A much better trading session for Asian stocks as the slightly weaker USD takes some pressure off while Chinese stocks finally saw a rebound on PBOC speculation of support. The Japanese financial minister talked up Yen which saw a near one year high in the USDJPY pair before the inevitable retracement while the Australian dollar is still gaining traction on the weaker USD as it extends above the 62 cent level.

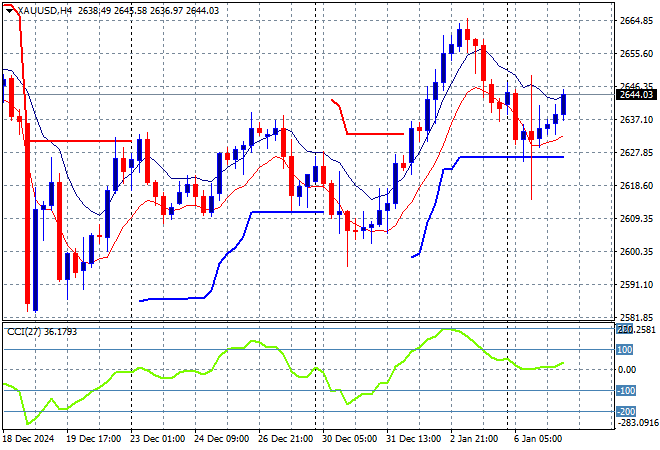

Oil futures are steady as they hold on to their Friday night gains with Brent crude just above the $76USD per barrel level while gold is trying to make a comeback after failing to hold its break out above local resistance at the $2630USD per ounce level:

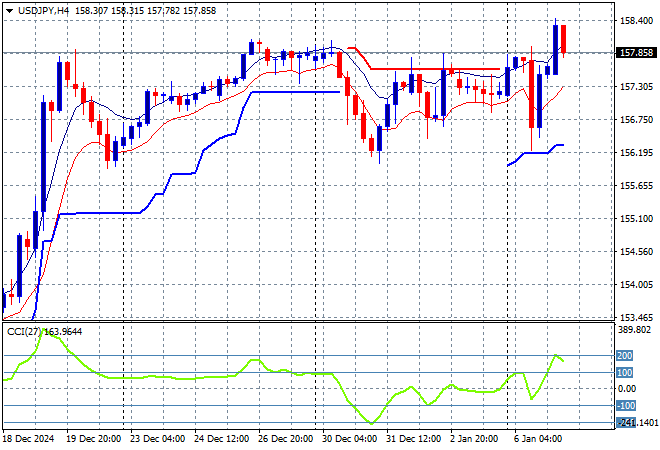

Mainland Chinese share markets are gaining in afternoon trade with the Shanghai Composite up more than 0.5% to push back above the 3200 point level while the Hang Seng Index has lost a lot of ground to close nearly 1.7% lower at 19352 points. Japanese stock markets are rebounding on Yen speculation with the Nikkei 225 closing more than 1.9% higher at over 40000 points while the USDPY pair has broken out of its recent funk to climb above last week’s finish but then retraced back below the 158 level:

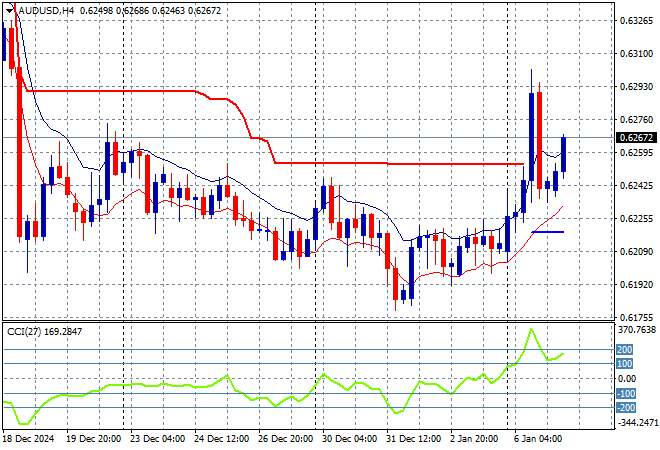

Australian stocks this time were the best performing in the region but the ASX200 did manage to put some runs on the board, closing 0.3% higher at 8285 points while the Australian dollar has managed to comeback from its overnight retracement to mid just above the mid 65 cent level:

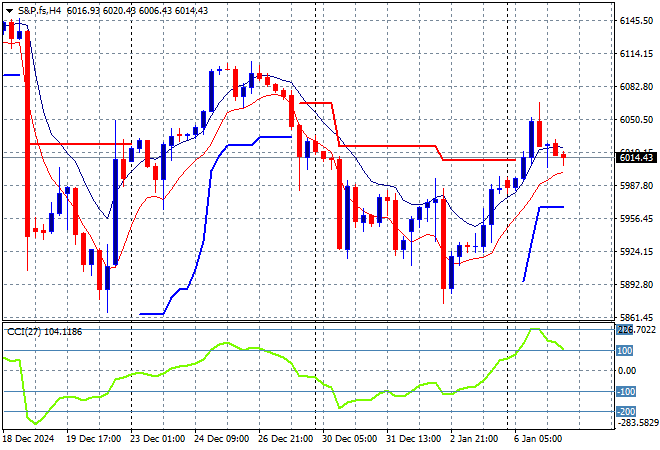

S&P and Eurostoxx futures are failing to lift higher as we head into the London session with the S&P500 four hourly chart showing momentum overbought but not looking healthy as it tries to tackle short term resistance levels around the 6000 point zone:

The economic calendar includes Euro wide unemployment and some internal inflation prints plus the US ISM Services PMI.