RBC is the most bearish LNG price forecaster I can find but that isn’t going to help Australia.

Looking ahead, as we detailed in our LNG deep dive recently, we see a wave of new LNG supply—the biggest yet—to take global exports closer to 440mt (605bcm) in 2025, 480mt (660bcm) in 2026 and 620mt (855bcm) by 2030, which would be almost 50% above 2024 levels.

Importantly, this is purely from projectscurrently producing + those already under-construction, with further growth from projects not already sanctioned at various pre-FID stages; our ‘unrisked’ upside estimate of exports is closer to 900mt (1,240bcm) by 2030.

The recent start-up of projects in the US marks the start of this wave, with material additions in the coming months via projects like LNG Canada Phase 1 (14mtpa, mid-year start-up), Qatar North Field East expansion (32mtpa, phased ramp-up with first cargoes expected in late 2025) and Golden Pass LNG (3 x 6mtpa trains, first train to start-up towards the end of 2025).

…Our view–maximum pessimism priced in?

As we noted earlier, while our storage modelling does show Europe exiting winter at a lower level (around 30%) than in recent years, incremental supply from both recent LNG start-ups as well as those due to start up in the coming months drives our confidence in Europe still achieving 90% storage ahead of the November 1st target.

Add to this the tail risk from the war in Ukraine ending, and absent a significant extended outage in Norway, we continue to see the summer 2025 TTF contract at $14.5/mmbtu as elevated and see downside to prices here.

In our commodity price deck update published today, we have revised our 2025-26 European gas price forecast, with an 18% increase in our 2025 TTF forecast to $11.50/mmbtu (vs. $9.85 previously), primarily driven by higher near-term pricing amid colder weather as well as incrementally tighter balances into summer relative to our prior expectations given the storage withdrawals.

Despite this increase, we are 20% below where the forward curve sits for 2025, and even lower in the summer months.

For 2026, our estimate moves up 7% to $9/mmbtu and we remain 28% below the forward curve here given our expectation of the incoming LNG supply.

It is worth noting positioning remains overwhelming positive and so we call the TTF bears out of hibernation.

Except in Australia, because these prices are still an LNG import disaster, as $9mmBtu gas in Europe lands in Australia at about $17Gj.

This is 25% higher than today’s already disastrous gas price.

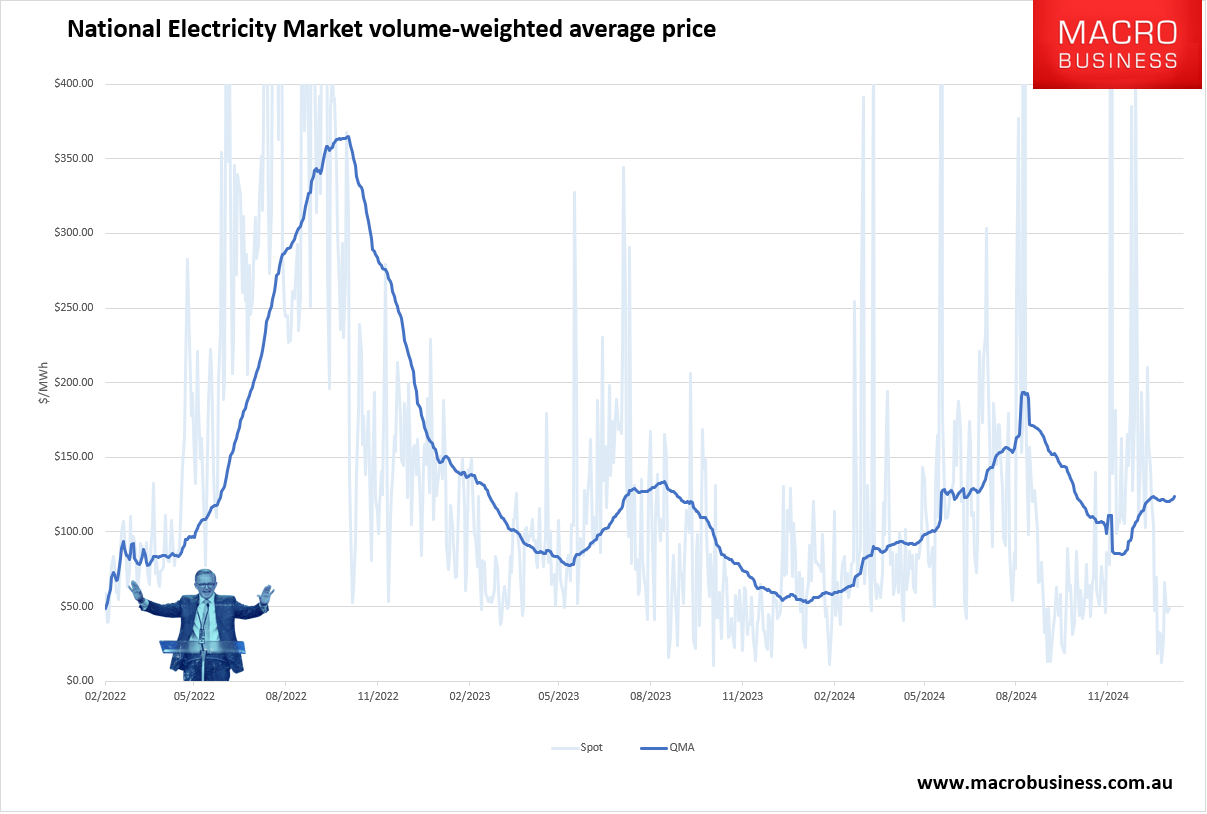

Which has electricity prices up 150% year on year.

LNG imports are insane. The equivalent of Saudi Arabia importing expensive shale oil from the US.

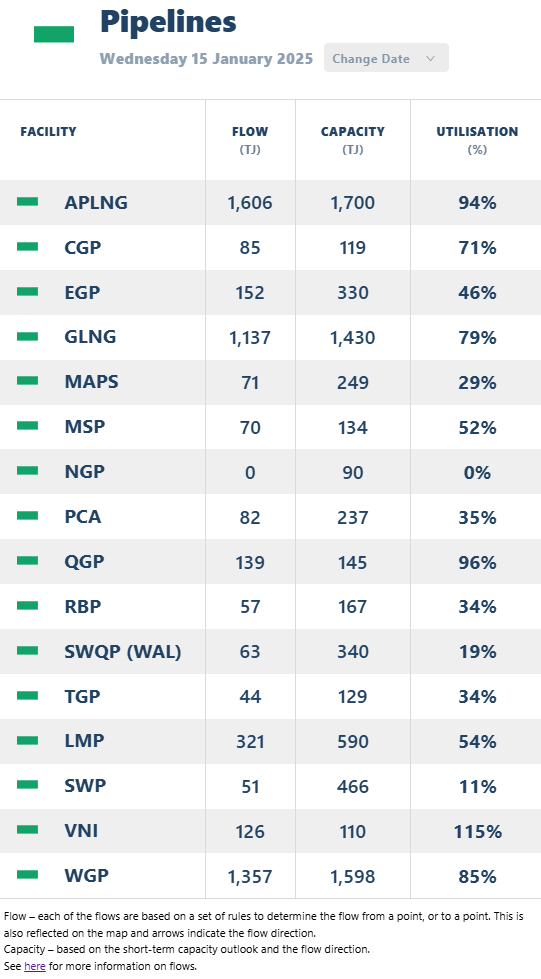

Meanwhile, the critical pipelines that should be carrying domestically reserved QLD gas south are running far below capacity when they should be filling significantly expanded southern storage for winter.

Just as every other nation does.

The only pipelines anywhere near capacity in the off-season are those shipping gas to China (APLNG, GLNG, GCP).

Mark my words. When iron ore buckles across 2026 and the budget is gutted as the AUD falls, LNG imports will deliver a huge energy shock just as unemployment jumps, cornering the RBA.

Australia’s mortgage economy will come apart like a smashed melon.