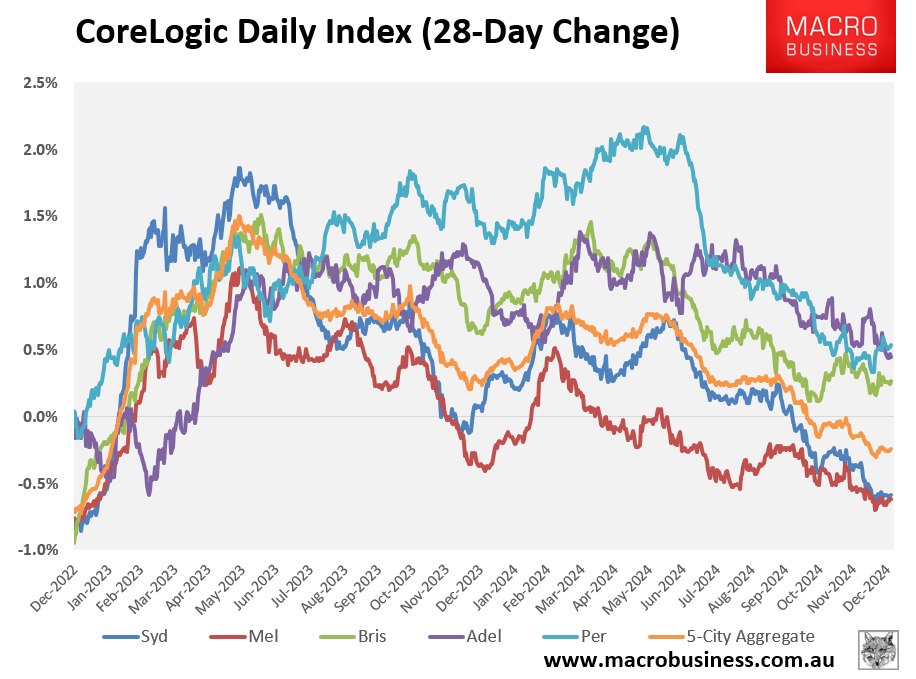

After growing strongly in the first half of the year, Australian dwelling values ended 2024 in the red, driven by falling values in Melbourne and Sydney.

The latest Australian Financial Review quarterly property survey revealed that economists and property experts expect residential home prices to rise by 3% in 2025, down from 4.9% in 2024.

The common theme among those surveyed is that declining affordability after two years of growth presents a handbrake to growth.

However, 2025 could also be a tale of two halves, with values nationally expected to begin 2025 in decline before rebounding over the second half after the RBA cuts interest rates.

“Lower interest rates should help from mid-year though to drive a renewed upswing, providing the economy stays out of recession and unemployment only rises to around 4.5%”, AMP chief economist Shane Oliver said. “If not, all bets are off and house prices are likely to fall through the year as a whole”.

Barrenjoey chief economist Jo Masters expressed similar sentiments.

“We expect prices have further to fall in Sydney and Melbourne and soften in other main capital cities over the next six months, but for momentum to improve over the second half of the year, boosted by rate cuts and real income growth, meaning that prices are unlikely to fall through calendar year 2025”, she said.

“Auction clearance rates are indicative of the weakness in the housing market and are consistent with further price falls in Sydney and Melbourne”.

“Borrowing capacity is set to remain constrained for some time longer as household income is improving more slowly than we had thought and we move our first rate cut from February to May”, she said.

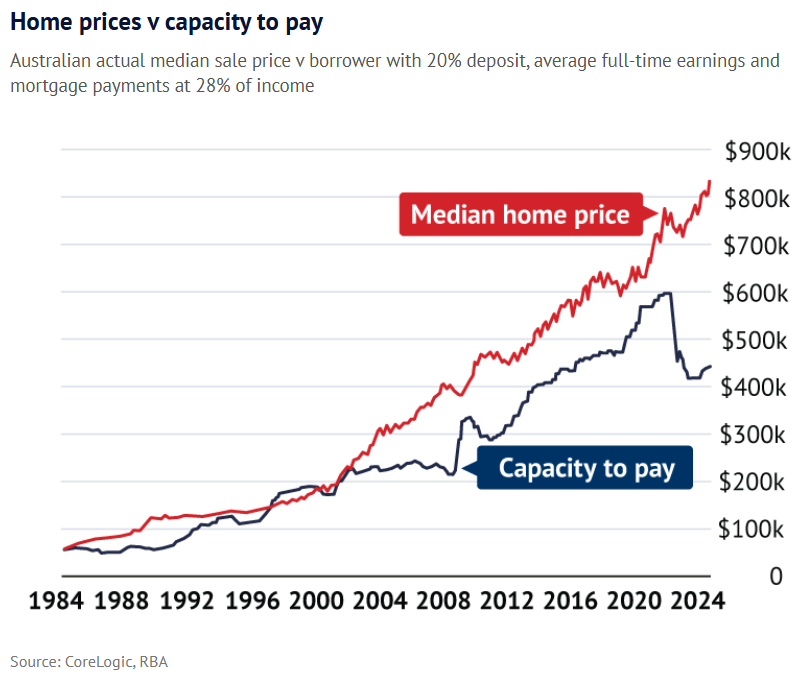

The reality is that Australian home values have decoupled wildly from borrowing capacity.

Given that net overseas migration has slowed and stock levels have recovered, the historical relationship between mortgage rates and home values is returning.

As a result, Australian home prices should continue to trend lower until the RBA cuts interest rates, improving borrowing capacity and mortgage affordability.