The superannuation guarantee is scheduled to increase to 12% in July, and Assistant Treasurer Stephen Jones says the federal government has no plans to expand it further.

However, Labor’s national platform in 2023 included setting a ‘pathway’ to increasing the super guarantee to 15% once the initial target of 12% was reached.

Jones says the policy platform is merely a set of principles rather than binding commitments, and Labor has no plans to increase the super guarantee further.

“As a broad democratic party, of course, we have things within our platform which are aspirational, and it’s then up to the parliamentary party to determine the policy that we’ll take to the election and the policies that we’ll implement over every year of a term in government”, Jones said on Tuesday.

“And we have no current plans to be moving beyond 12%”.

Lifting the superannuation guarantee to 15% would be retrograde for Australia’s working class.

As shown by the Henry Tax Review, the Grattan Institute, the Reserve Bank of Australia, the Australian Treasury, the Productivity Commission, and the Parliamentary Budget Office, the superannuation guarantee trades off current wages for more savings in retirement.

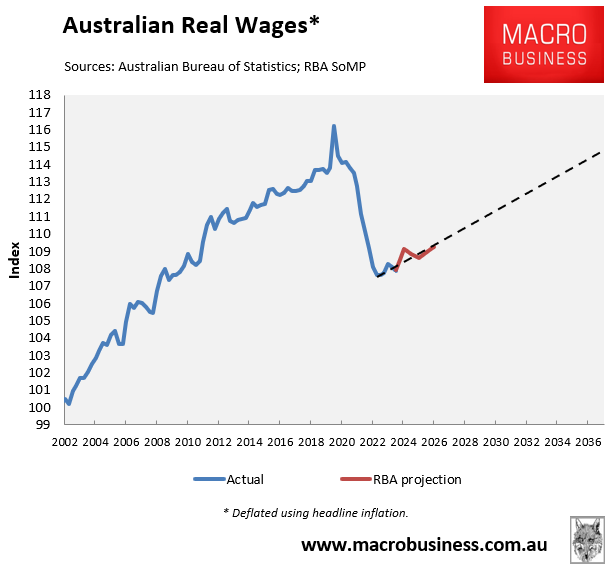

Australian real wages have experienced their largest-ever decline and likely will not recover until the mid-2030s.

Therefore, increasing the superannuation guarantee would inevitably hinder future wage growth, reducing disposable income—a dire situation for lower-income earners who are already grappling with financial difficulties.

Lifting the SG will also damage the federal budget since the cost of superannuation concessions outweighs any future gains from lower pension costs.

Our modelling shows that the legislated increase in the SG will not have much impact on the Age Pension for many years but will reduce it by about 0.1% of GDP in the second half of this century on current means testing settings.

Conversely, the tax concessions from the increase are more immediate and they will average about 0.22% of GDP throughout this century.

Simply put, the federal government would not break even on compulsory superannuation until well into the next century. It hardly sounds like a wise policy.

Impartial modelling from the Grattan Institute also showed that “both the short and long term, superannuation tax breaks cost the budget more than they save in pension payments”:

As did the Henry Tax Review:

“An increase in the superannuation guarantee would … have a net cost to government revenue even over the long term (that is, the loss of income tax revenue would not be replaced fully by an increase in superannuation tax collections or a reduction in Age Pension costs).”

Furthermore, given that the 15% flat tax on contributions and earnings primarily benefits higher-income earners, what rationale is there for raising the superannuation guarantee?

The below chart from the ABS tells the story, with households in the highest income and net worth quintile receiving 47% and 74% of total household superannuation benefits:

The following chart from the Australian Treasury tells the same story: higher income earners receive a disproportionate share of superannuation concessions.

As illustrated above, the Treasury projected the top 1% of earners to receive more than $700,000 in superannuation concessions over their working lives, dwarfing the $50,000 of concessions received by the bottom 10% of income earners.

Concessions should be made more progressive rather than increasing the superannuation guarantee further. This way, low-income workers could enjoy a boost in their retirement savings without reducing their take-home pay and wrecking the federal budget.