ANZ with the details.

The global gas market showed tentative signs of recovery last year following recent supply side shocks.

However, the market remains finely balanced.

We see a few key issues dictating the market in 2025.

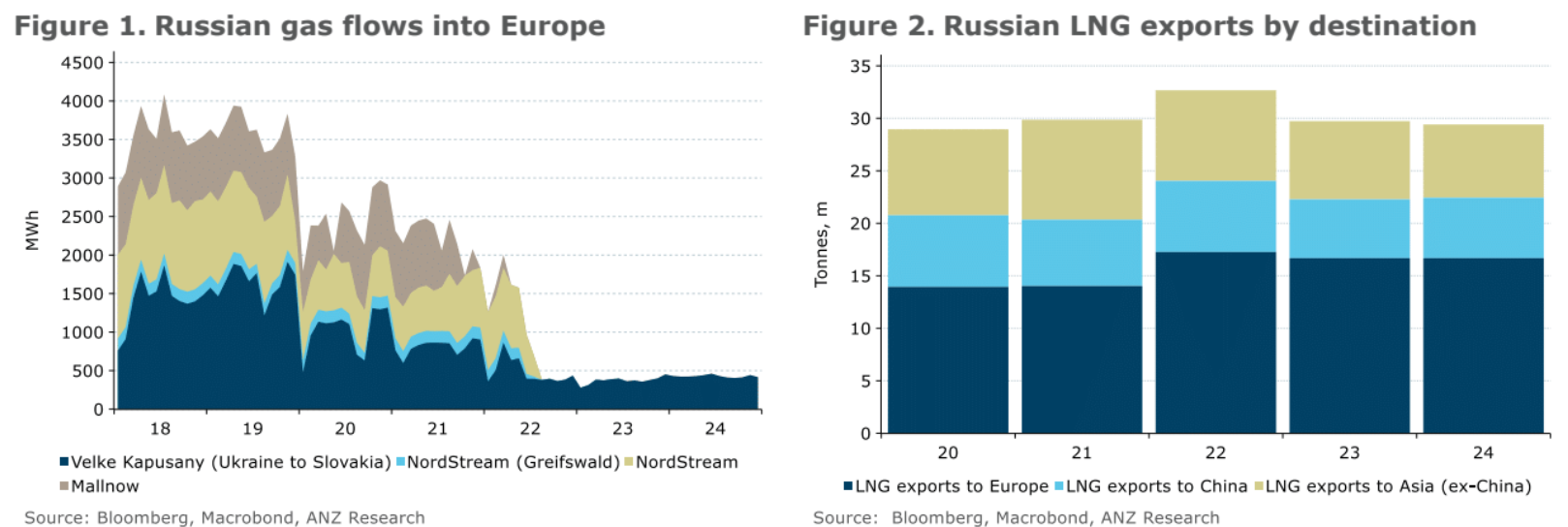

Geopolitical issues are likely to dominate global gas markets this year, particularly Russia’s role as a gas and LNG supplier.

New US sanctions on Russia’s energy industry are likely to have a significant impact.

Europe is at the same time becoming more reliant on the global LNG market, pitting it against hungry Asian buyers.

Renewable power, particularly wind, is increasingly interlinked with gas.

Periods of low wind power generation have resulted in surges in demand for gas.

And wind increasing in variability, forcing many countries to build up gas stocks to ensure supply to meet power demand when wind fails.

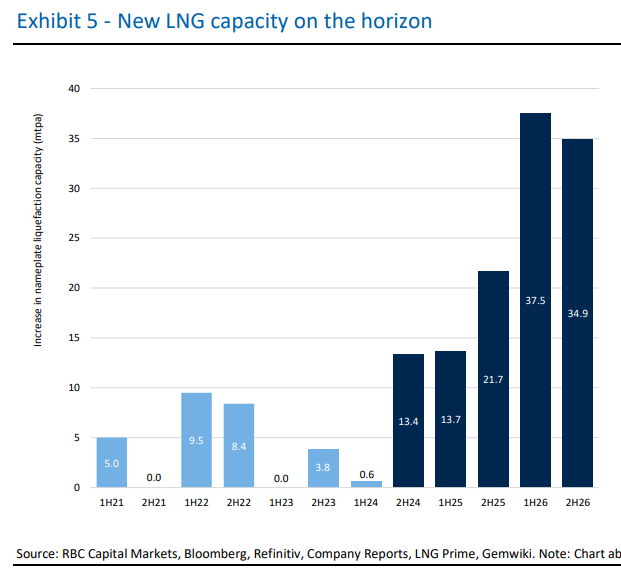

We expect another year of supply side issues in the LNG market.

Our base case for 2025, based on new projects mostly in North America coming online, is for supply growth of 4%.

This target could easily be missed, with a tight US market creating bottlenecks for feed-gas to these new projects.

Overall, we see ongoing upward pressure on global gas prices this year.

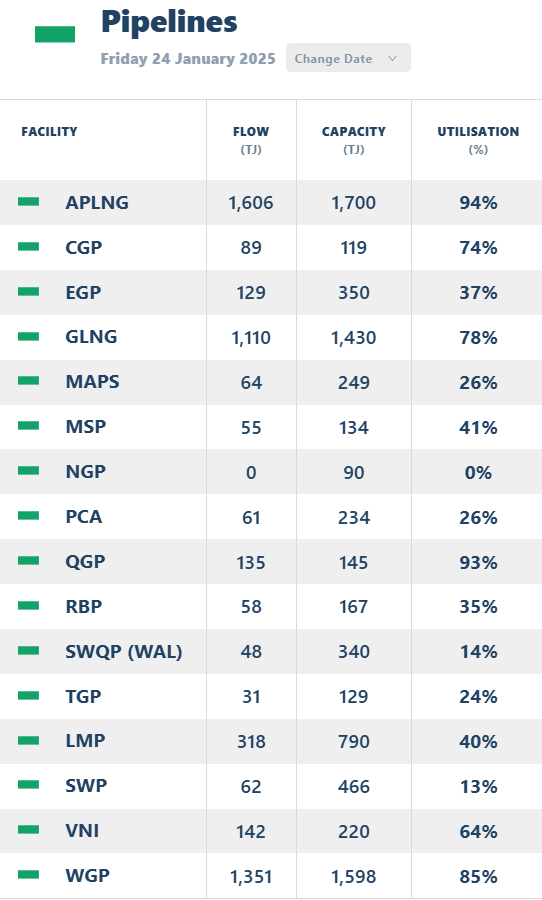

Why are countries with no gas busy building up stockpiles to cope with renewable intermittency when a country like Australia that is swimming in gas is exporting it all to China while building up zero inventory to cope with its own seasonal fluctuations?

Why aren’t major southern storages being built to store domestically reserved QLD in the off-season when pipelines south are empty?

This is beyond retarded. It’s straight-up economic suicide.

Australia is planning, if you call it that, to launch LNG exports directly into a global shortage of gas.

The moment this gas filters into the local network, it will become the marginal price setter of all local gas supply. Prices will double at today’s Asian prices.

This will deliver roughly a 4% CPI shock unless offset by billions more in rebates, just as the budget comes under intensifying pressure from the looming iron ore price rout.

Even looking on the bright side, that there is a lot more gas coming through to 2028, is terrifying.

Much of it has already been delayed and will be again. Even when it arrives, Aussie gas prices won’t fall below today’s $14Gj according to Asian gas futures.

The risk in gas exports is asymmetric all the wrong way.

Domestic reservation and export levies now!