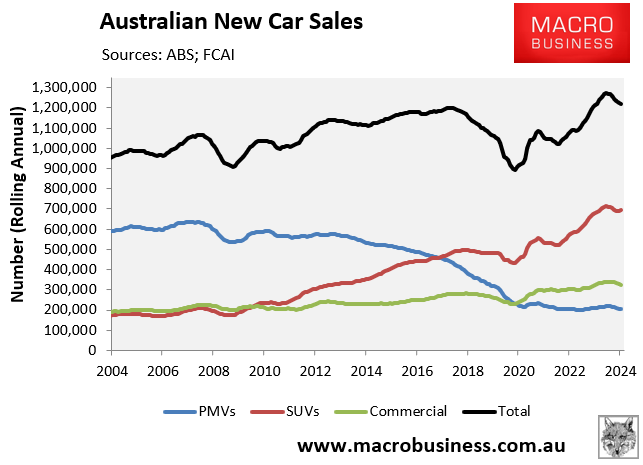

The Federal Chamber of Automotive Industries (FCAI) reported new car sales for December, which showed a sharp deceleration of sales over the second half of 2024.

There were 95,895 new car sales in the year to December, down 19.9% from the June 2024 peak of 119,659 sales.

FCAI Chief Executive Tony Weber was downbeat, noting that 2025 will be challenging amid cost-of-living concerns and new vehicle efficiency standards.

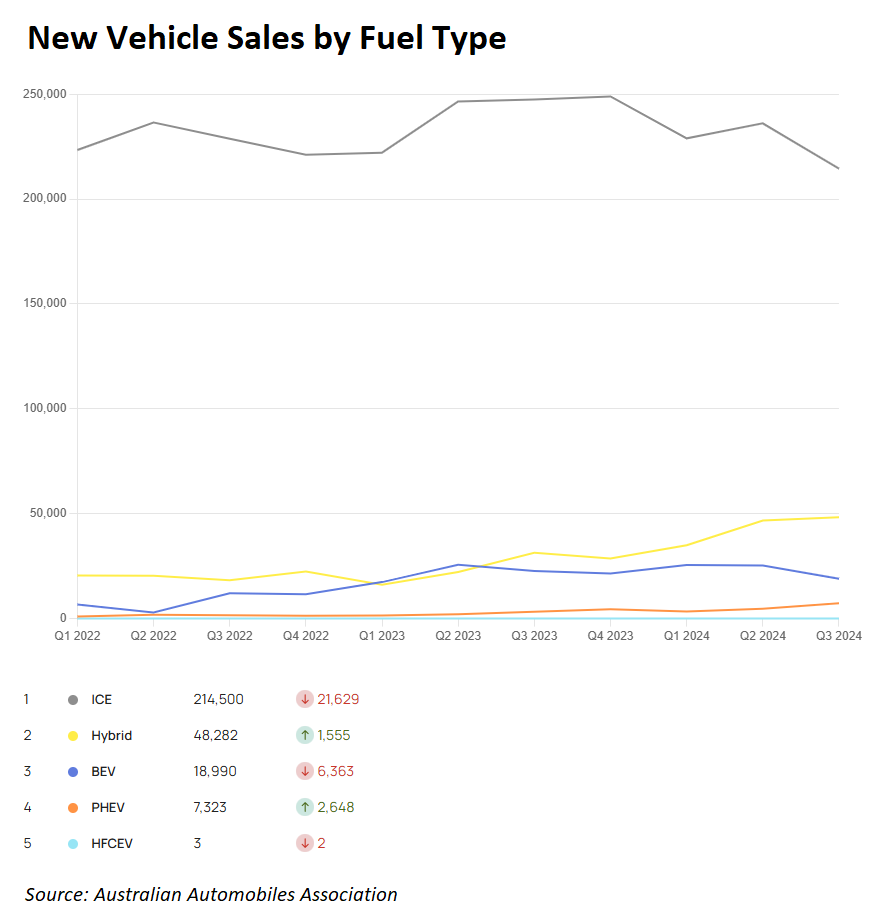

Weber also noted that while demand for hybrid vehicles is strong, battery electric vehicles (BEV) sales have been disappointing.

“The second half of the year showed a concerning trend with sales in the Private segment falling to very low levels as interest rates and general cost of living pressures impacted Australian families”, Weber said.

“Customers are also increasingly making choices regarding environmental outcomes and the associated total cost of ownership of moving to low emissions technologies”.

“So, while the sales of battery electric vehicles are lower than expected, this is offset to a degree by an increasing number of buyers turning to hybrid and plug-in hybrid models which make up 14.1% and 1.9% of the total market respectively”.

Weber also warned that buyer preferences do not align with new government emissions mandates, which will financially penalise car makers if they sell too many higher-emitting vehicles.

“The industry is responding to NVES by increasing the range of zero and low emission vehicles on offer”, he said.

“However, a continuation of current customer buying preferences will inevitably lead to the accrual of substantial penalties under the Government’s new scheme, which will create price inflation within the new vehicle market”.

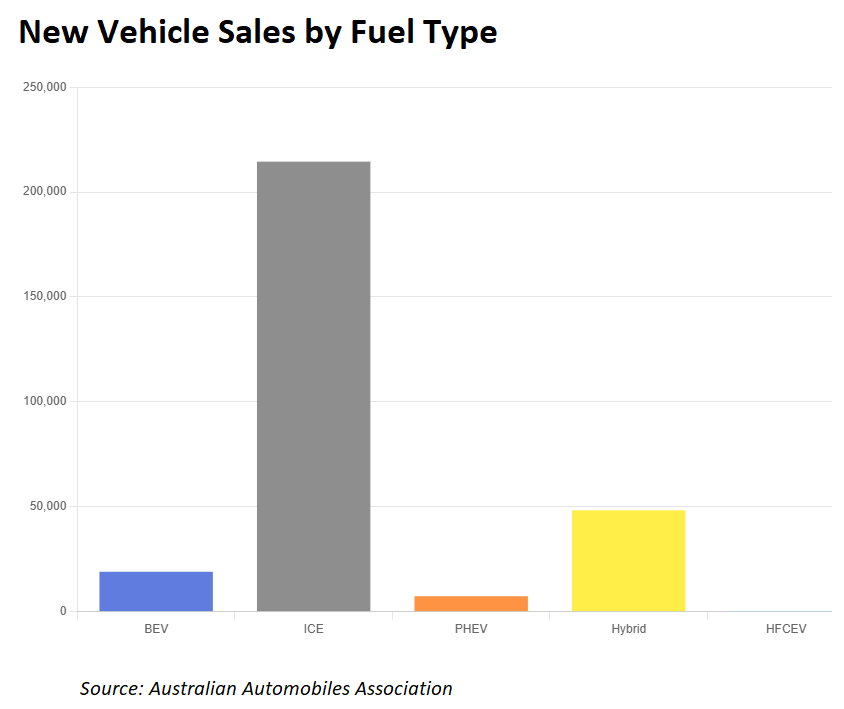

The Australian Automobile Association’s Electric vehicle Index shows that BEV sales fell in the year to Q3 2024, whereas hybrid vehicle sales grew strongly and internal combustion engine (ICE) vehicles continued to dominate.

BEV sales were also a rounding error in the overall passenger vehicle market.

Despite a slew of financial incentives from the federal and state governments, BEV adoption remains slow. These subsidies include an increase in the luxury car tax threshold and exclusions from fringe benefits tax and customs duty.

BEVs are also exempt from paying road user charges through the 50.6 cents a litre fuel excise, which is essentially a subsidy.

However, numerous jurisdictions across Australia have cut rebate programs and tax breaks, which has reduced demand for BEVs.

The $3,000 rebates in New South Wales and South Australia ended on January 1 of 2024. The New South Wales government recently removed a stamp duty rebate for new and secondhand zero-emission vehicles worth up to $78,000. Both incentives had been available since 2021.

Victoria’s $3,000 rebate, which began in 2021, expired in mid-2023.

The ACT’s inducement of two years of free registration expired on June 30, 2024.

Queensland’s $6,000 incentive for electric vehicles expired in September 2024.

The Australian Energy Market Operator (AEMO) also recently slashed its projection for BEV adoption over the next decade from seven million to four million units.

FCAI CEO Tony Weber also noted that lower than expected sales results for BEVs were being replicated around the world.

“Governments around the world have set regulations that are ahead of available zero emissions technologies and this is impacting both car makers and consumers”, he said.

“Manufacturers in the UK, Europe and the USA are under pressure because they have made huge investments to manufacture EVs, but customers are not buying them in the numbers needed to meet emission targets and to provide a return on investment”.

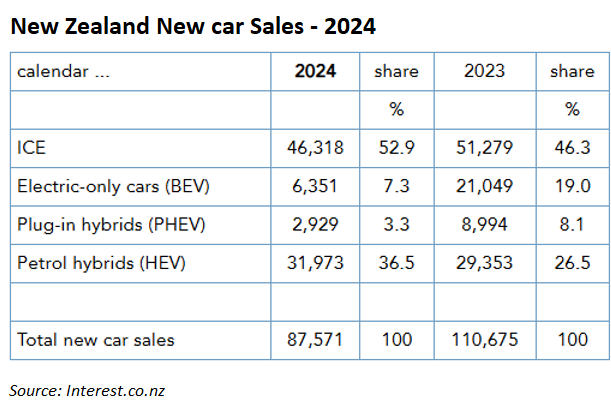

Indeed, BEV sales collapsed in New Zealand in 2024 after the Clear Car Discount subsidy was ended on 31 December 2023. By contrast, standard hybrid sales boomed despite the absence of subsidies.

Given the lack of buyer interest in BEVs, Tony Weber has called for more taxpayer subsidies to stimulate demand.

“I urge the Commonwealth Government to support its emissions reduction policies by considering ongoing consumer support such as a continuation of the FBT exemption for plug-in hybrid vehicles which is due to end on 1 April 2025”, he said.

“If consumers do not want, cannot afford or cannot find new low emission vehicles that meet their needs, then no amount of effort from governments and car makers will make a difference”.

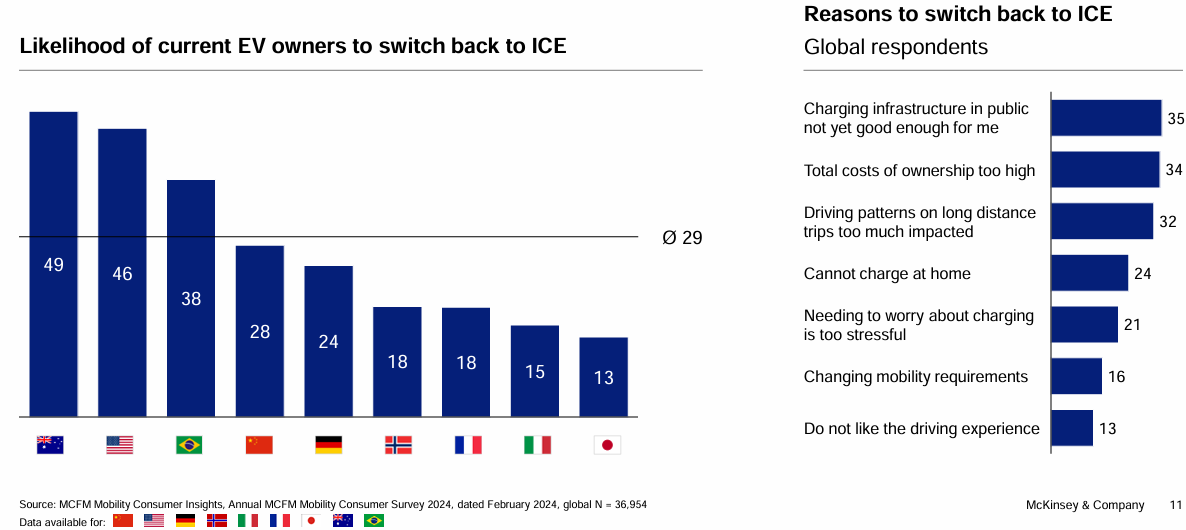

A recent McKinsey Mobility Consumer survey found that 49% of Australian BEV owners are “very likely” to return to ICE vehicles.

Respondents’ biggest concerns were the poor status of public charging infrastructure (35%), as well as high purchasing costs (34%).

The comparison website Compare the Market recently expressed concern about BEV insurance costs. According to a study of 12 insurers, BEVs cost around 50% more to insure than their internal combustion engine counterparts.

“EVs are generally more expensive to insure because the battery pack creates more complexity for repairers, many EV-specific parts need to be imported from overseas, and there are fewer qualified smash repairers for electric cars”, Compare the Market’s economic director, David Koch said.

Several major global automobile manufacturers have curtailed BEV production due to sluggish customer demand and lacklustre global sales.

The truth is that BEVs are not ready for mass deployment. They remain prohibitively expensive, lack quick and convenient charging options, have a short range (particularly on highways without regenerative braking or when heavy heating or air conditioning is required), incur high insurance and repair costs, and depreciate in value dramatically.

Standard hybrids, on the other hand, address the most of these drawbacks, explaining why their sales have skyrocketed.

Toyota has been producing reliable and reasonably priced hybrid cars since the late 1990s, when it introduced the Prius.

Hybrid vehicles provide exceptional fuel economy and range, are convenient, and have a higher resale value. In contrast, BEVs are inconvenient if you do not have offstreet parking or engage in long roadtrips, and they depreciate similarly to throwaway consumer electronics.