The beauty of MB is you don’t have to wait four months for the MSM to tell you the so-called “news” that is four months old. You can track it when it happens.

We have been predicting a new round of retail bill shocks delivered from the AER in March for 2025/26 and the ground is now being prepared.

Average prices for both gas and electricity in the last three months of 2024 were higher than in the same period the previous year, despite new records being set for solar output and minimum electricity demand, the Australian Energy Regulator says.

The price outcomes were largely driven by “significant coal outages” and higher priced wholesale energy offers in the market, along with interconnector limitations, the regulator said.

The data in the AER’s wholesale markets quarterly, released on Thursday, mirror those released also on Thursday by the Australian Energy Market Operator, which showed that the cost of generating electricity across Australia’s grid over the final three months of 2024 increased more than 80 per cent.

…The price increases will feed into the Default Market Offer for electricity prices, with the AER to release a draft determination in March before a final decision in May.

Most analysts expect modest decreases, however the new price data could be a headwind to those anticipated declines.

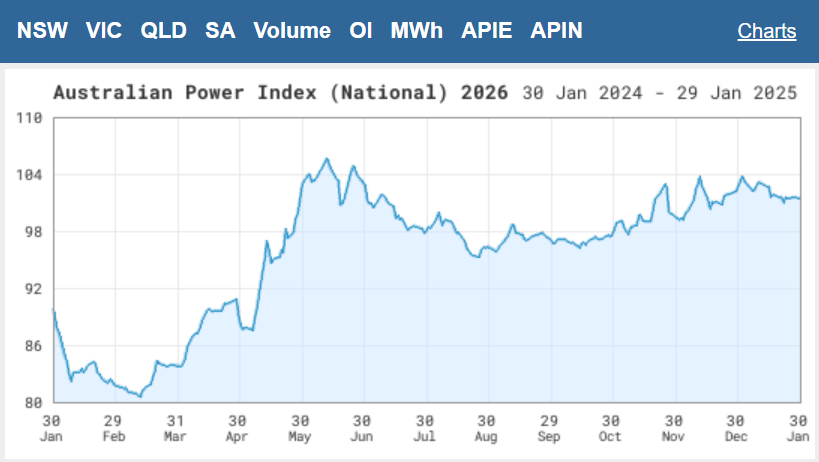

Most analysts are morons. The 12-month moving average for the wholesale electricity price is up roughly 15%. Futures are similar.

AER is going to jack up bills 5-10%.

Let’s not stand on ceremony here. The new round of price shocks is not because there was a shortage of coal. It is because there is a shortage of something to replace coal.

That is, there is a shortage of gas.

And it is going to get worse. Much worse.

LNG imports kick in later this year. This immediately doubles the price of ALL local spot gas as the export cartel will restrict supply until we reach import party prices.

That price is today $25Gj minimum versus $13.50Gj today.

This will equate to another 30% electricity bill shock in 2026/27. Plus huge gas bill hikes.

But wait. There’s more.

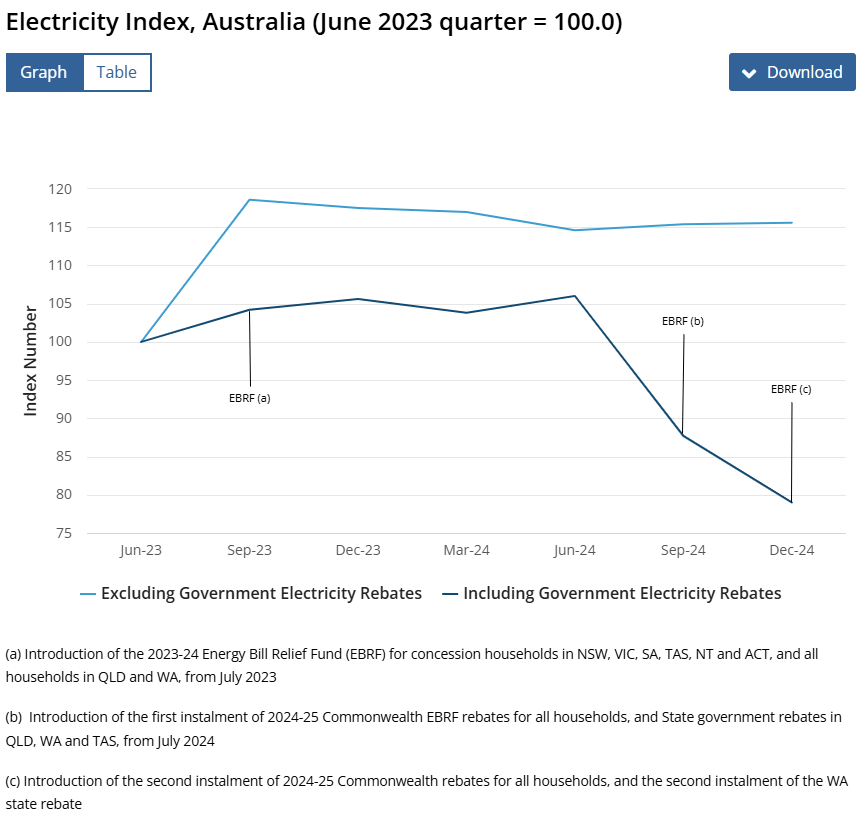

At the moment, you are being protected by energy rebates from the federal government that have dropped your energy costs on average.

Peter Dutton has committed the Coalition to the removal of the rebates. If he wins power, the shock in your power bills will be more like 50-60% in 2026/27.

That will add roughly 5% to the CPI with spillovers and quite possibly drive the economy into recession all by itself as the RBA hikes rates and household budgets are destroyed.

The alternative of voting Labor means more rebates. But that also means the cost will be shifted into your taxes over time.

All of this is to protect a China-beholden, foreign-owned, war-profiteering, lying scumbag, gas export cartel that pays no tax.

How about instead we domestically reserve 15% of QLD’s exported gas and apply an export levy above $7Gj?

This will crush local energy prices instantly, put the entire energy transition back on track, and make us a cool $10bn a year in export levies to boot.

Yeh, nah. She’ll be right.