The Reserve Bank of New Zealand has cut the official cash rate by 1.25% over the past three monetary policy meetings.

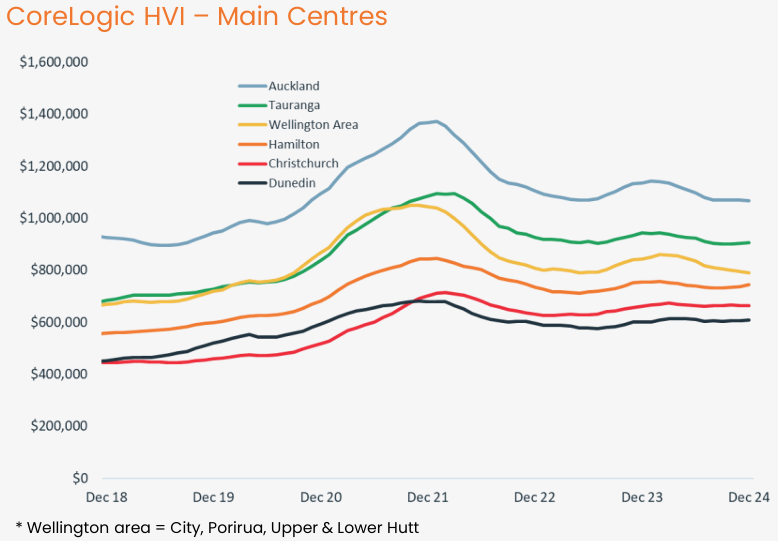

Despite the cuts, CoreLogic reported that New Zealand dwelling values continued to fall in December.

Home values nationally declined by 0.2% in December, marking the ninth drop in the past 10 months, according to CoreLogic.

The national median value was $803,624 in December, down 3.9% annually and equivalent to a $32,200 price reduction.

Home values in New Zealand are 17.6% lower than the post-COVID peak, but 16.2% higher than the pre-COVID level as of March 2020.

“Since the mini-peak back in February, property values have drifted lower at a modest pace, initially reflecting the high level of mortgage rates, but more recently the weakness of the labour market”, CoreLogic NZ Chief Property Economist, Kelvin Davidson said.

“December’s mild drop was simply a continuation of that pattern and sums up the market’s soggy performance in 2024″.

“December’s mild drop was simply a continuation of that pattern and sums up the market’s soggy performance in 2024″, he said.

Davidson added that values appear to be bottoming out, “consistent with the influence of lower mortgage rates, particularly the falls for the internal serviceability test rates at the banks”.

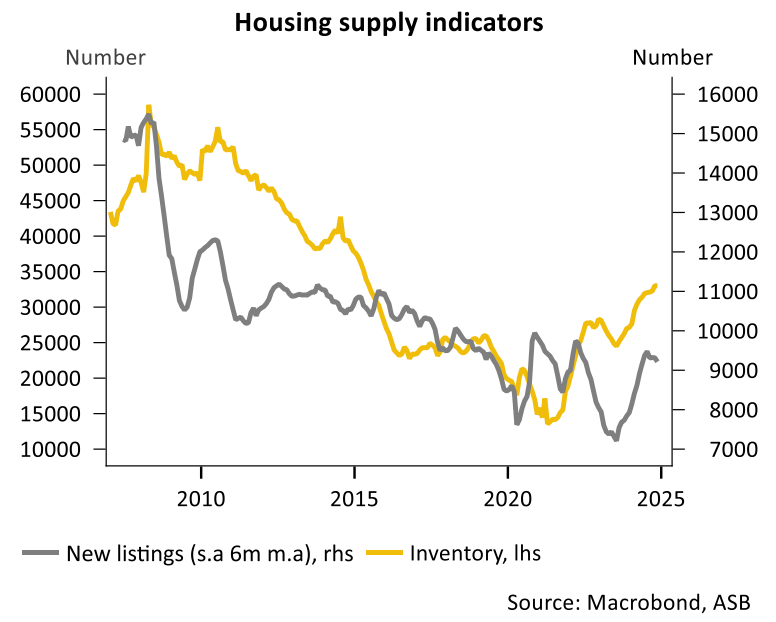

“However, job insecurity will still be playing a restraining role, as is the elevated levels of listings available on the market”.

“These ‘conflicting forces’ may remain a key theme for the property market in 2025 as well, with the effects of lower mortgage rates dampened to some extent by a still-sluggish economy and credit restrictions in the form of debt to income ratios”, Davidson said.

A buildup in for-sale inventory is one of the key factors weighing on prices.

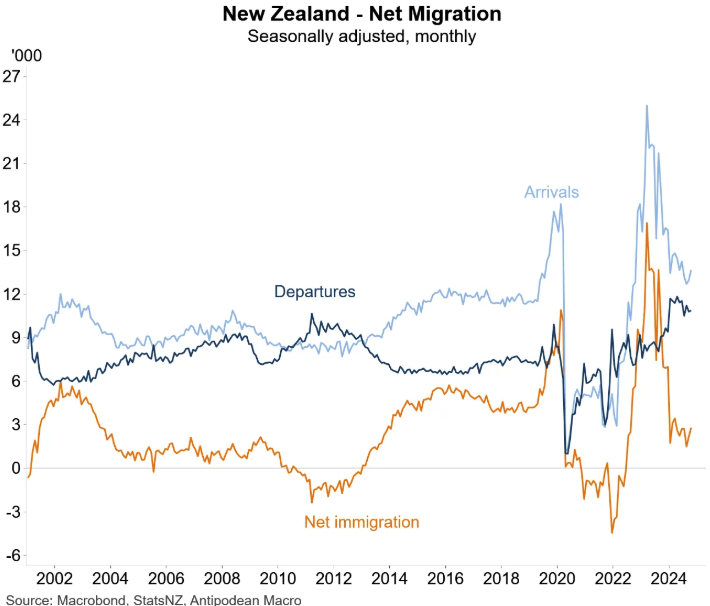

So too is the sharp decline in net overseas migration.

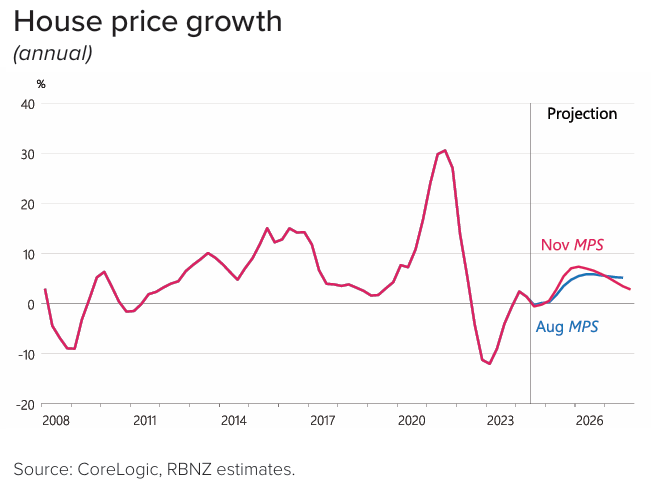

Nevertheless, with further rate cuts anticipated throughout the year, the Reserve Bank has forecast that house prices will rebound by 7.1% in 2025.