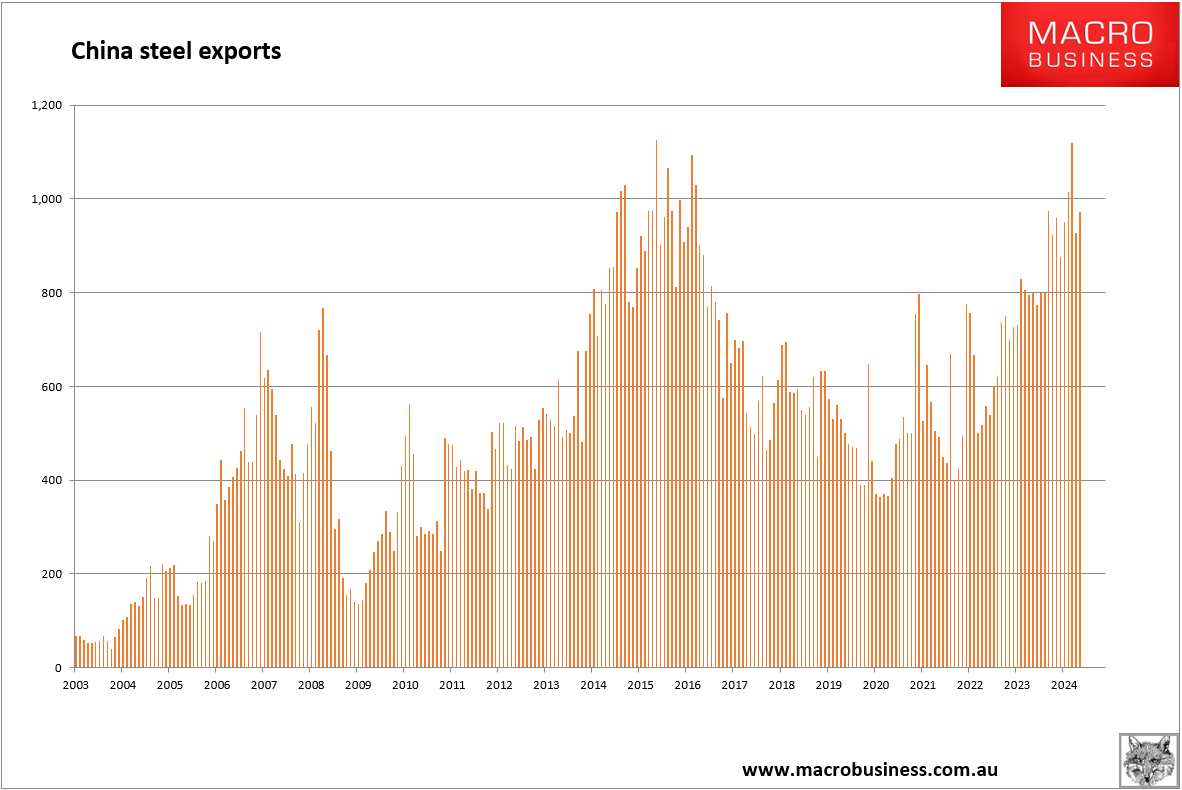

Chinese December steel exports continued their strong run at 9.7mt, up 26% year on year, driven in part by tariff frontrunning.

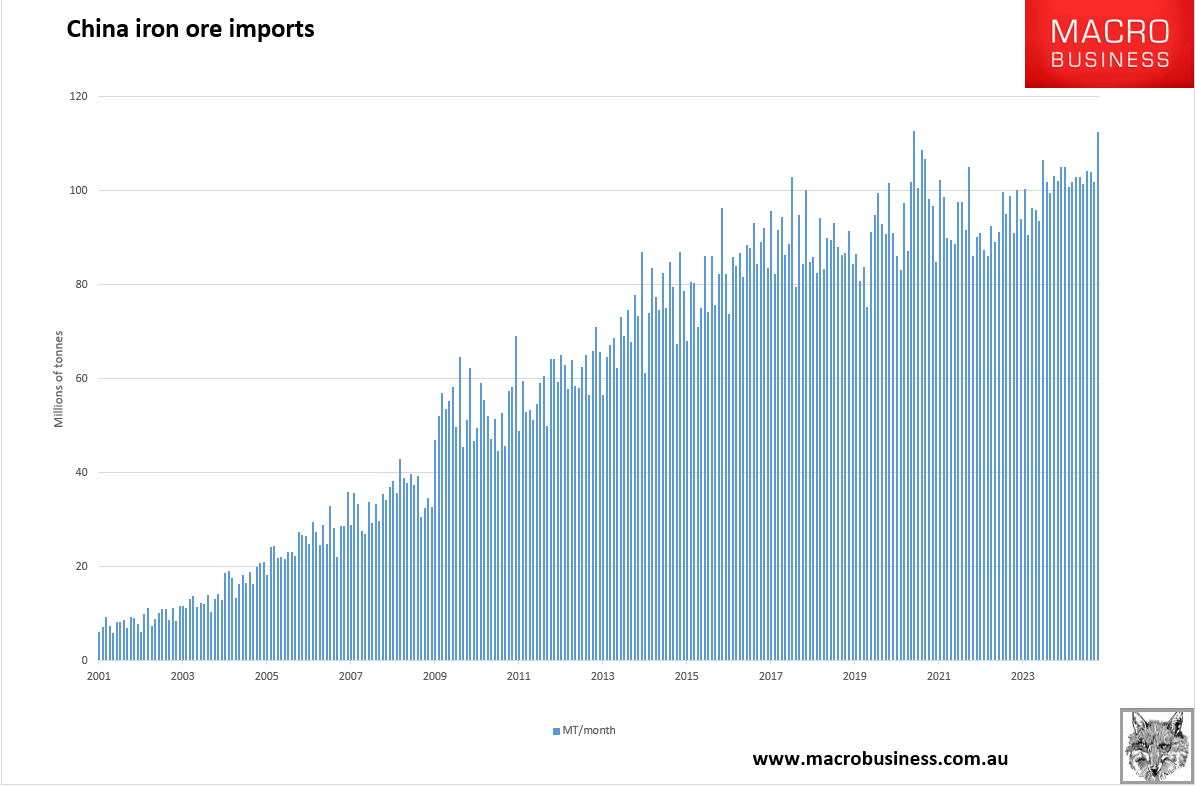

That paled next to iron ore imports, which went within a whisker of a record at 12.49mt.

Advertisement

On the day, the import numbers were enough to excite markets, which lifted both steel and iron ore futures.

However, it doesn’t bode well in my book.

Advertisement

We can expect portside stocks to rise in China through January, pressuring prices.

I also anticipate an air pocket for Chinese exports demand whenever tariffs come to bear.

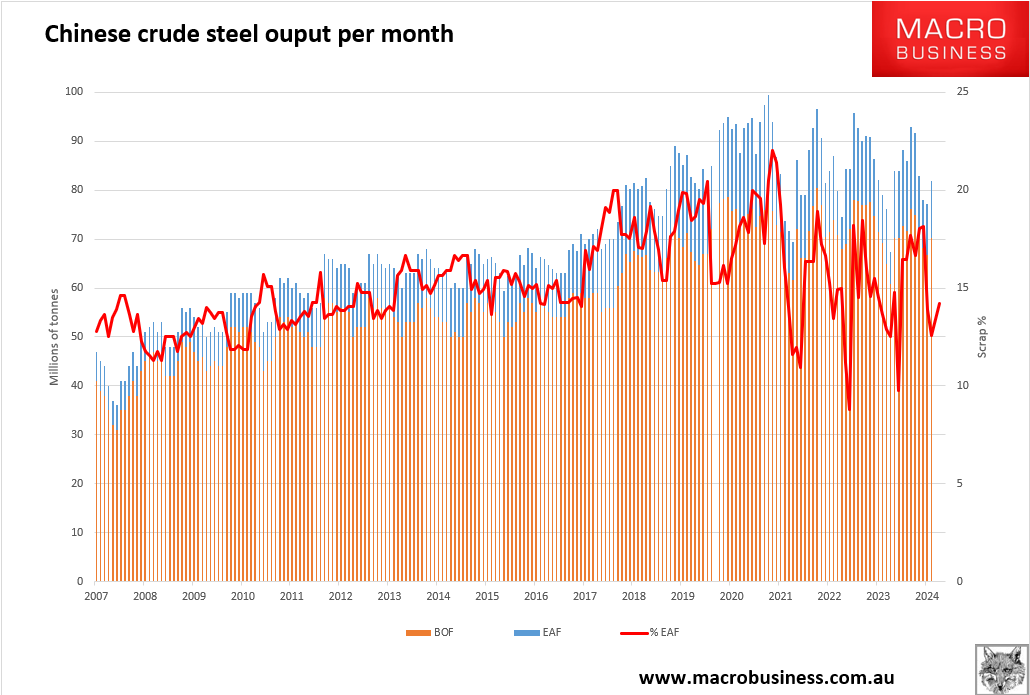

As an aside, if you are wondering why steel output can fall 2.7% in 2024 yet iron ore imports rise up 4.9% to a record then falling scrap production is your answer.

Advertisement

Chinse steel decarbonisation is in full reverse!