The Australian Bureau of Statistics (ABS) has released the consumer price index (CPI) for Q4 2024, which printed below the Reserve Bank of Australia’s (RBA) expectations.

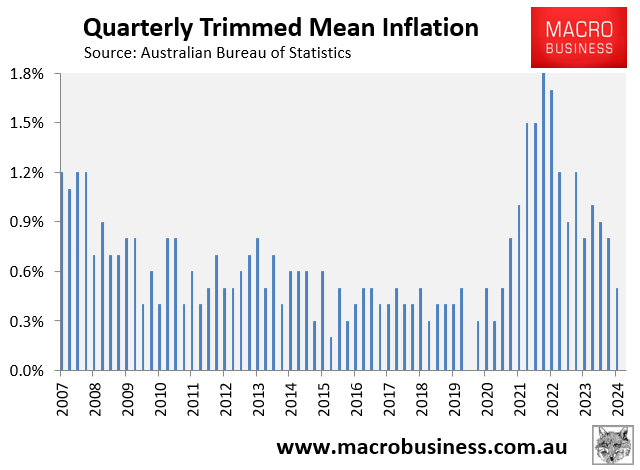

Three of the Big Four banks forecast that the pivotal “trimmed mean” inflation would be 0.5% in Q4. The fourth Big Four bank (Westpac) was only slightly higher, tipping trimmed mean inflation at 0.6%.

Wednesday’s official ABS release reported trimmed mean inflation of 0.5%, in line with economists’ expectations.

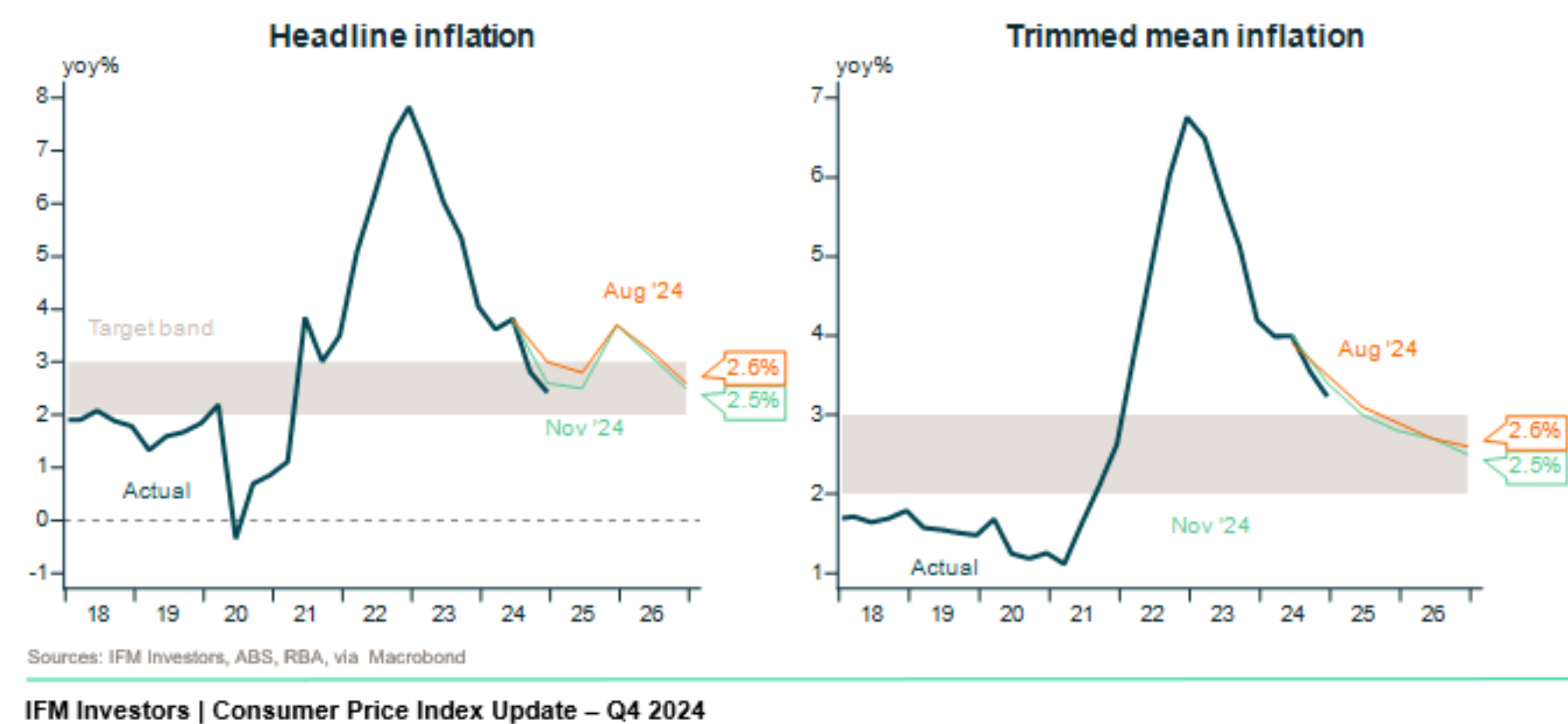

The six-month annualised trimmed mean inflation rate also fell to 2.6%, around the mid-point of the RBA’s inflation target of 2% to 3%.

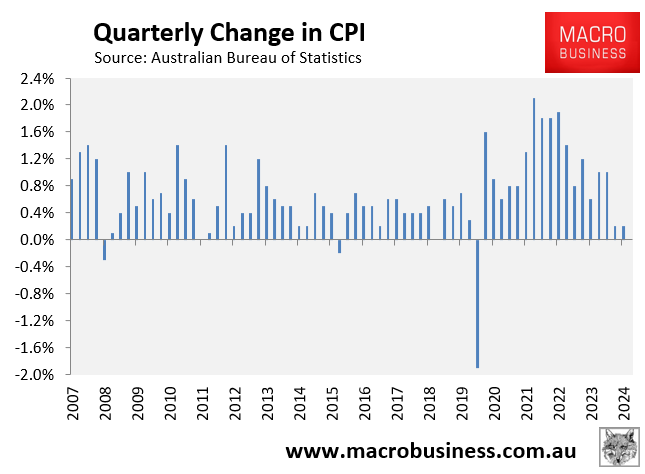

Headline inflation has collapsed, falling to 0.2% in Q4 2024 and 2.4% annually.

However, headline inflation has been heavily impacted by energy and rent subsidies. As a result, the RBA has stated that it will ignore the headline measure and focus on trimmed mean inflation instead.

Regardless, the sharp decline in trimmed mean inflation opens the door for rate cuts at the next monetary policy meeting on 18 February.

That said, the RBA could still keep rates on hold pending the results of the Q4 wage price index (due 19 February) and the January Labour Force Survey (due 20 February). Instead, rates could be cut at the 1 April monetary policy meeting.

Expect heavy lobbying from the Albanese government, which desperately needs rate cuts to bolster its reelection chances.