Asian stocks are generally lower due to subdued Chinese inflation numbers and continued hesitation around Trumpian macro machinations with the USD regaining strength against all the undollars again. The poor showing on Wall Street overnight is likely to continue with volatility around interest rates likely to spike with a number of Fed speeches to watch out for later tonight. The better than expected retail sales numbers didn’t help the Australian dollar which fell back below the 62 cent level.

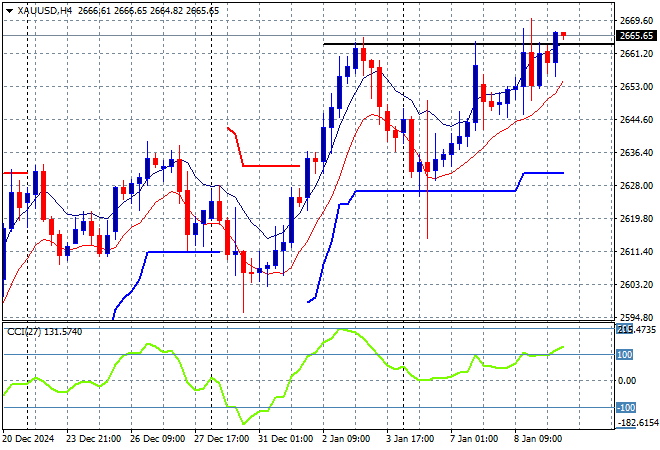

Oil futures are failing to push higher as they pull back on their recent gains with Brent crude holding just above the $76USD per barrel level while gold is no longer in a holding pattern after its recent comeback above local resistance at the $2630USD per ounce level:

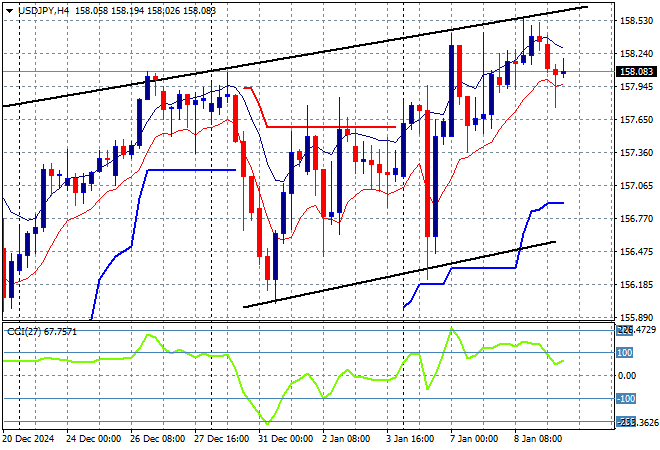

Mainland Chinese share markets have again failed to gain momentum in afternoon trade with the Shanghai Composite down more than 0.5% to just above the 3200 point level while the Hang Seng Index is flat at 19284 points. Japanese stock markets are off the worst with the Nikkei 225 losing nearly 1% to close well below the 40000 point level while the USDPY pair has failed to continue its short term breakout as it stalls around the 158 level:

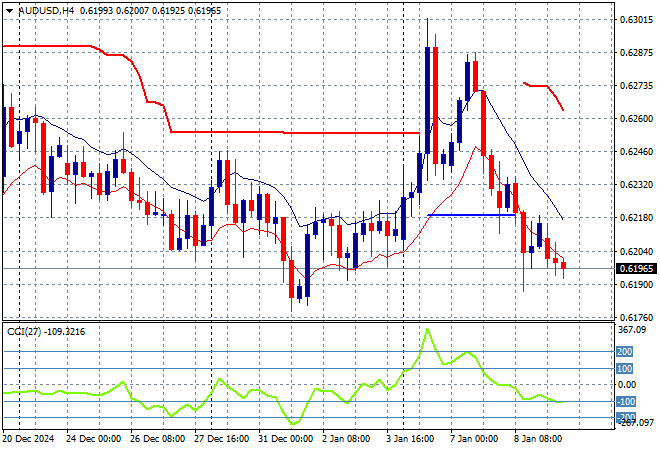

Australian stocks were the best performing in the region but still fell with the ASX200 closing more than 0.2% lower at 8329 points while the Australian dollar has pulled back below the 62 handle, reverting to type:

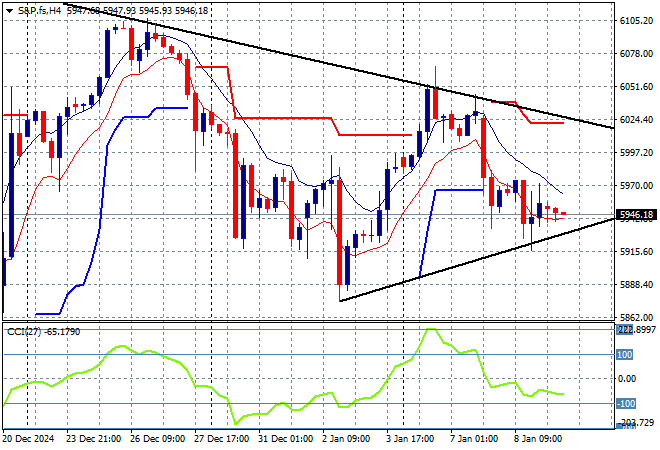

S&P and Eurostoxx futures are flat as we head into the London session with the S&P500 four hourly chart showing momentum now in negative territory and not looking healthy as it fails to tackle short term resistance levels around the 6000 point zone:

The economic calendar includes Euro area wide retail sales figures plus quite a few Fed member speeches to keep an ear out on.