The median forecast of 36 economists polled by The Australian Financial Review is that the Reserve Bank of Australia (RBA) will begin reducing the cash rate at its board meeting on 19-20 May.

This is several days after the last possible date for a federal election.

Financial markets are a little more optimistic, tipping rate cuts at the 1 April meeting.

Interest rate futures tip an April rate cut.

Betashares’ chief economist David Bassanese says inflation data for the December quarter—to be released in late January—will be crucial to the timing of a rate cut.

“It will need to at least match the RBA’s current expectation of 3.4% annual trimmed mean inflation [for 2024] but that might not be enough to get a rate cut in February over the line, given the ongoing apparent strength in the labour market”, he said.

Meanwhile, Katrina Ell from Moody’s says the strength of the labour market is keeping the central bank from easing monetary policy, with the official unemployment rate falling to 3.9% in November.

The Albanese government will be praying for rate cuts before the upcoming election.

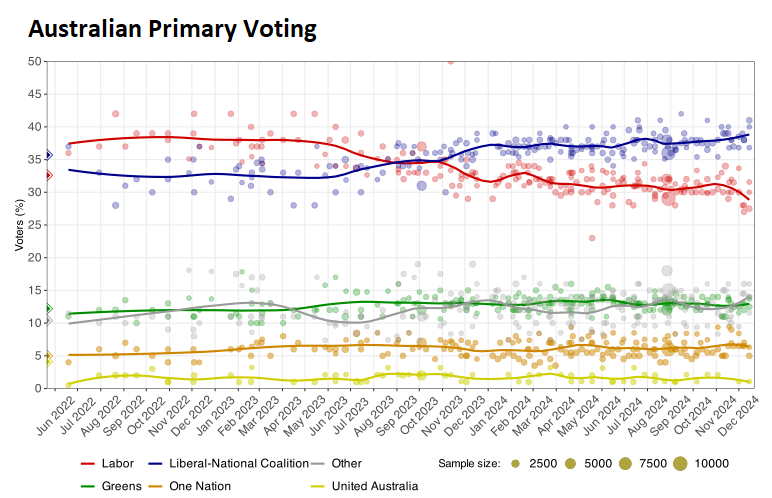

As illustrated below, Labor’s primary vote has collapsed to below 30%.

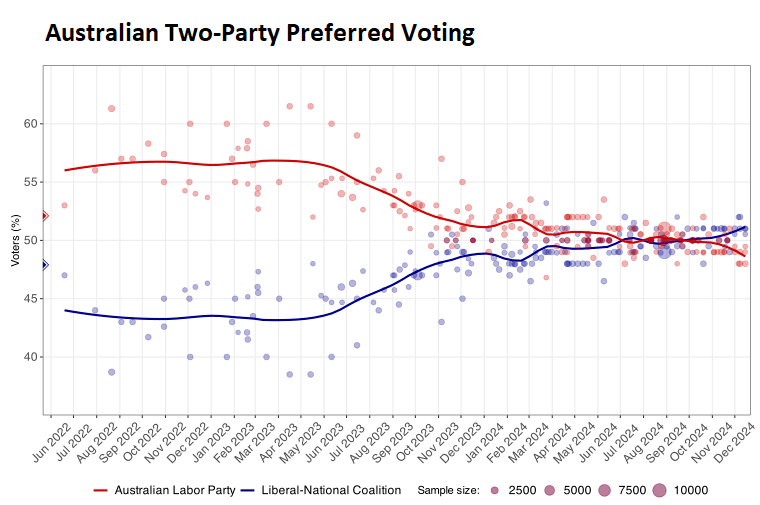

The Coalition is also leading by around 52% to 48% on a two-party preferred basis.

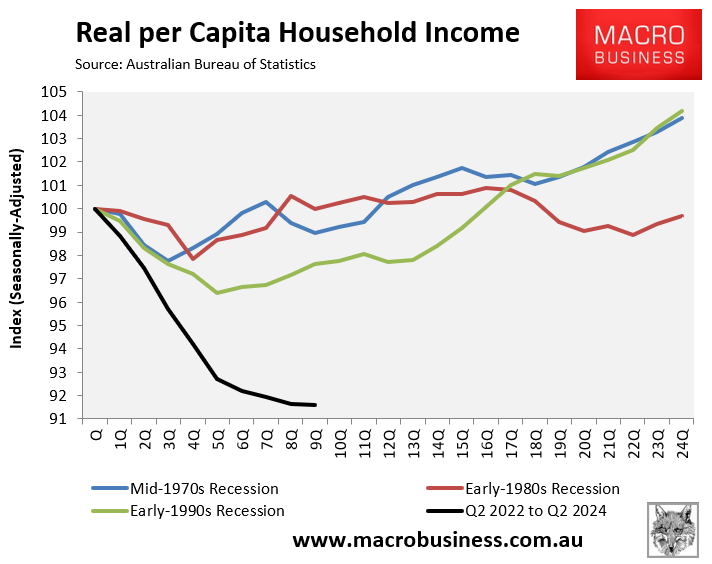

In a broad sense, the polling reflects the world-record decline in household disposable incomes.

Redbridge Group Director Simon Welsh told Sky News in the week before Christmas that the Albanese government had abandoned the “forgotten Australians”.

“I think what we are going to see in 2025 is these forgotten people – the outer-suburbans, the regional voters, in particular”, he said.

“This is going to impact Labor and it’s very much about the failures to stand strong on cost of living”.

Indeed, Labor has abandoned the working class in favour of virtue-signaling.

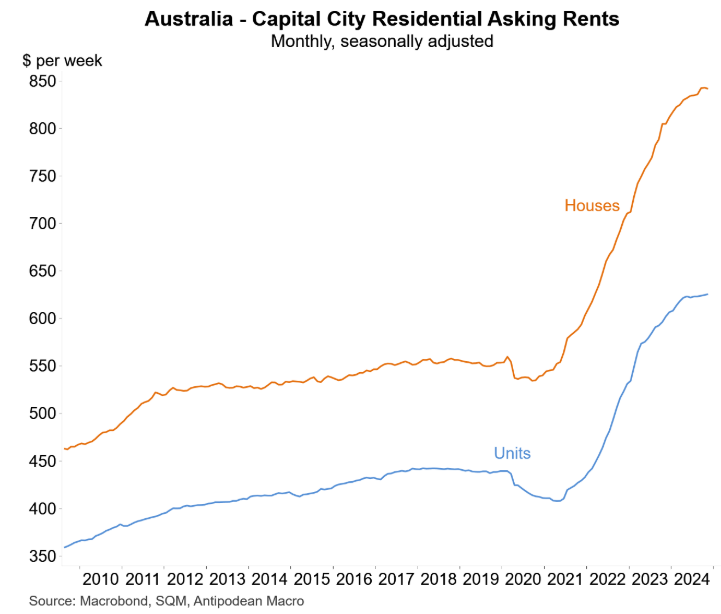

It created a rental catastrophe with its reckless mass immigration and has done little to address the East Coast energy crisis.

If rate cuts do not arrive before the May federal election, the Albanese government faces the prospect of becoming the first one-term government since the Great Depression.