So says the CBA’s excellent Gareth Aird.

We forecast GDP growth to have been 1.1%/yr at Q4 24 and to accelerate through 2025 to be 2.2%/yr in Q4 25.

The unemployment rate is expected to edge higher in H1 25 and we anticipate it will end the year at 4.3% (the peak in this cycle).

Headline inflation will remain within the target band over H1 25, but outcomes in H2 25 will be dependent on whether government energy rebates are extended (we consider an extension more likely than not).

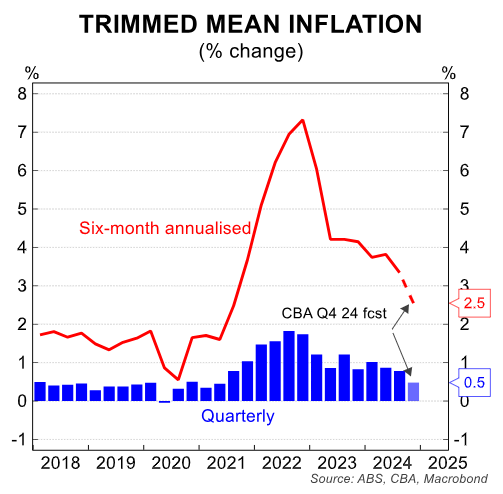

Our forecast is for the monetary policy‑relevant trimmed mean CPI to be 3.2%/yr in Q4 24 and 2.6%/yr in Q4 25.

We anticipate national home prices to end 2025 up ~4%, but prices are likely to continue to edge lower in H1 25, before lifting over the second half of the year as borrowing capacity increases due to lower mortgage rates.

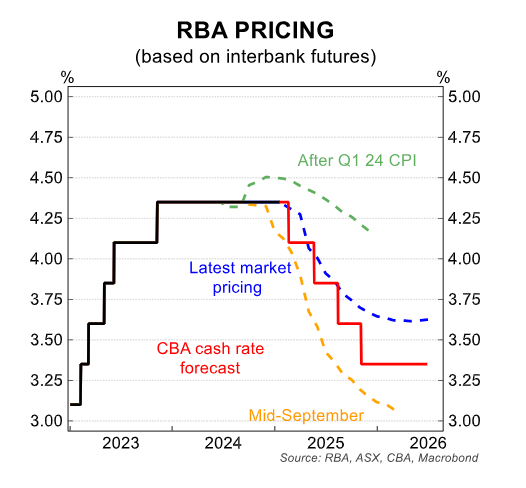

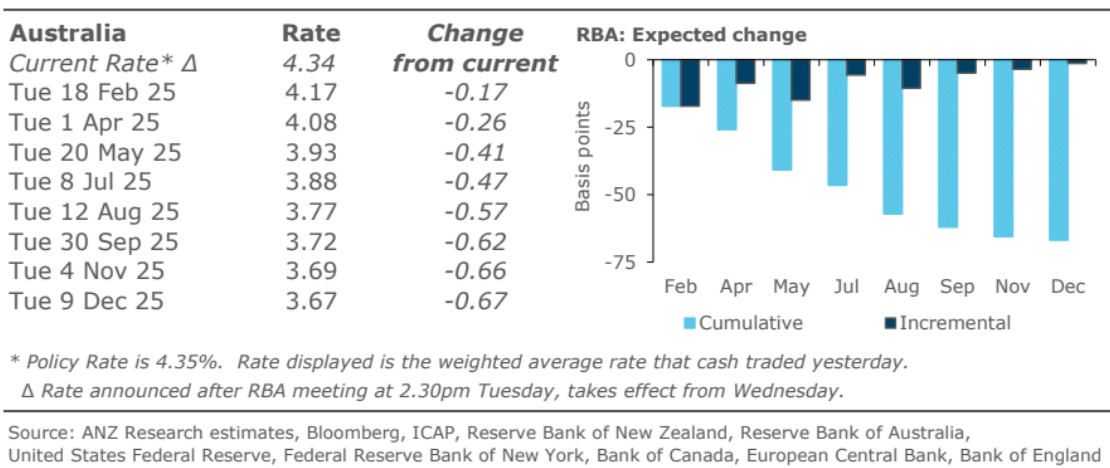

Our base case remains for the RBA to commence an easing cycle in February 2025 (i.e. at the next Board meeting). We look for 100bp of easing over 2025 that would take the cash rate to 3.35%; the risk sits with a shallower easing cycle.

Fiscal policy is the key source of domestic uncertainty, particularly given the federal election will be held by May 2025

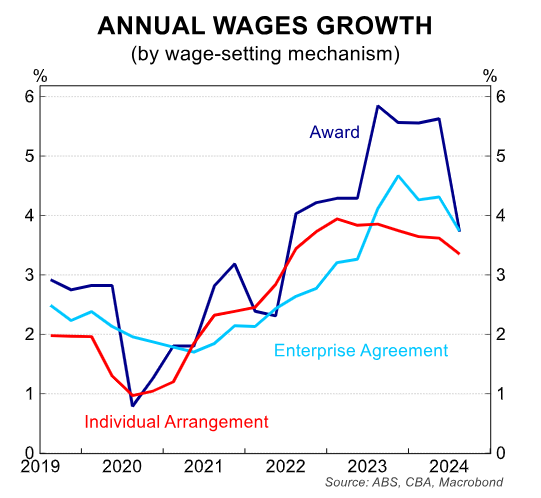

And the real killer of inflation? Not rate hikes. The Indian inundation. I expect wage growth to fall all year.

As the ANZ shows, markets are priced to begin cutting in February but have one less cut priced for 2025.

I lean towards more than less unless the gas cartel wrecks the party.