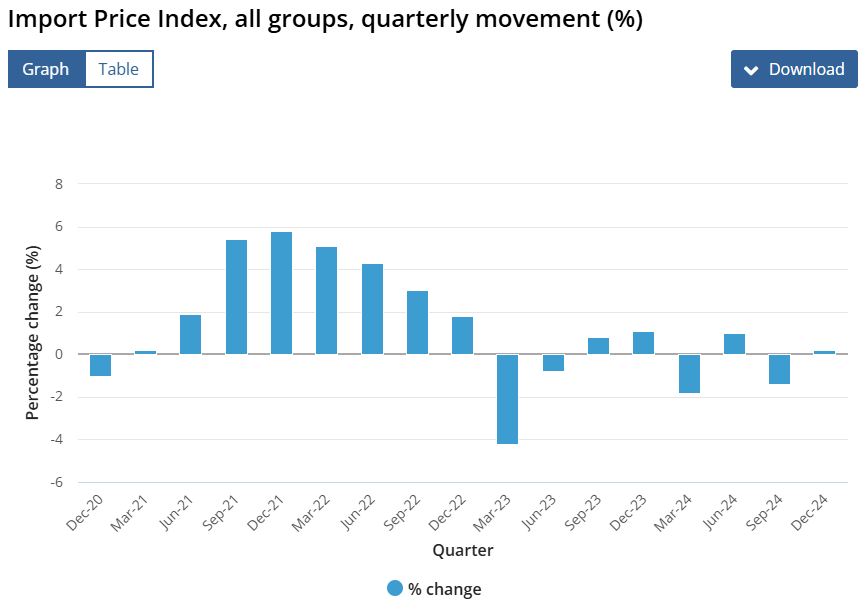

The dollar has been eviscerated. But import prices are going precisely nowhere.

Key statistics

- Export price index rose 3.6% this quarter and fell 8.6% through the year.

- Import price index rose 0.2% this quarter and fell 1.9% through the year.

With the private economy so weak, importers are bringing in falling international prices for goods, and absorbing the lower AUD in shrinking margins.

I cannot see how a tariff war between China and the US will change this as Chinese goods flood alternative markets.

However, the major contributor to import price falls was oil.

Now, imagine what happens if we launch LNG imports that not only cancel this out but also add massive gas import inflation tipped directly into your utility bills. Or taxes to hide it.

Utter madness.