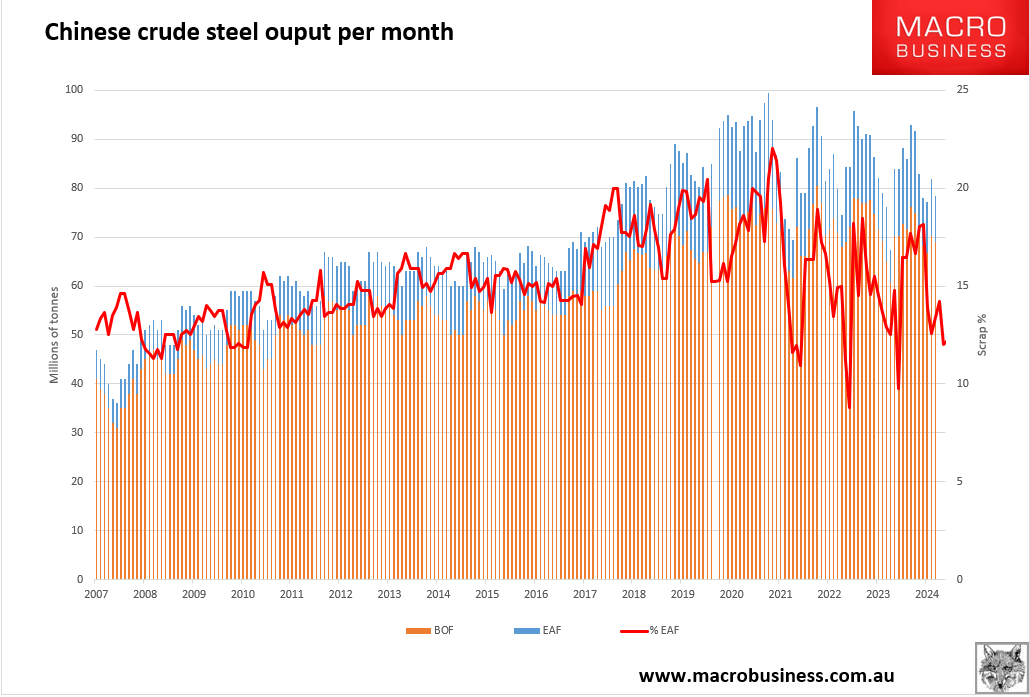

It is amusing to watch, in the usual dark way, how China keeps promising to decarbonise steel while in actuality pumping ever more carbon.

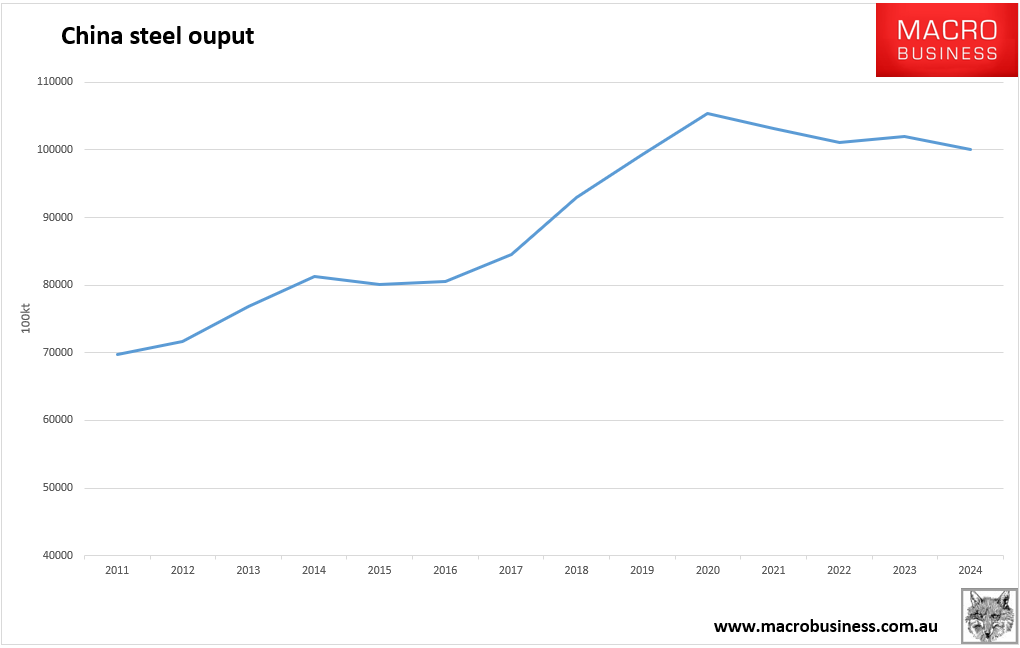

December data from the NBS showed steel output slowed into year end, with annual production falling 1.7% to 1.005bn tonnes. Down roughly 50mt from the peak.

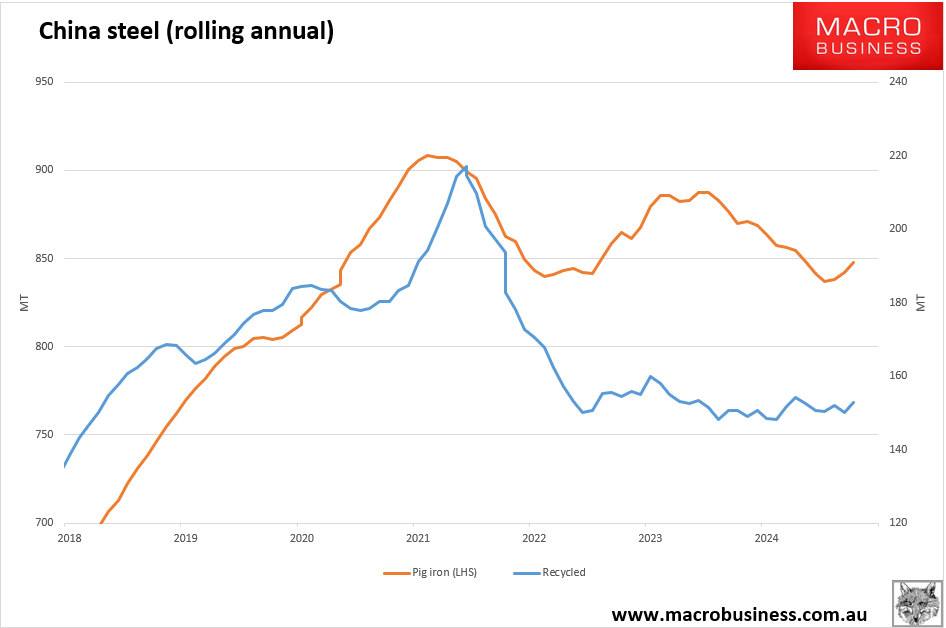

The slump would have been far worse for iron ore had steel recycling not taken the brunt of it.

The recycling ratio continues to shrink, contrary to all Five Year Plans.

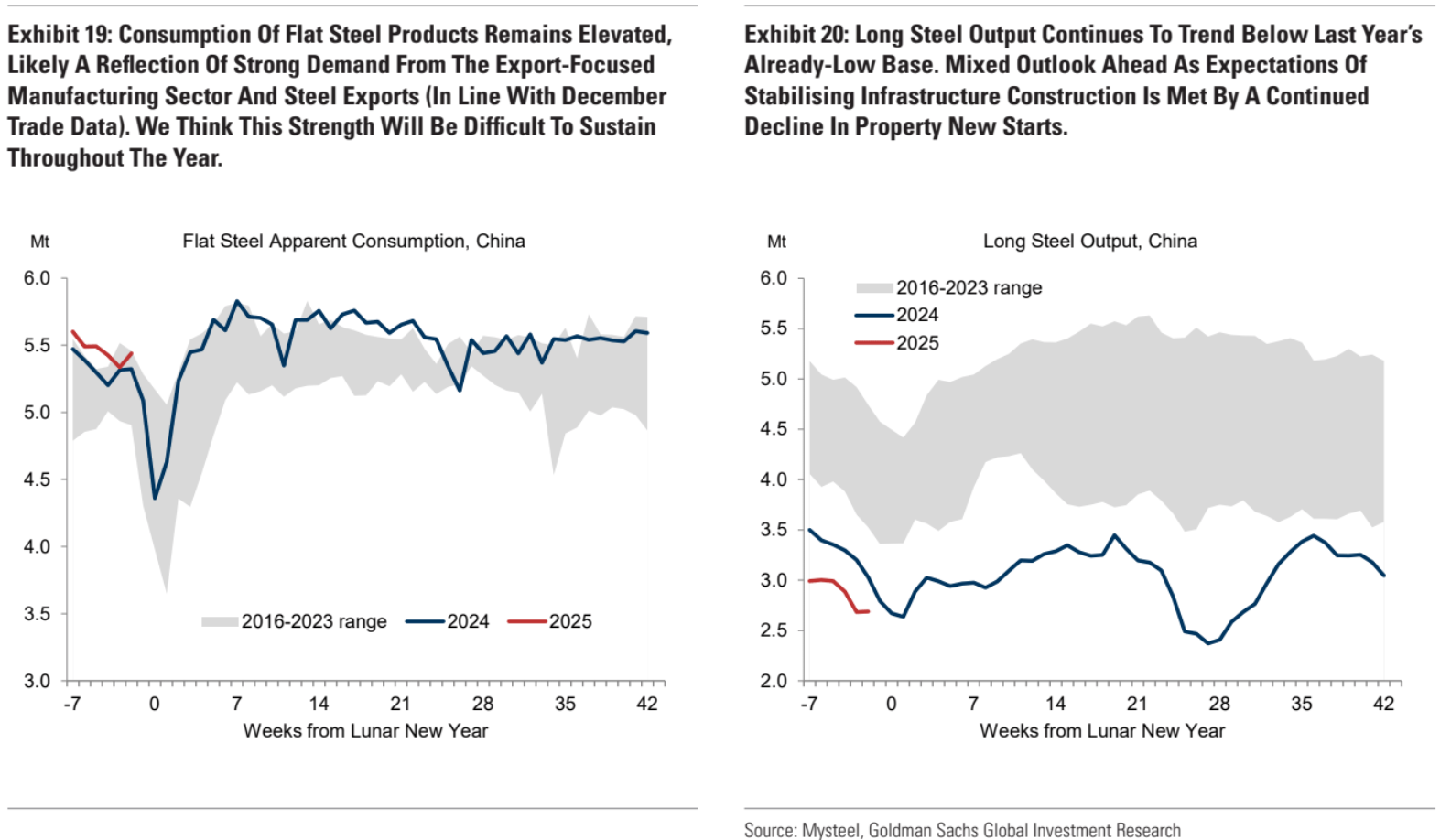

Partly this is a function of long steel for construction collapsing while flat steel for manufacturing holds up.

However, with tariffs looming, flat steel is in the gun even as long keeps falling.

On the supply side, 2024 was strong while 2025 will be stronger.

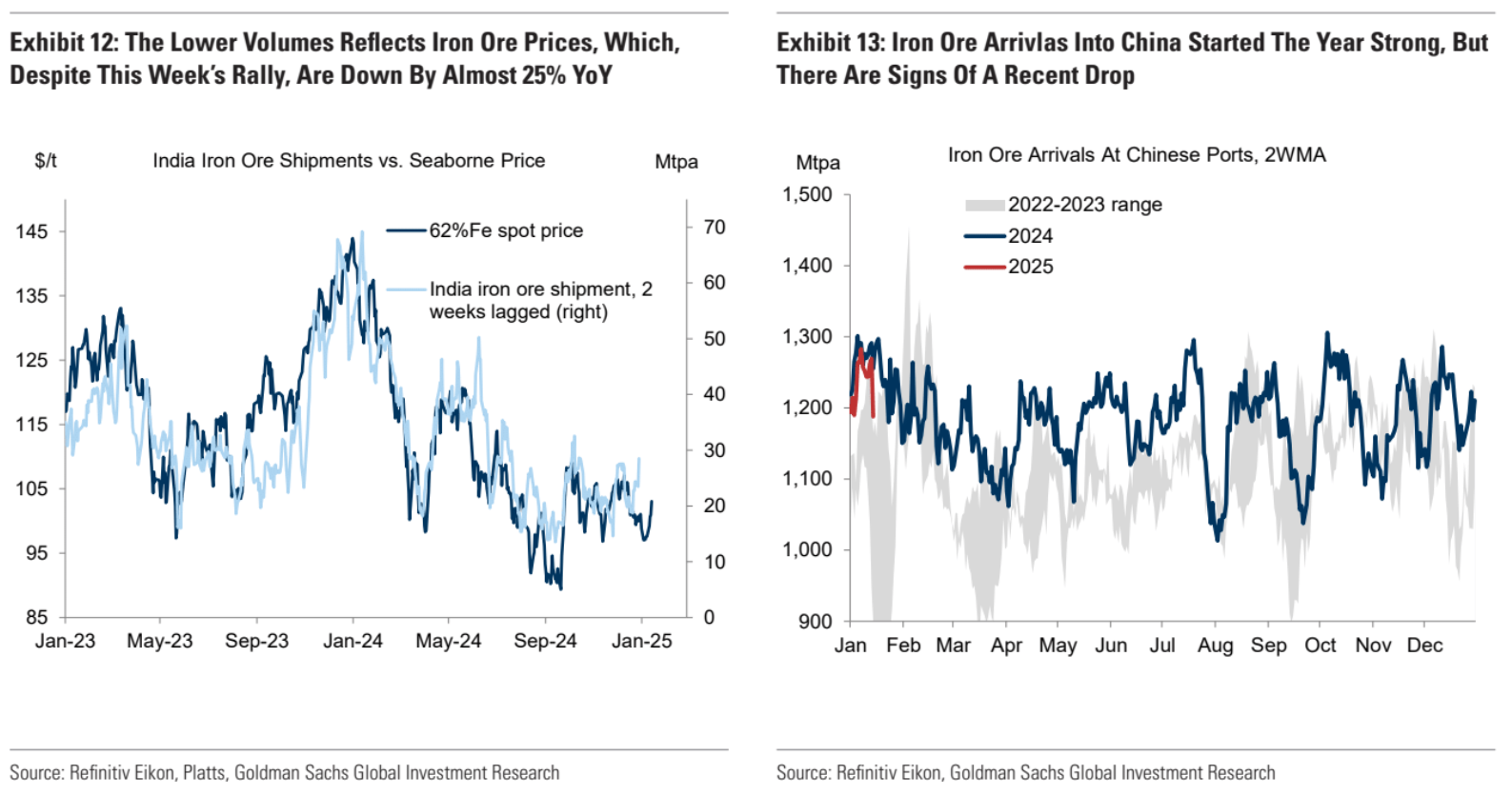

Indian iron ore is the swing producer for the moment, but at 20-30mt it is not enough to balance another 2% fall in steel production plus 50mt of new supply.

Goldman sees rising iron ore port stocks as an offer, but why? They are already at records. I see lower prices and curtailed production instead.

Iron ore in the $80s before long is the call. Much lower next year as the Pilbara killer begins.