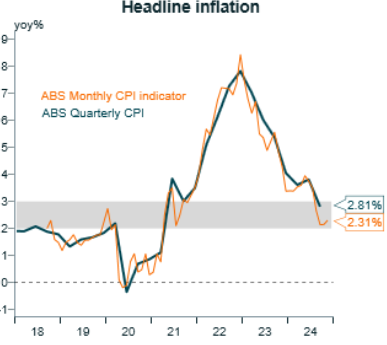

The Australian Bureau of Statistics (ABS) has released the monthly inflation gauge for November, which recorded headline CPI inflation of 2.3% year-on-year, slightly above expectations of a 2.2% rise.

Chart by Alex Joiner (IFM Investors)

ABS head of prices statistics, Michelle Marquardt, noted:

“Annual CPI inflation has risen since last month, in part due to the timing of electricity rebates. In some states and territories, households received two rebate payments in October in lieu of not receiving a payment in July”.

“From November, most households received one payment. As a result, electricity prices fell 21.5% in the 12 months to November, compared to a fall of 35.6% to October”.

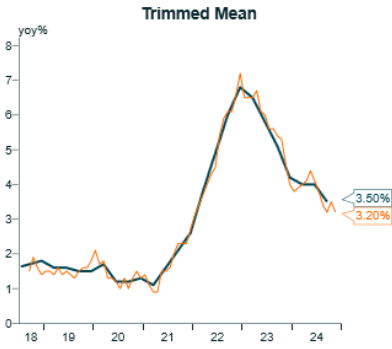

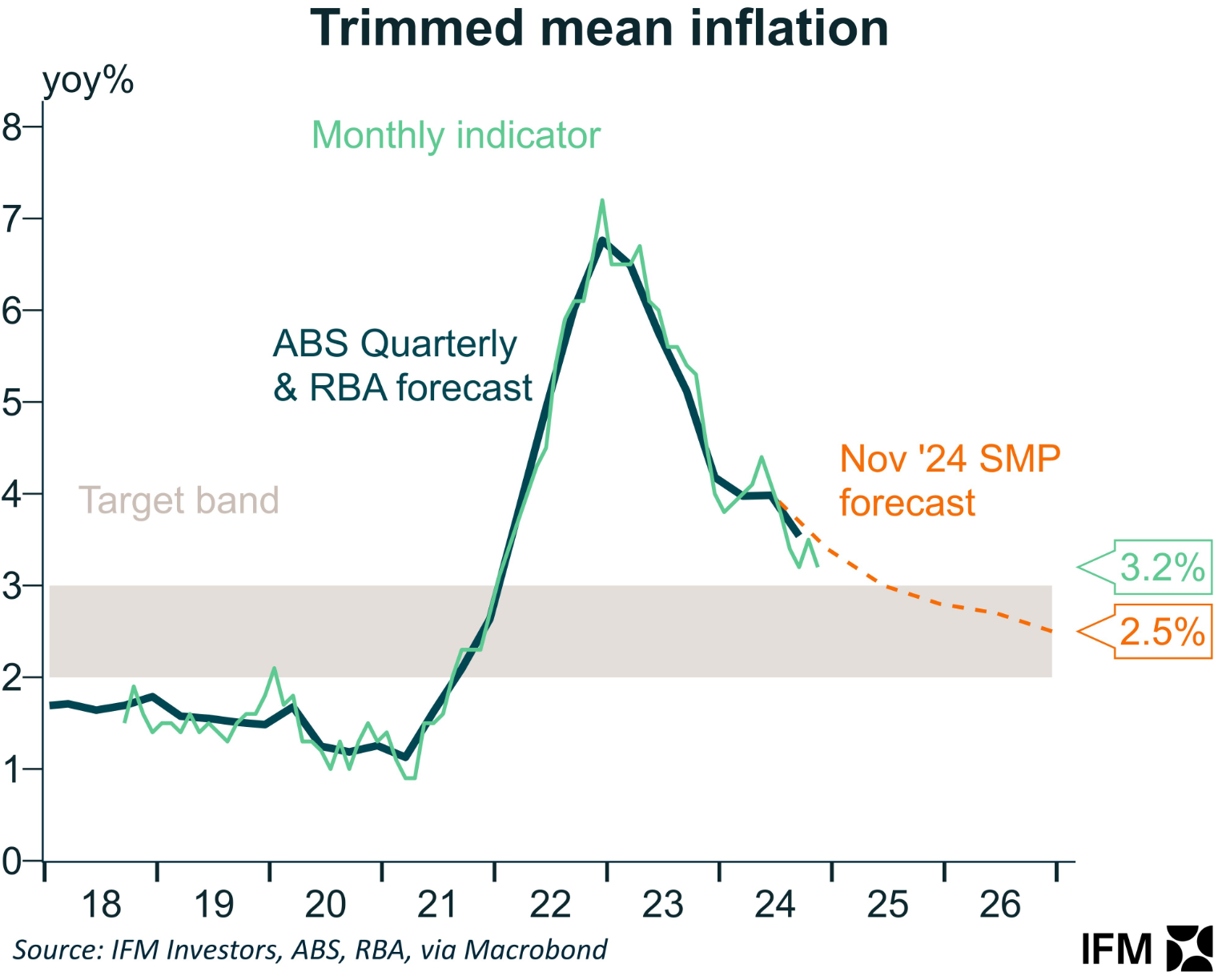

The news was better regarding underlying (trimmed mean) inflation, which fell to 3.2%, down from 3.5% in October.

Chart by Alex Joiner (IFM Investors)

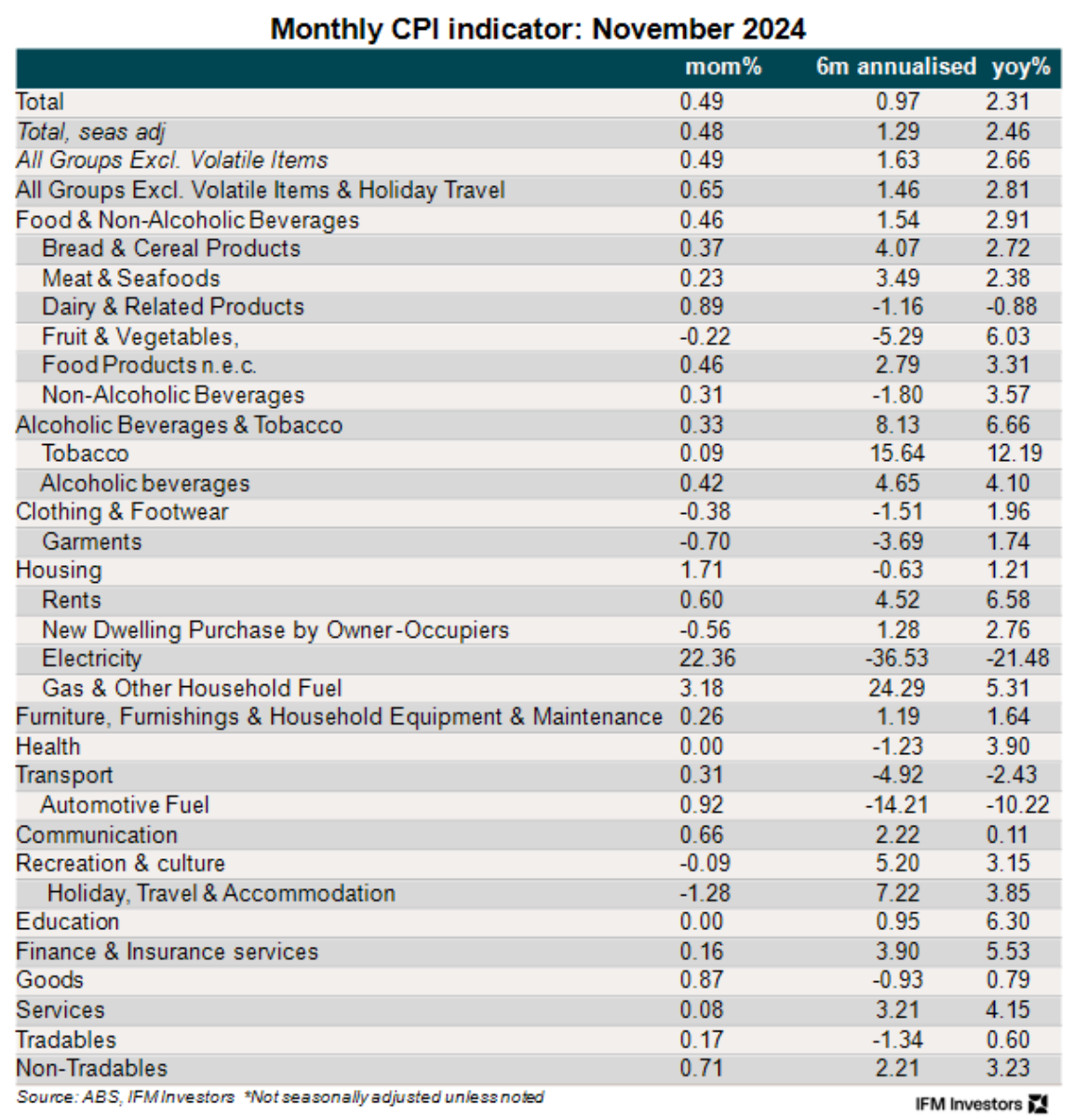

The following table from Alex Joiner at IFM Investors breaks down inflation by component.

The most interesting data tidbit is that energy rebates drove a 36.5% decline in electricity prices on a 6-month annualised basis, whereas gas prices soared by 24.3% over the same period.

The following chart from Joiner plots trimmed mean inflation against the RBA’s forecasts.

“On the face of it today’s CPI is continued progress for the RBA”, Joiner noted via Twitter (X).

“Yes, the the quarterly release is still key to a February move (with all the trimmed mean concern taken into account)”.

“We only need to see data print in line with the Bank’s forecasts to see it start seriously considering a cut”, Joiner wrote.

A Q4 trimmed mean print of 0.7% or below could see the RBA cutting rates in February.

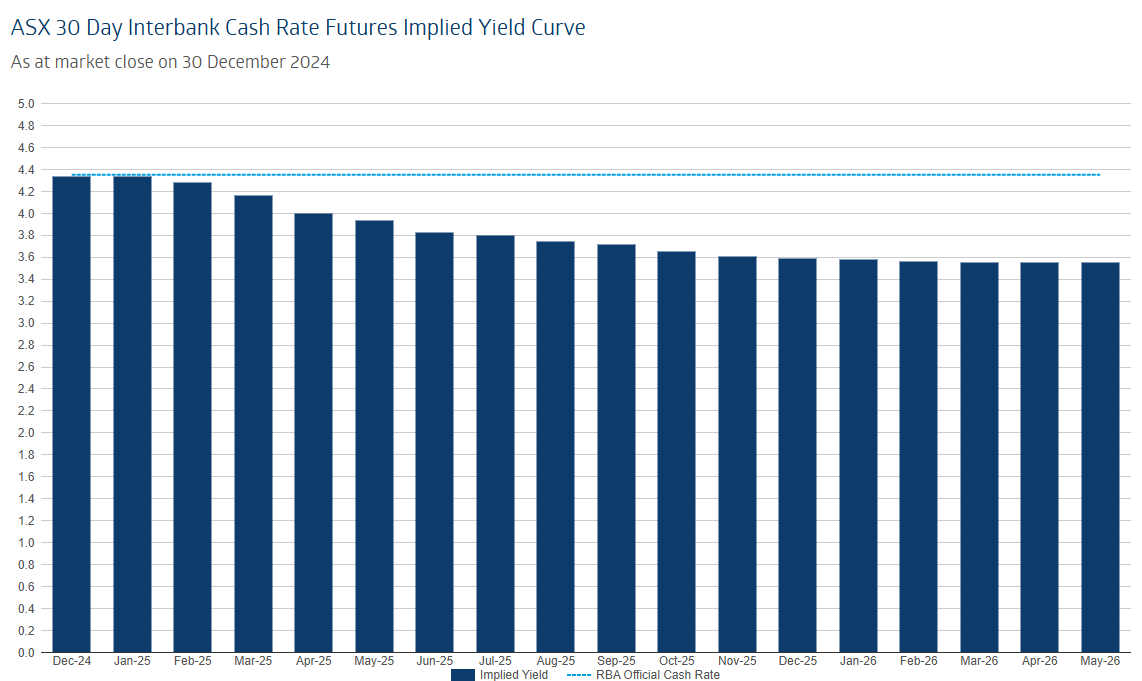

For what it is worth, futures markets are still favouring an April rate cut.