The iron ore price has lifted in recent days with support from Pilbvara disruptions and daily declarations for yawnulus in China.

Steel has firmed a little, but, as usual, iron ore is pricing itself out first.

But, the year ahead still shapes badly.

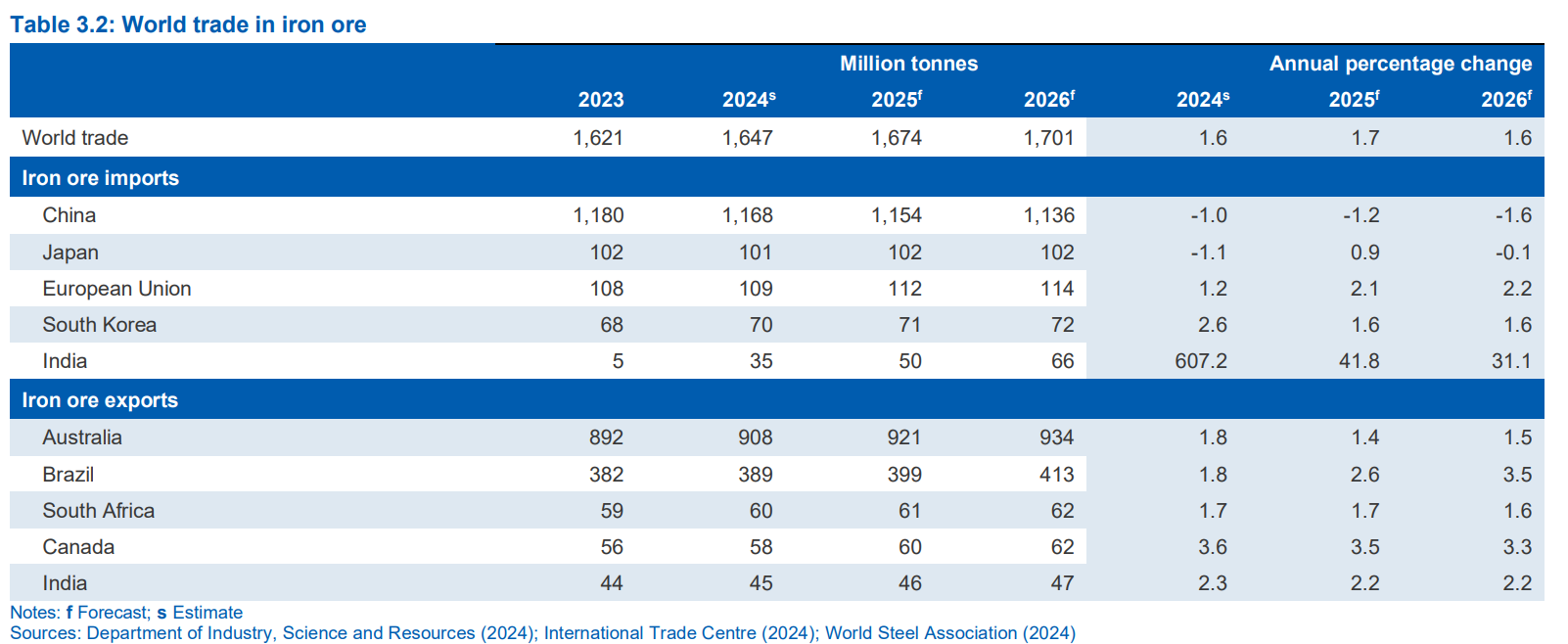

Chinese steel demand is likely to fall another 2-3% under pressure from realty and tariffs and there is only so long it can keep running down recycling as an offset.

On the supply side, Brazilian iron ore is on a charge.

Brazil’s iron ore exports have surged to levels not seen since before the 2019 Brumadinho dam disaster. The country shipped 389.1 million tonnes of iron ore in 2024, nearly matching the 389.8 million tonnes exported in 2018.

The growth will continue this year, and even more so in Australia.

The Pilbara killer Simndou rail corridor opens before year-end, beginning a ramp-up of 120mt of iron ore output over two years. But up to double that eventually as majors and third parties pile in.

Recent metallurgical testwork at Simandou North, in Guinea, has confirmed the potential for premium-quality iron-ore, with grades surpassing 66% iron and alumina levels below 0.5%, Arrow Minerals has reported.

“For some time, the market has been experiencing a decline in the supply of low alumina product to the steelmaking industry. The Simandou North mineralisation is inherently low in alumina, which is a bonus for the project. This testwork has once again demonstrated that a simple gravity separation process is highly effective in getting rid of the silica and producing a very high iron grade product with very low alumina content,” he stated.

The iron ore everywhere scenario is not priced at $100!