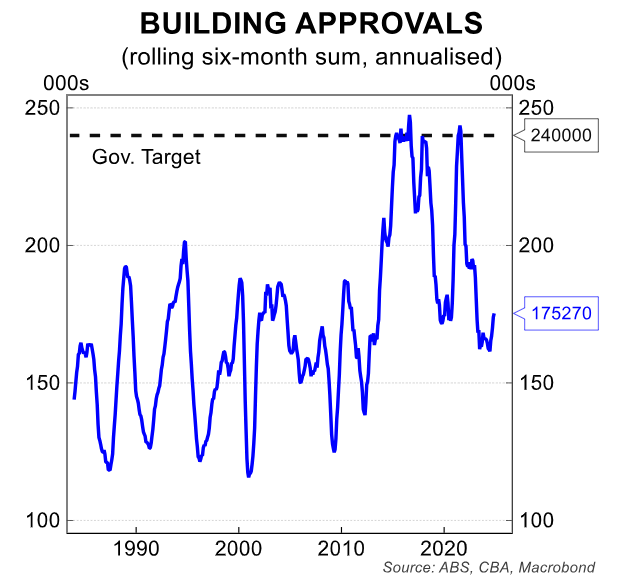

CBA economist Harry Ottley published the following chart showing the massive disconnect between dwelling approvals and the Albanese government’s 240,000 annual housing target.

As you can see, annual approvals in the year to November (175,270) were around 25% below the 240,000 target.

“The number of dwellings being approved clearly remains well below what is required to ease the housing shortage and meet government targets”, Ottley wrote.

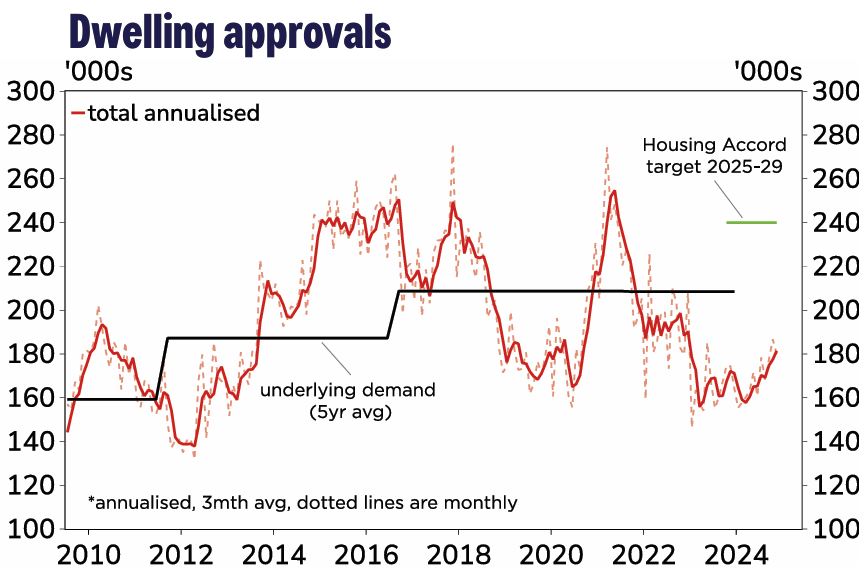

The following chart from Westpac’s Head of Australian Macro-forecasting, Matthew Hassan, forecasts that Australia’s underlying housing demand averaged around 205,000 over the past five years, well above the current rate of approvals.

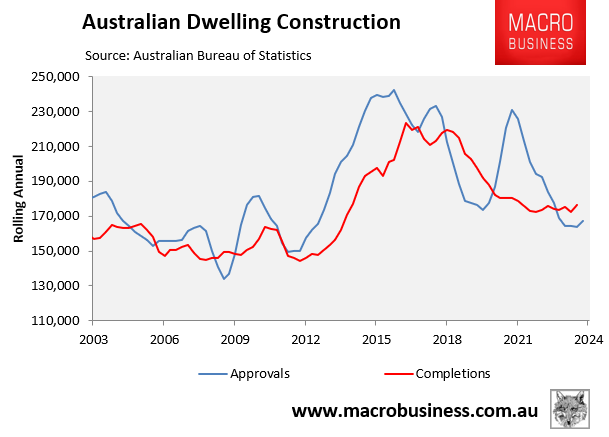

It is worth pointing out that dwelling approvals tend to run well above construction and that not all homes that are approved end up being built.

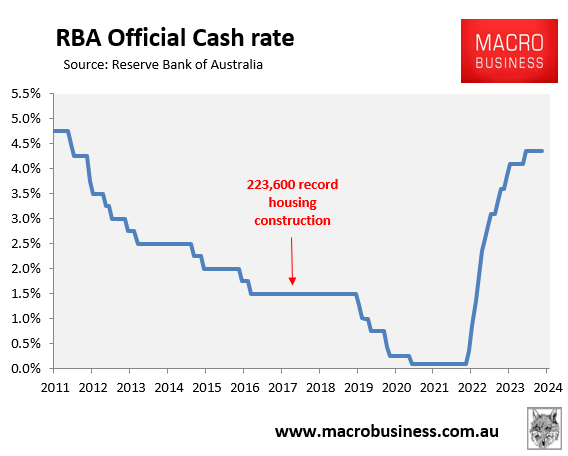

As illustrated in the following chart, the record number of homes constructed in a 12-month period was 223,600 in 2017, versus record approvals of 242,200.

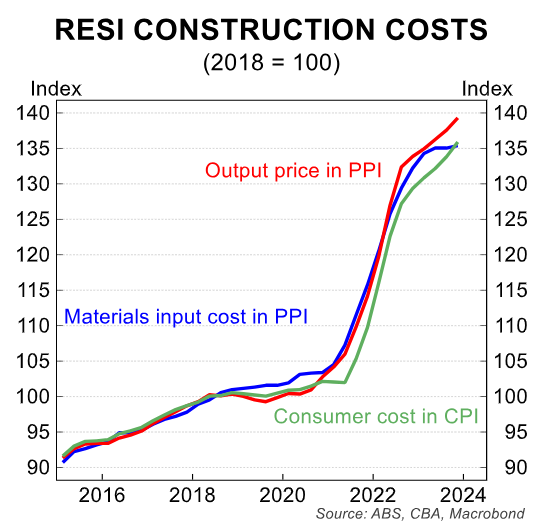

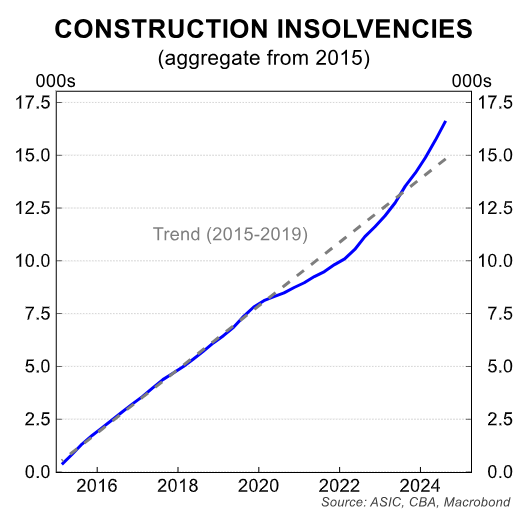

As we know, Australia’s homebuilding industry faces stiff headwinds that are preventing a strong rebound in construction.

Residential construction costs are now tracking around 40% higher than pre-pandemic levels.

A large number of construction firms have collapsed and builders are competing for scarce labour against government infrastructure projects, reducing capacity in the industry.

Finally, Australian interest rates are likely to remain structurally higher than they were pre-pandemic.

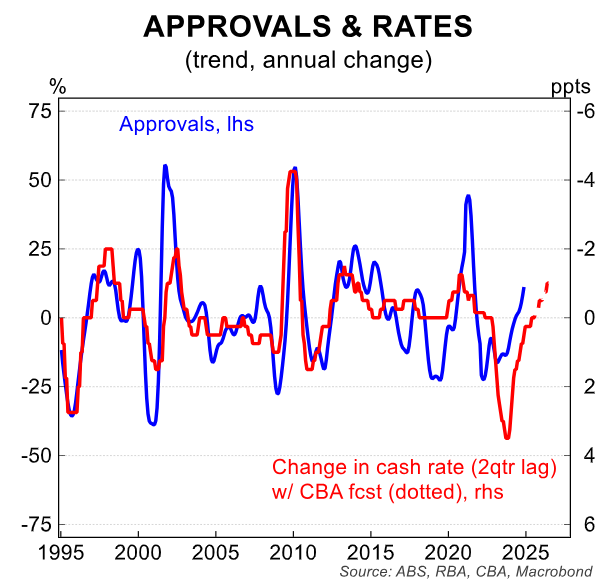

This last point about interest rates is important. Harry Ottley at CBA argues that interest rate cuts are a necessary precondition for a rise in housing construction.

“The cash rate has not been increased since November 2023”, Ottley wrote. “This has likely boosted the number of dwellings being approved because it is the change, not the level of the cash rate that typically stimulates or discourages new builds”.

“If the cash rate is lowered this year, building approvals are likely to keep improving. We expect a shallow easing cycle, however, which means hitting government targets in the near term remains unlikely assuming no other major policy changes”, Ottley noted.

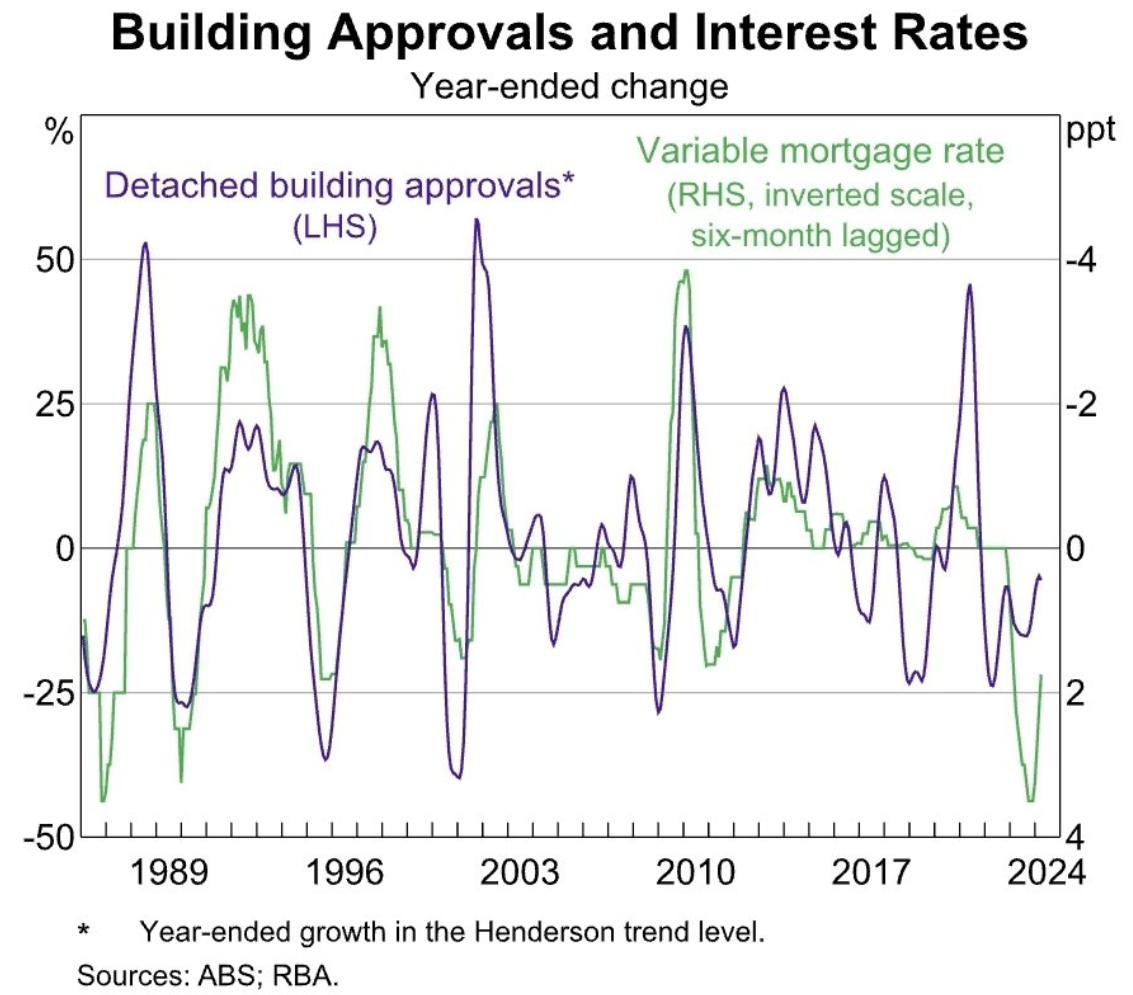

The following chart from the RBA also shows the historical relationship between mortgage rates and dwelling approvals.

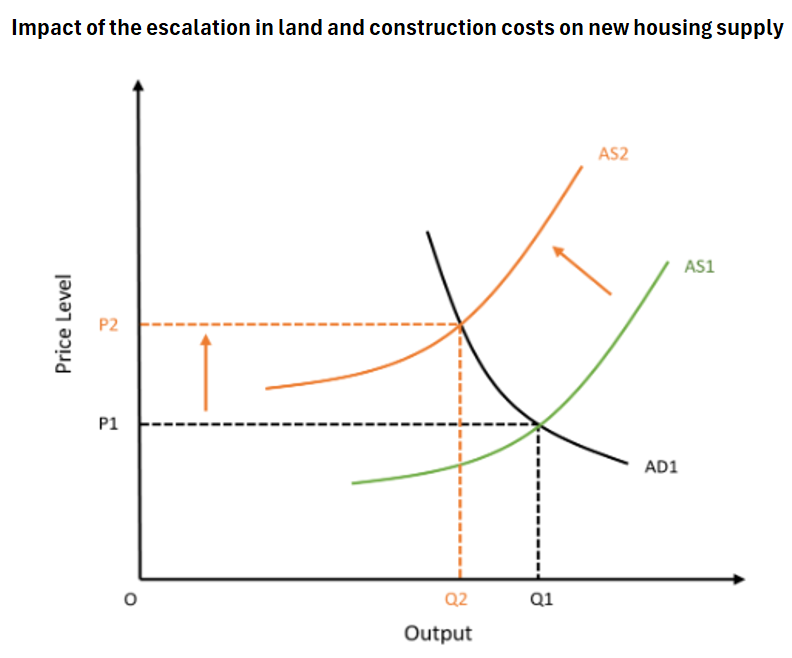

Put simply, there are strong forces working against a significant rebound in housing construction, which have effectively shifted the supply curve for housing to the left, reducing capacity and increasing cost.

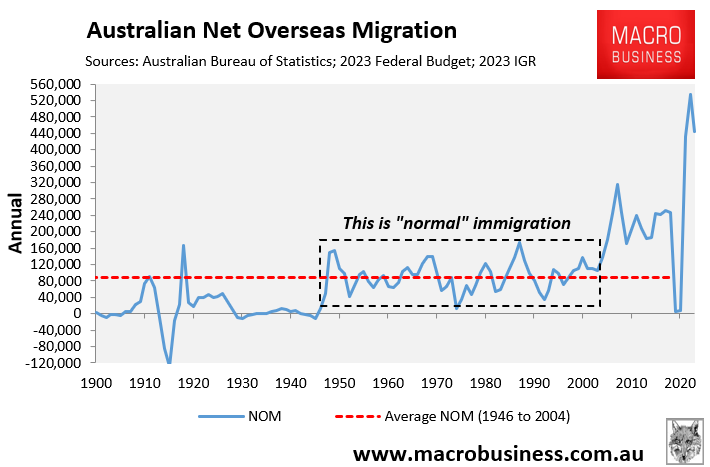

The logical policy response is to reduce demand commensurably by cutting net overseas migration to a level compatible with the supply side.

Sadly, Australian policymakers and so-called housing experts refuse to acknowledge this basic fact and continue to present the problem as a supply issue.