Interest rates and house prices lower together? Wouldn’t that rock the foundations of Aussie entitlement?

It’s not inconceivable.

The current affordability is unprecedented after Albo’s economic demolition.

Core Logic with more.

Interest rates might be cut in early 2025 as inflation continues to drop, with annual core inflation falling to 3.2% in November (below the RBA forecast of 3.4% for December). Two of the big 4 banks are currently expecting a rate cut in February.

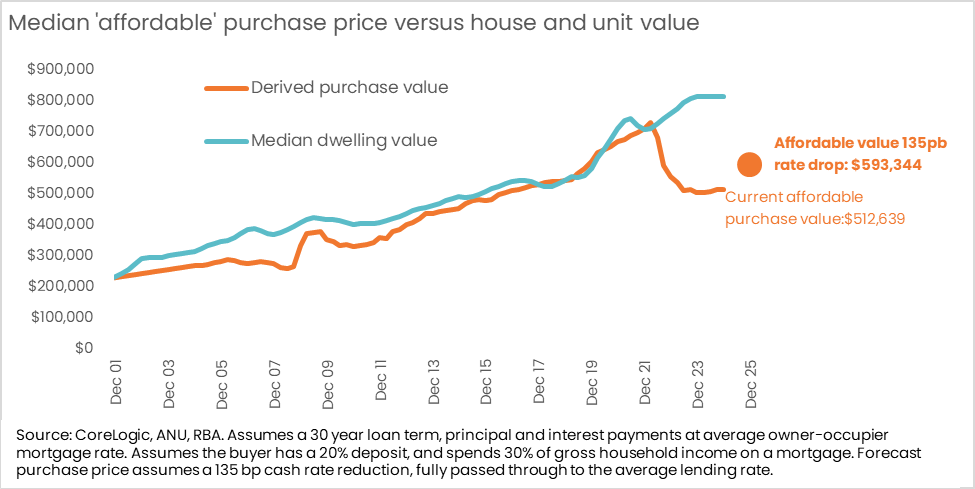

The industry should brace for the possibility that rate reductions may have little effect on home values and transaction activity this year. Even if the average mortgage rate drops by 135 basis points (the lower-bound of forecasts for the cash rate at the end of 2025), a median-income household could reasonably afford a $593,000 home — still much lower than the current median home value of $815,000. A rate of 3.1% by the end of 2025 is also higher than the pre-COVID, decade average (2.55%) that supported strong lending volumes in the 2010s.

A potential window into how Australians would respond to higher borrowing capacity is the Stage 3 tax cuts from 2024. While this would have boosted borrowing capacity through higher net income, the housing market saw an anaemic response, with growth in values slowing from June 2024.

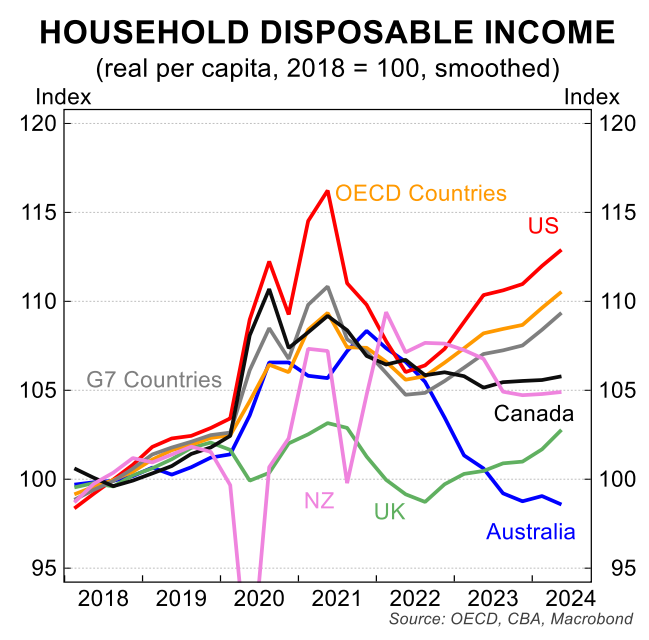

The chart uses gross household income so that the affordability jaws may be even wider given Albo’s annihilation of net disposable income via inflation blundering in immigration and energy.

There are other reasons to be sceptical of a sudden boom in house prices.

Although immigration is still strong, Albo’s Indian inundation is much lower rent for property than previous surges of cashed-up and real estate-hungry Chinese.

This may be why it has had a much stronger impact on rents than capital values.

There is also the ongoing income crunch as the Indian inundation kills wages. Modest real wage gains are the best anybody can hope for.

It is certainly the case that the housing supply side is a disaster and could help prevent price falls.

However, it makes sense that more than the usual amount of monetary easing will be needed to lift house prices from here.

Not least because the looming iron ore shock will smash national income all over again.

Australia’s neutral interest rate is much lower than most people think.