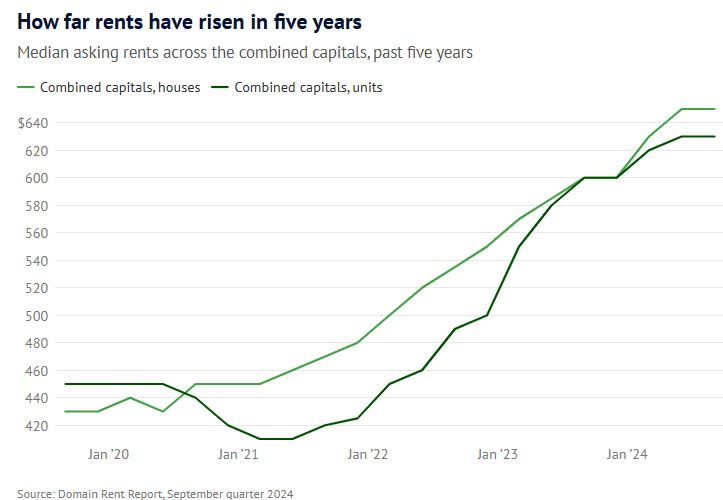

Australian tenants have just endured the worst rental inflation in history, with asking rents soaring by more than 40% since the pandemic.

According to Domain, median house rents soared by $220, or 51%, from $430 to $650 between December 2019 and September 2024.

Median unit rents rose by $180 or 40%, over the same period, from $450 to $630.

ABC Journalist David Taylor reported on Twitter (X) that investment bank JP Morgan expects that ongoing strong population growth via net overseas migration will put further upward pressure on rents.

“The combination of strong population growth and weak residential construction activity suggests Australia’s dwelling supply challenges are likely to persist, which in our view will continue to exert upward pressure on residential rents”, JP Morgan reportedly said.

In a similar vein, BIS Oxford Economics head of macroeconomic forecasting, Sean Langcake, recently warned that Australia’s rental crisis would persist because population demand would continue to exceed supply.

“It’s more likely that the odd market comes off, but generally demand remains high with steady population growth, while government housing targets feel very aspirational”, he said.

“It’s hard to see rents falling back in a very big way. I think it’s more a question of how quickly are they going to go up, rather than when are they going to go down”.

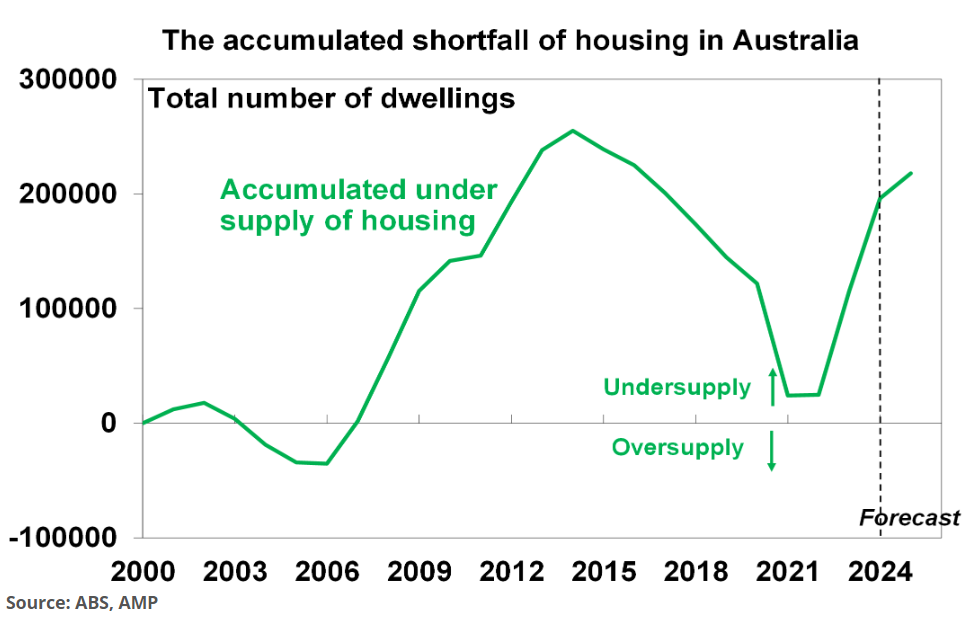

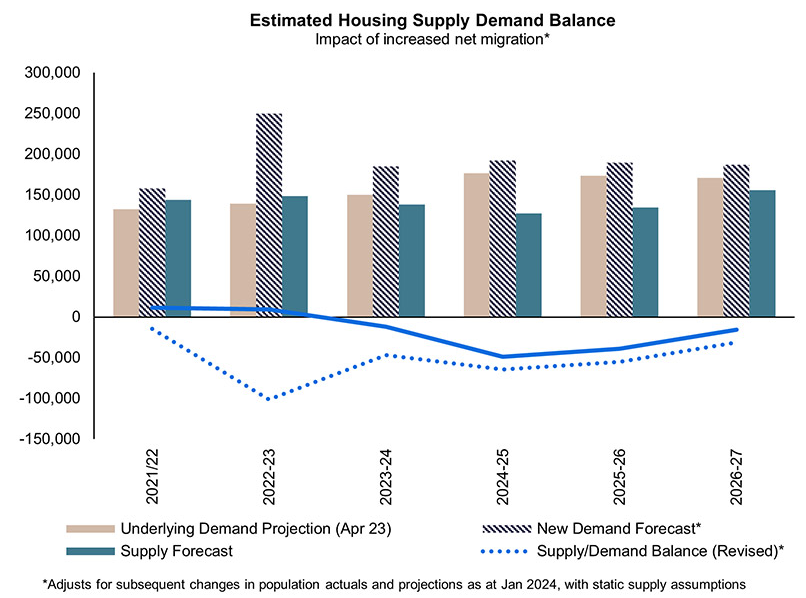

Housing Australia (formerly NHFIC) also recently upgraded their forecast supply gap from 115,600 units by 2027 to 197,847 based on higher expected population growth.

Source: Housing Australia (2023)

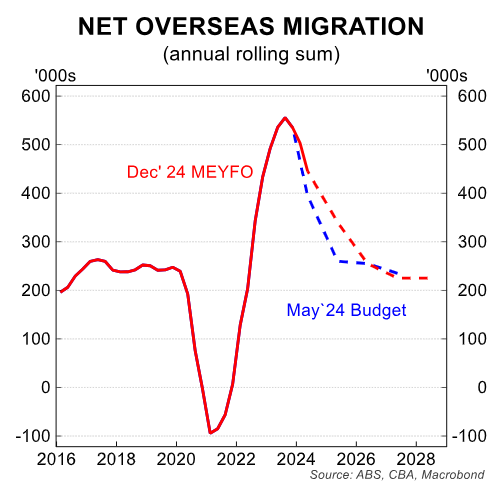

Since the above forecast by Housing Australia was released, the federal government’s December MYEFO revised net overseas migration upwards to 340,000 in 2024-25, up from 260,000, meaning the housing shortfall will likely be higher.

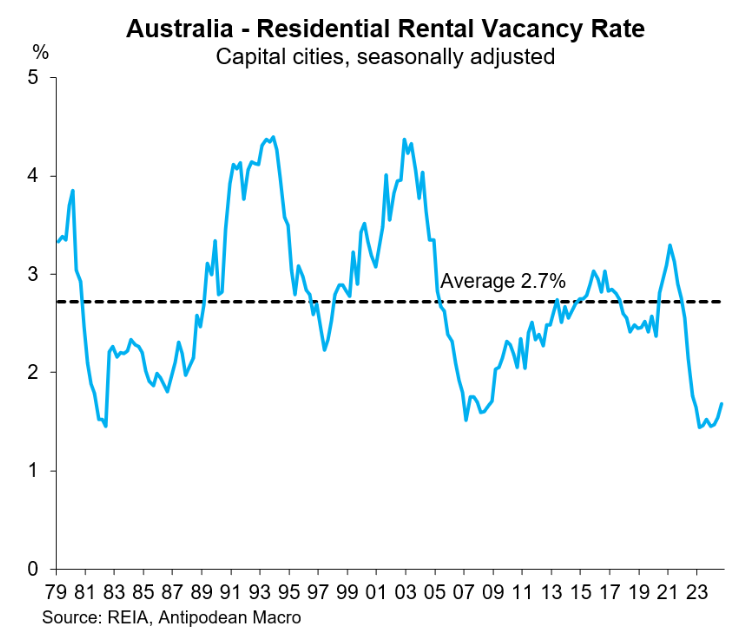

“Australia is currently grappling with a severe housing crisis, caused by a significant imbalance between demand and supply”, JLL reported in August 2024.

“It is characterised by low rental vacancy, rising homelessness, surging rents and dwelling prices. This is a persistent housing crisis that is unlikely to be resolved in the short-term”.

“The country has experienced record high net overseas arrivals… This influx of people, including the return of international students and skilled migrants, is creating substantial pressure on the housing market and has caused the demand to exceed the current rate of housing construction”…

“The combination of labour shortages, rising construction costs, and industry insolvencies has created a perfect storm, which has severely hampered Australia’s housing market increased supply”.

“As a result, housing completions remain well below pre-pandemic levels, despite the urgent need for more housing. This situation is likely to persist in the short to medium term”, JLL said.

The reality is that Australian tenants will continue to suffer so long as the federal government continues to import large volumes of renters from overseas.

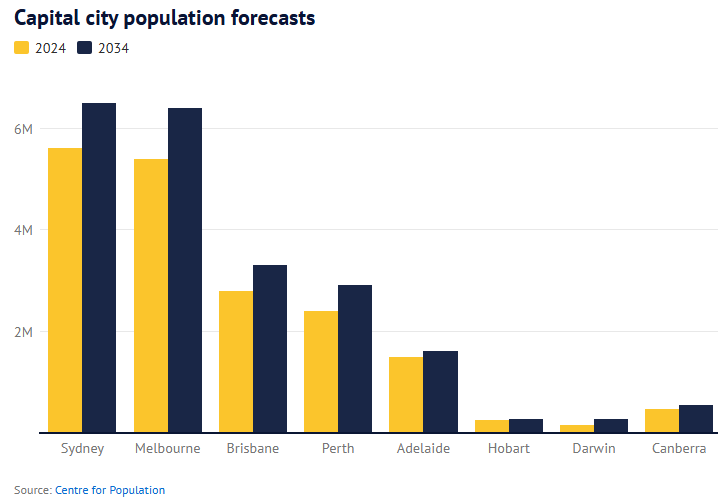

The Centre for Population last month forecast 410,000 annual population growth over the next ten years—roughly equalivalent to growing by a Canberra every year—ensuring that population demand would forever outstrip supply.

Melbourne’s population is projected to balloon by one million people over the coming decade, Sydney’s by 900,000 people, whereas Brisbane’s and Perth’s populations are projected to swell by 500,000 apiece.

As a result, Australia’s housing shortage will inevitably grow, punishing renters.