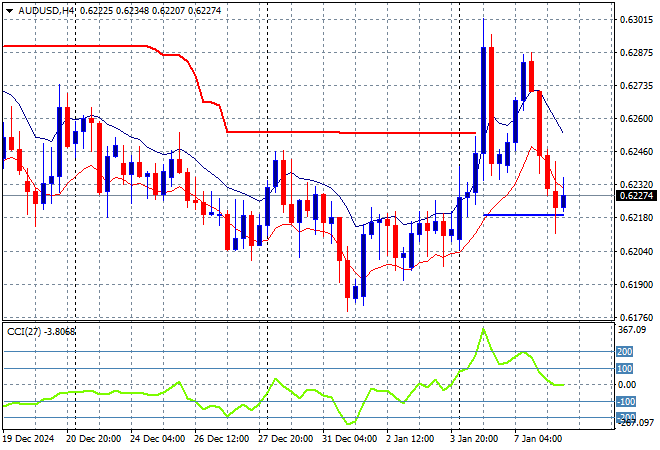

Asian stocks are generally lower due to individual local conditions and not the overall macro view although the slump on Wall Street overnight is not helping risk markets overall. Chinese shares are reeling with some regulatory changes on trade while Japanese equities are treading water on rate hike speculation. Local shares are going the other way on the slightly lower domestic inflation print with the RBA likely to start cutting rates sooner rather than later, pushing the Australian dollar back down to the 62 cent level.

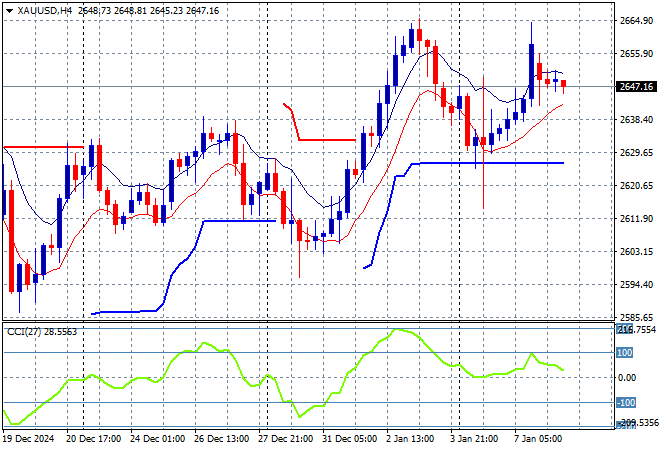

Oil futures are pushing higher as they expand on to their Friday night gains with Brent crude now well above the $77USD per barrel level while gold is in a holding pattern after its recent comeback above local resistance at the $2630USD per ounce level:

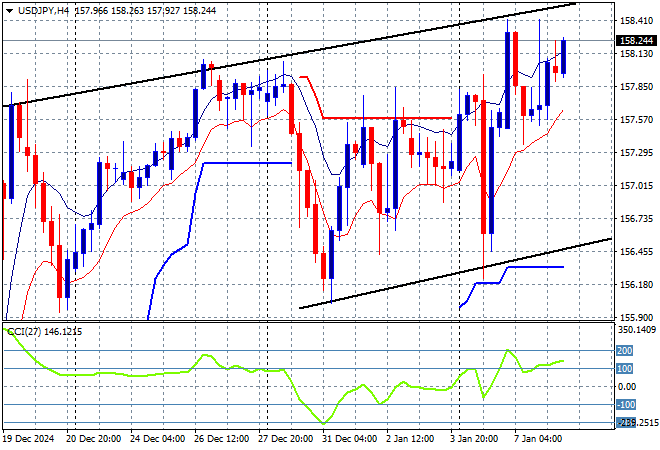

Mainland Chinese share markets have rolled over sharply in afternoon trade with the Shanghai Composite down more than 1.5% to get back below the 3200 point level while the Hang Seng Index is following along, currently 1.7% lower at 19137 points. Japanese stock markets are off slightly but the Nikkei 225 is holding just above 40000 points while the USDPY pair has continued its short term breakout to climb above last week’s finish and above the 158 level:

Australian stocks were the best performing in the region due to the monthly inflation print and RBA rate cut scuttlebutt with the ASX200 closing more than 0.8% higher at 8351 points while the Australian dollar has managed to pull back to its start of week position just above the 62 cent level:

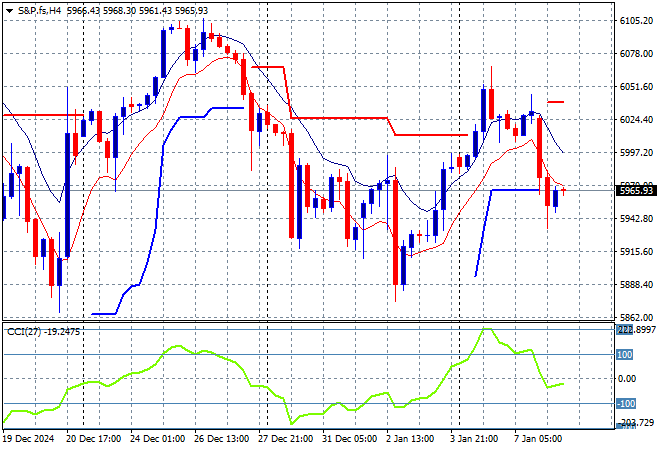

S&P and Eurostoxx futures are failing to lift higher as we head into the London session with the S&P500 four hourly chart showing momentum now in neutral territory and not looking healthy as it fails to tackle short term resistance levels around the 6000 point zone:

The economic calendar includes German retail sales and EuroArea consumer sentiment followed by US weekly initial jobless claims.