Chinese stock markets have had their worst start to a trading year in nearly a decade due to a relatively poor performing Caixin manufacturing PMI print. The satellite Australian bourses didn’t care as New Year hangover hasn’t kicked in yet while the Australian dollar looks fierce mild just above the 62 handle.

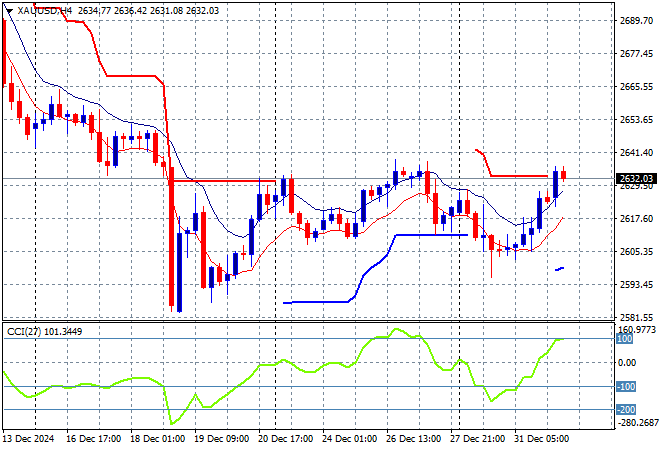

Oil futures are up slightly again with Brent crude lifting towards but not above the $75USD per barrel level while gold is trying to break out here above local resistance at the $2630USD per ounce level:

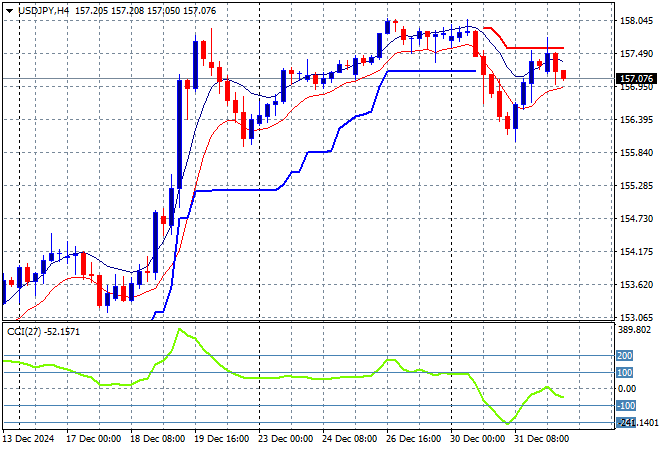

Mainland Chinese share markets are having very poor sessions as the new year gets underway with the Shanghai Composite down more than 2% to break below the 3300 point level while the Hang Seng Index is down a similar amount, losing 2.2% to close at 19613 points. Japanese stock markets remain closed while the USDPY pair has pulled back slightly to just above the 157 level:

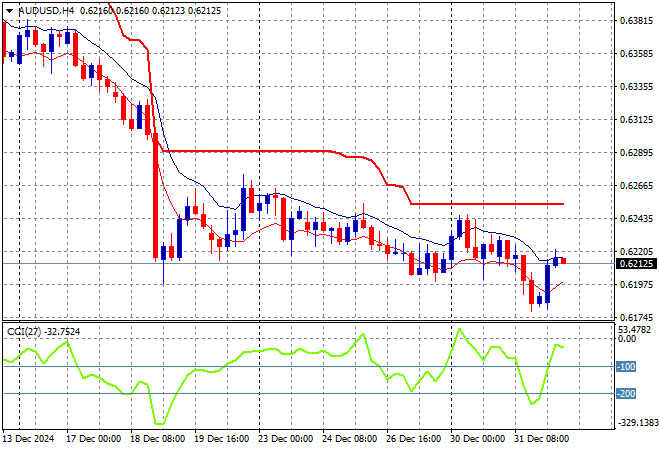

Australian stocks are the best performing in the region with the ASX200 up more than 0.5% to close at 8201 points while the Australian dollar has rebounded back above the 62 handle after making a new yearly low just after Xmas, but this looks ominous to say the least:

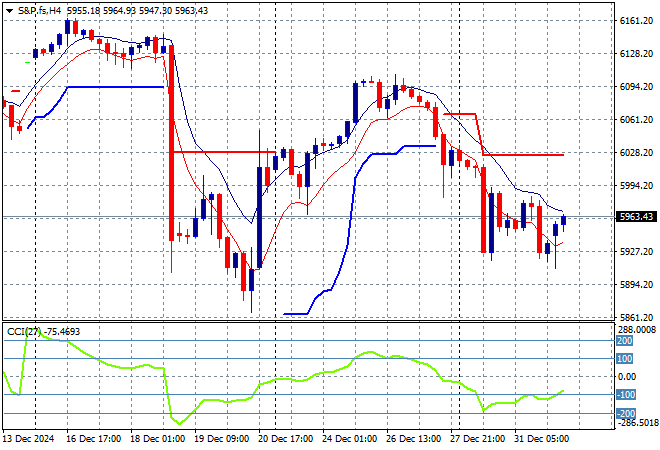

S&P and Eurostoxx futures are trying to lift higher from their recent steep losses as we head into the London session with the S&P500 four hourly chart showing momentum barely out of its oversold condition as it fails to tackle short term resistance levels:

The economic calendar is relatively quiet with US initial jobless claims the one to watch out for. And burning Cybertrucks.