The fearmongering over the exodus of property investors from Victoria has continued.

Rental bond data from the Victorian Government shows that the state lost 24,726 rentals (3.6% of its stock) in the year ending 30 September 2024, the sharpest decline in rental bonds on record.

Melbourne lost 23,108 rentals (4.2% of its stock) over the same period.

In contrast, the number of rental bonds ticked up slightly in Queensland and NSW in the year to 30 September 2024.

Real Estate Institute of Victoria chief executive Kelly Ryan warned that the sharp decline in Victorian rental bonds risks driving prices and rents higher.

“This decline is a strong indicator of investor withdrawal from the rental market”, Kelly Ryan said.

“It further implies a contraction in available rental properties, driving up prices while limiting renters’ choices”.

Charlotte Pascoe, the chief executive of real estate group Stockdale & Leggo, which has 32 offices in Victoria and Queensland, noted that the number of rent rolls in Victorian real estate firms has shrunk by around 15% amid the investor exodus.

“Some rent rolls in Victoria, we’ve been monitoring, have experienced a huge reduction in properties, and they haven’t been replaced because investors weren’t in the market to buy those properties again”, he said.

“The amount of investment properties within real estate businesses has reduced, as a general rule of thumb, at an attrition rate of about 15%”.

Meanwhile, Real Estate Institute of NSW chief executive Tim McKibbin warned that the number of property investors is failing to keep pace with population growth.

“The number of rental properties is not keeping pace with our population growth”, he said.

“I’ve been at the REINSW for 20 years, and from my experience over that time, the normal yearly increase in properties was circa 5%”.

Last month, Dorian Traill from Metropole argued that Australia is facing a “critical shortage of property investors” that is “further fueling the nation’s escalating rental crisis”.

“Between March 2019 and March 2024, Australia’s population grew by an extraordinary 1.8 million people, requiring an additional 212,000 rental properties to house them”, Traill wrote.

“However, only 110,000 new investors entered the market during this period, far fewer than the 145,000 needed to meet demand”.

In actuality, the investor sell-off has benefited Victorian tenants and first-time home buyers.

“Melbourne rents were down 0.4% through the second half of 2024, mostly due to a 1.1% fall in unit rents, while house rents are unchanged over the past six months”, CoreLogic Research Director Tim Lawless noted last month.

“At the same time, we are seeing a rise in rental vacancy rates and an easing in rental growth, suggesting less rental supply is being accompanied by less rental demand”.

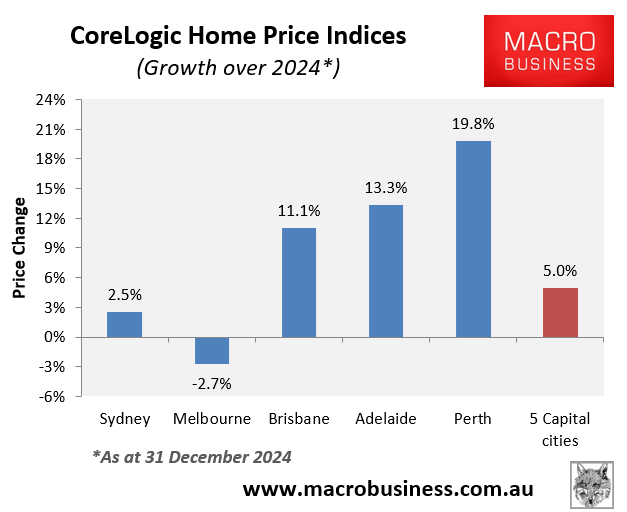

CoreLogic also reported that Melbourne home values fell by 2.7% in 2024, making homes more affordable for first-time purchasers.

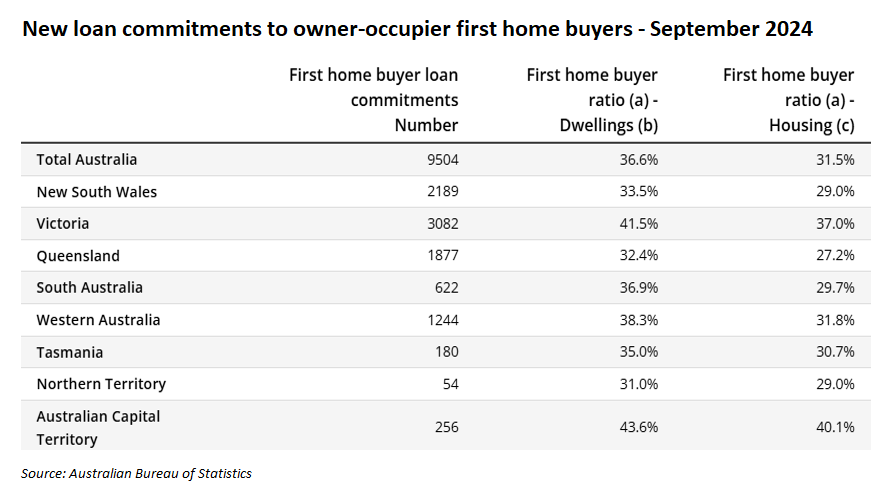

According to the Australian Bureau of Statistics, Victoria has by far the most significant proportion of first-time home buyers of any state in Australia.

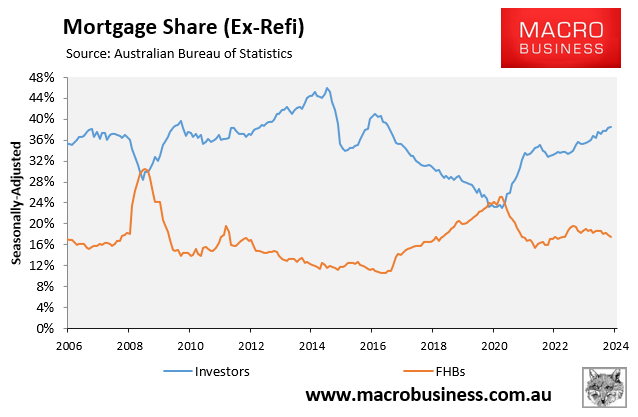

This should come as no surprise, given that there has historically been an inverse relationship between investor mortgage demand and first-home buyer mortgage demand.

When investors sell their properties, they invariably end up in the hands of first-time home purchasers.

Moreover, when an investor sells to a first-time homebuyer, a rental property is removed from the market. However, it also takes a rental household off the market.

As a result, rental supply and demand are lowered in tandem, leaving the rental market balance the same.

If policymakers genuinely want to increase home ownership, they should limit the number of investors in the market.

They should encourage investors to sell to first-time homebuyers, as is happening in Victoria.