The ANZ is getting dovish.

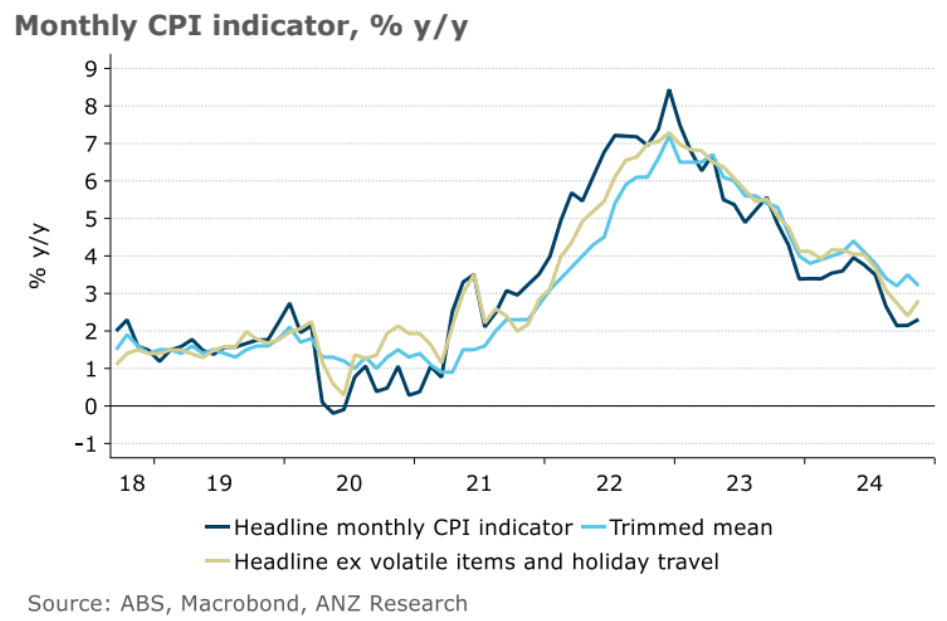

The November monthly CPI indicator points to downside risk to our and the RBA’s Q4 trimmed mean CPI forecasts (both 0.7% q/q and 3.4% y/y).

This raises the probability of a February rate cut, although the resilience in the labour market (noted in the RBA’s December minutes from 24 December) will be a key consideration.

The 4.2% q/q rise in Q4 job vacancies (also released today) suggests momentum in labour demand may be picking up again, adding to this resilience.

If the major impediment to a rate cut in February is a strong jobs market then get on with it.

The strength is all low-paid bullshit jobs for migrants.

As a consequence, wage growth is plummeting.

There is zero risk of wage-push inflation with Albo’s Indian army pouring through the gap he tore in the border with that nation. As the RBA noted in the minutes.

A second consideration was developments in wages growth, which had slowed by more than expected. Members discussed whether this could signal that potential labour supply was more abundant than had been assumed. They noted that it was possible for wages growth to slow even when employment was above its full employment level, so long as the labour market was moving towards better balance and inflation expectations remained anchored. They also discussed the possibility that the slowing was in response to earlier weakness in productivity growth, noting that growth in unit labour costs had also declined from its previously rapid rate.

So now weak productivity is constraining wages? Make up your damn mind.

As it has been since 2013, when immigration-led labour-market growth supplanted capital investment growth as the Australian economic model, a permanent labour supply shock hard caps wage growth.

We will never run out of workers in this growth model, at least not until India runs out 1.4bn untouchables.

And then we’ll move on to Africa.