The gas import catastrophe begins this year.

The chief executive of the country’s most advanced LNG import venture has rejected findings by the competition watchdog that gas consumers in southern states will be slugged with higher prices as they start to rely on imported fuel as early as 2026.

…“We strongly reject the assumption that LNG import prices may be higher than current domestic gas prices,” Mr Wheals said.

“By 2028, the size of the global LNG market will be about 80 times bigger than Australia’s southern gas markets,” Mr Wheals said. “Furthermore, importing gas will drive down prices during winter peaks by increasing supply.”

Promises, promises. If LNG imports were on the market right now, they would cost around $25Gj. The current spot price is $12.97Gj.

That is, gas prices would double. The gas export cartel would immediately limit domestic flows to ensure all local gas is priced against imports.

This would lead to a one-third jump in retail electricity prices and add 4% to the CPI with spillovers.

Of course, this won’t happen because Canberra will have no choice but to keep doubling the energy rebates. They were $3.5bn in 2024. Expect $7bn by 2027 to be sucked from the budget and recovered via your taxes.

It is true that the big US and Qatari expansions will drop international gas prices over the next few years. US gas will be the marginal price setter in Asia, where Squadron will buy its gas.

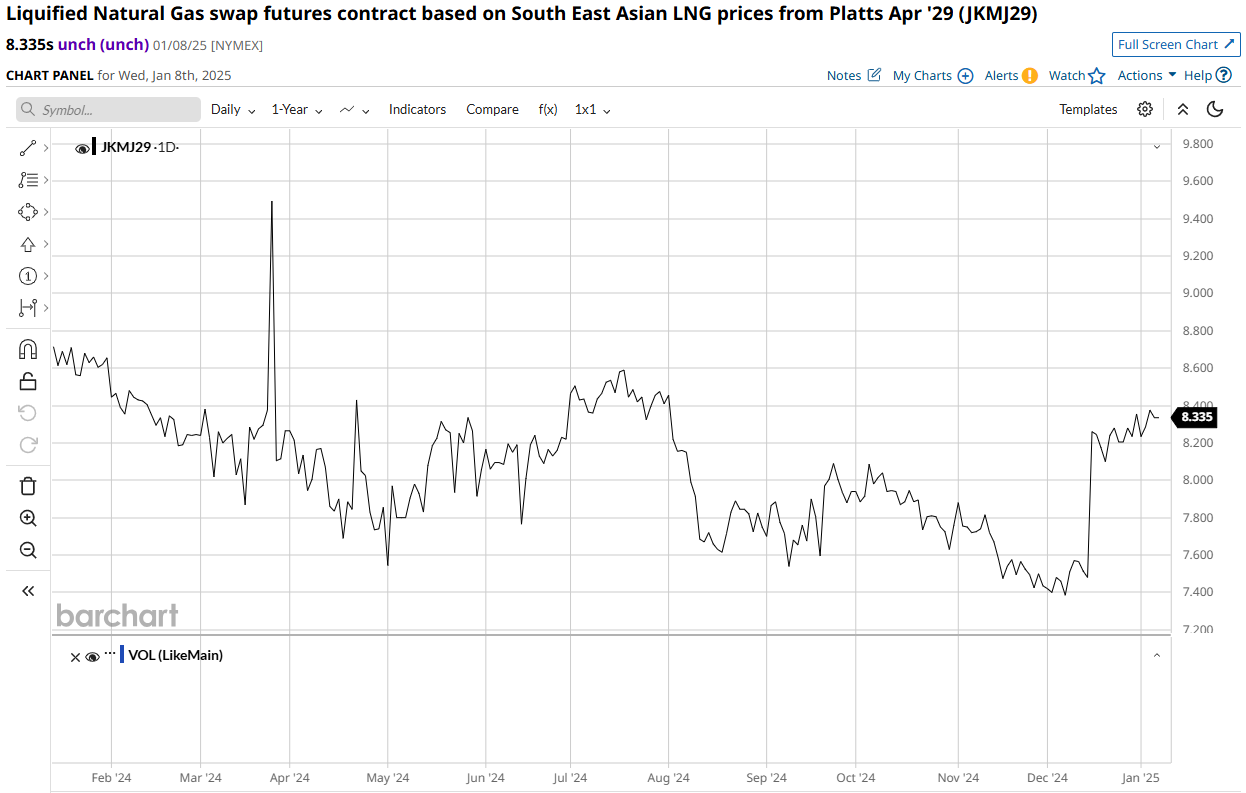

However, Asian JKM futures still don’t see price falls for Australia. JKM future prices average USD8-9Gj post-2028, which, at the current exchange rate, equates to about $16Gj landed and distributed gas in Australia.

This points directly to the madness of LNG imports. Imports embed supply and currency risk, meaning any and every time there is supply disruption anywhere on the planet, local gas prices will rise, and because such shocks typically sink the AUD, the price impact will be further exaggerated.

In short, we will have shifted the East Coast economy from stable local supply averaging $3Gj gas to unstable international supply costing $16Gj on a good day, and ANYTHING on a bad day. For instance, it peaked at $70Gj during the Ukraine War shock.

And we will have done it for a fossil fuel industry that employs next to nobody while paying next to no tax.

The only phrase that captures the impact of this is ‘economic suicide’.

Gas reservation and export levies now.